By using our website, you agree to the use of cookies as described in our Cookie Policy

Blog

Weekly Market Commentary

The Markets

It’s Spring and economic recovery is in the air.

Last week, the Bureau of Economic Analysis reported the U.S. economy grew at a 6.4 percent annualized rate for the first three months of 2021. While that’s good news for companies and workers, asset managers are checking their expectations.

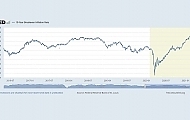

The stock market reflects what investors think may happen in the future. During the past year, major U.S. stock indices moved higher as investors anticipated vaccines and economic recovery, reported Patti Domm of CNBC. Since its March 2020 low, the Standard & Poor’s 500 Index has gained 88 percent.

Amidst strong signs of recovery in the United States, some asset managers are positioning for “inflation and tapering,” according to a source cited by Naomi Rovnick of Financial Times. “Investors have topped up their cash holdings at the fastest rate since March 2020 as debate intensifies over whether stock markets will continue rallying now the U.S. economic recovery from the pandemic is firmly under way.”

Investors were feeling cautious last week, but there were no signs of tapering, which occurs when the Federal Reserve begins to buy fewer bonds. On Wednesday, the Fed left its supportive policies in place.

When the Fed begins to change course and rates move higher, equity market valuations may adjust. “The main worry for stocks is that higher bond yields translate into lower equity valuations. Higher yields reduce the current value of future profits and therefore can reduce earnings multiples,” reported Jacob Sonenshine of Barron’s.

Profits were strong during the first quarter of 2021. U.S. companies continued to report exceptional earnings last week. With 60 percent of firms in the Standard & Poor’s 500 Index reporting, the blended earnings growth rate was 45.8 percent. More than 8 of 10 companies have reported better than expected earnings, reported John Butters of FactSet.

Major U.S. stock indices finished the week flat to down. Rates on 10-year Treasuries edged higher.

(The one-year numbers in the scorecard below remain noteworthy. They reflect the strong recovery of U.S. stocks from last year’s coronavirus downturn to the present day.)

Data as of 4/30/21 |

1-Week |

Y-T-D |

1-Year |

3-Year |

5-Year |

10-Year |

|

Standard & Poor's 500 (Domestic Stocks) |

0.0% |

11.3% |

43.6% |

16.5% |

15.0% |

11.9% |

|

Dow Jones Global ex-U.S. |

-0.5 |

6.0 |

41.6 |

4.7 |

7.6 |

2.6 |

|

10-year Treasury Note (Yield Only) |

1.6 |

NA |

0.6 |

2.9 |

1.9 |

3.3 |

|

Gold (per ounce) |

-0.8 |

-6.4 |

3.8 |

10.4 |

6.4 |

1.4 |

|

Bloomberg Commodity Index |

2.2 |

15.8 |

48.4 |

0.3 |

1.3 |

-6.3 |

S&P 500, Dow Jones Global ex-US, Gold, Bloomberg Commodity Index returns exclude reinvested dividends (gold does not pay a dividend) and the three-, five-, and 10-year returns are annualized; and the 10-year Treasury Note is simply the yield at the close of the day on each of the historical time periods.

Sources: Yahoo! Finance; MarketWatch; djindexes.com; Federal Reserve Bank of St. Louis; London Bullion Market Association.

Past performance is no guarantee of future results. Indices are unmanaged and cannot be invested into directly. N/A means not applicable.

Estimates suggest there will be 25 million by 2100. Take a guess: electric vehicles, household robots, wild elephants, centenarians, or streaming services per household?

- Electric vehicles. There may be far more than 25 million – estimates suggest 145 million – on the road by 2030.

- Household robots. Domestic robots that offer companionship or help with tasks like lawn mowing, vacuuming, and mopping are becoming popular. Estimates suggest about 55 million domestic bots will be sold next year.

- Wild elephants. From 1989 to 2018, the number of elephants in the wild doubled to 34,000, reported Earth.org.

- Streaming services per household. Currently, the average number of streaming services per household is four. There’s room for growth, but probably not that much.

- Centenarians. The world is in the midst of a longevity revolution and, by 2100, there may be as many as 25 million centenarians – people age 100 or older – around the globe, according to a source cited by Science Direct.

The world’s 65 and older population is growing rapidly.

According to the most recent population estimates from the United Nations, “…1 in 6 people in the world will be over the age 65 by 2050, up from 1 in 11 in 2019. The latest projections also show the number of people aged 80 or over will triple in the next 30 years. In many regions, the population aged 65 will double by 2050, while global life expectancy beyond 65 will increase by 19 years.”

Longevity deserves more thought than it often receives. It is an essential part of every financial and retirement plan, influencing savings goals, investment choices, and retirement income levels. Yet, people often underestimate their potential longevity.

In the United States, the average life expectancy at age 65 is 19 years, according to the Centers for Disease Control (CDC). Consequently, many people assume they should plan to live to age 84. However, the CDC estimate is an average. Half of 65-year-olds will live beyond age 84.

