By using our website, you agree to the use of cookies as described in our Cookie Policy

Blog

Why Have Interest Rates Ballooned?

While the rising rate environment over the past 2 years has not come as a surprise, given that the Fed telegraphed rate hikes to fight inflation, the additional spike in interest rates over the past month has occurred amidst cooling inflation. Why now? Ben Carlson evaluates several theories, but ultimately is left with more questions than answers.

Concerns about government debt or government dysfunction are a possible explanation, but as Carlson observes, complaints about government debt have been ongoing for decades, while government shutdowns have occurred numerous times in recent decades without broader consequences. Carlson also dismisses the idea of an oversupply of bonds, given that investors are already aware of high government spending since the onset of the pandemic in 2020; moreover, higher yields should be attractive to bond buyers.

The belief that inflation would stay higher for longer could be in play, as the Fed has for months emphasized the possibility of higher rates for longer. It is odd to see rates surge more during cooling inflation than at peak inflation; Carlson notes that the bond market could have been assuming that inflation would be transitory, but is skeptical that this explains the timing and extent of the rate surge.

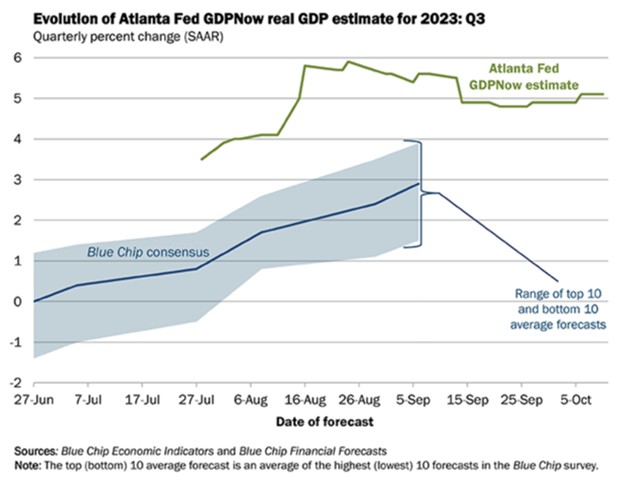

Carlson wonders if the bond market is reflecting the economy’s strength; historically, periods of strong growth and significant inflation have been accompanied by higher bond yields. Is the economy strong? The labor market has defied the predictions of doomsayers, but forecasts of GDP growth are more nuanced:

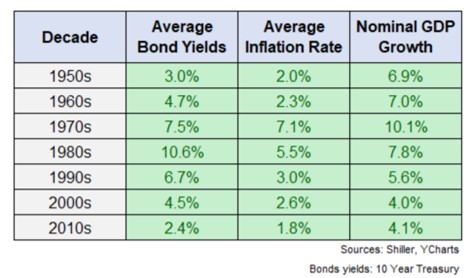

The Q3 GDPNow growth estimate is over 5%, which is well above forecaster estimates of between 1%-4%. Still, as Carlson states, higher growth and inflation has usually dovetailed with higher yields:

Finally, Carlson cites evidence from Robert Shiller suggesting that the bond market may have its own struggles feeling the pulse of the economy. In theory, high long-term interest rates could suggest that the bond market anticipates high inflation for a substantial period of time. In practice, over the past 100+ years in the US, long-term interest rates and subsequent 10-year inflation are nearly uncorrelated. Moreover, the correlation between one decade’s total inflation and the next decade’s total inflation is only 2%. 10-year Treasury yields, however, showed much more correlation with past inflation than future inflation, which suggests bond markets have sometimes over extrapolated from the past.

As Carlson notes, in the past 4 years we’ve had a pandemic, a sharp recession, massive government spending, supply chain shocks, an inflation surge, and rapid monetary tightening. We’re in uncharted waters, and market and economic shifts may not lend themselves to easy explanations.

###

JMS Capital Group Wealth Services LLC

417 Thorn Street, Suite 300 | Sewickley, PA | 15143 | 412‐415‐1177 | jmscapitalgroup.com

An SEC‐registered investment advisor.

This material is not intended as an offer or solicitation for the purchase or sale of any financial instrument or investment strategy. This material has been prepared for informational purposes only, and is not intended to be or interpreted as a recommendation. Any forecasts contained herein are for illustrative purposes only and are not to be relied upon as advice.

‹ Back