When it comes to planning for the future, having above average expectations for longevity may be a good idea.

Weekly Focus – Think About It

“I am not more gifted than the average human being. If you know anything about history, you would know that is so – what hard times I had in studying and the fact that I do not have a memory like some other people do…I am just more curious than the average person and I will not give up on a problem until I have found the proper solution. This is one of my greatest satisfactions in life – solving problems – and the harder they are, the more satisfaction do I get out of them. Maybe you could consider me a bit more patient in continuing with my problem than is the average human being. Now, if you understand what I have just told you, you see that it is not a matter of being more gifted but a matter of being more curious and maybe more patient until you solve a problem.”

--Albert Einstein, Theoretical physicist

Best regards,

JMS

Sources:

https://www.bea.gov/sites/default/files/2021-04/gdp1q21_adv.pdf

https://www.ft.com/content/dc17fddb-3e09-419d-aabe-90ee89511bc5 (or go to https://resources.carsongroup.com/hubfs/WMC-Source/2021/05-03-21_FinancialTimes-Investors_Move_into_Cash_at_Fastest_Rate_Since_March_Last_Year-Footnote_3.pdf)

https://www.barrons.com/articles/the-stock-market-ignored-the-fed-meeting-why-that-could-be-a-mistake-51619715102 (or go to https://resources.carsongroup.com/hubfs/WMC-Source/2021/05-03-21_Barrons-The_Stock_Market_Ignored_the_Fed_Meeting-Why_that_Could_be_a_Mistake_Footnote_4.pdf)

https://insight.factset.com/sp-500-earnings-season-update-april-30-2021

https://www.barrons.com/market-data (or go to https://resources.carsongroup.com/hubfs/WMC-Source/2021/05-03-21_Barrons-Market_Data-Footnote_6.pdf)

https://www.mordorintelligence.com/industry-reports/household-robots-market

https://earth.org/kenya-is-seeing-a-boom-in-elephants/

https://www.un.org/development/desa/en/news/population/our-world-is-growing-older.html

https://www.cdc.gov/nchs/data/vsrr/VSRR10-508.pdf

https://www.goodreads.com/quotes/tag/average

The material in this work is proprietary to and copyrighted by Carson Coaching and is used by JMS Capital Group Wealth Services LLC with permission.| Government bonds and Treasury Bills are guaranteed by the U.S. government as to the timely payment of principal and interest and, if held to maturity, offer a fixed rate of return and fixed principal value. However, the value of fund shares is not guaranteed and will fluctuate. | Corporate bonds are considered higher risk than government bonds but normally offer a higher yield and are subject to market, interest rate and credit risk as well as additional risks based on the quality of issuer coupon rate, price, yield, maturity, and redemption features.| The Standard & Poor's 500 (S&P 500) is an unmanaged group of securities considered to be representative of the stock market in general. You cannot invest directly in this index.| All indexes referenced are unmanaged. Unmanaged index returns do not reflect fees, expenses, or sales charges. Index performance is not indicative of the performance of any investment.| The Dow Jones Global ex-U.S. Index covers approximately 95% of the market capitalization of the 45 developed and emerging countries included in the Index. | The 10-year Treasury Note represents debt owed by the United States Treasury to the public. Since the U.S. Government is seen as a risk-free borrower, investors use the 10-year Treasury Note as a benchmark for the long-term bond market.| Gold represents the afternoon gold price as reported by the London Bullion Market Association. The gold price is set twice daily by the London Gold Fixing Company at 10:30 and 15:00 and is expressed in U.S. dollars per fine troy ounce.| The Bloomberg Commodity Index is designed to be a highly liquid and diversified benchmark for the commodity futures market. The Index is composed of futures contracts on 19 physical commodities and was launched on July 14, 1998. | The Dow Jones Industrial Average (DJIA), commonly known as “The Dow,” is an index representing 30 stock of companies maintained and reviewed by the editors of The Wall Street Journal.| The NASDAQ Composite is an unmanaged index of securities traded on the NASDAQ system.| International investing involves special risks such as currency fluctuation and political instability and may not be suitable for all investors. These risks are often heightened for investments in emerging markets.| Yahoo! Finance is the source for any reference to the performance of an index between two specific periods.| Opinions expressed are subject to change without notice and are not intended as investment advice or to predict future performance.| Economic forecasts set forth may not develop as predicted and there can be no guarantee that strategies promoted will be successful.| Past performance does not guarantee future results. Investing involves risk, including loss of principal.| You cannot invest directly in an index.| Stock investing involves risk including loss of principal.| The foregoing information has been obtained from sources considered to be reliable, but we do not guarantee it is accurate or complete.| There is no guarantee a diversified portfolio will enhance overall returns or outperform a non-diversified portfolio. Diversification does not protect against market risk.| Asset allocation does not ensure a profit or protect against a loss.| Consult your financial professional before making any investment decision.

JMS Capital Group Wealth Services LLC

417 Thorn Street, Suite 300 | Sewickley, PA | 15143 | 412‐415‐1177 | jmscapitalgroup.com

‹ Back

Comments