By using our website, you agree to the use of cookies as described in our Cookie Policy

Blog

Trade, China and Manufacturing

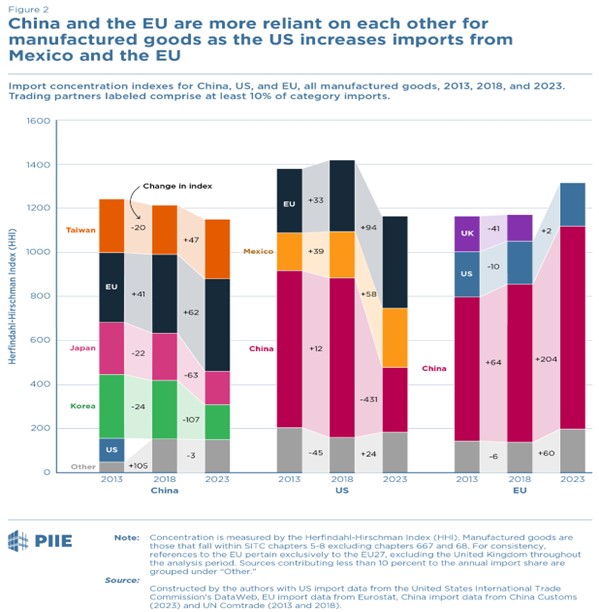

Both the Trump and Biden administrations have pursued a decoupling policy with respect to China. PIIE’s Mary Lovely and Jing Yan detail the changes in import patterns of the United States, China, and the EU from 2013 to 2023. The authors provide a chart that shows the United States diversifying its sources of manufacturing imports over the past decade:

The Herfindahl-Hirschman Index (HHI) shows import concentration. A higher number means less variety of import sources, and a lower number means greater diversity. Over the past five years the US HHI has fallen significantly, with almost all of that shift coming from diversification away from China (along with increased imports from Mexico and the EU). On the other hand, it appears that Chinese manufacturing exports largely shifted to the EU, which saw its HHI increase from 2018 to 2023. There’s also been a large decline in the share of imports of high-skill, technology-intensive goods from China, which is not surprising given that the US has sought greater decoupling from China.

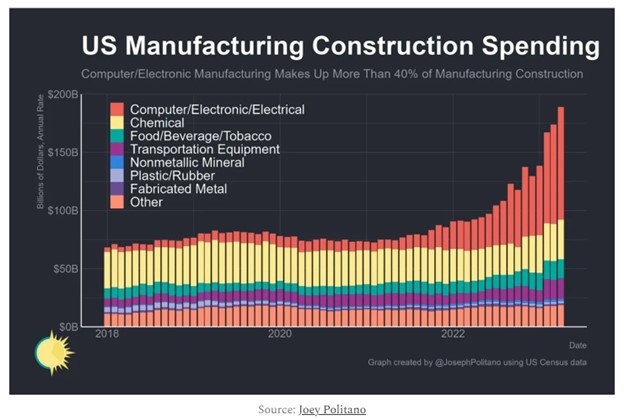

Along with shifting import patterns, the US has also sought to increase its manufacturing base, and Noah Smith points out that manufacturing construction spending has risen sharply over the past year:

As Smith notes, most of the increased spending comes from the computer/electronic/electrical area, with some increased spending from transportation equipment. Considering that the Inflation Reduction Act of 2022 targeted semiconductors, batteries, and electric vehicles, it appears that this legislation has been effective in inducing spending in these areas. Smith also uses the example of the Chips Act of 2022 to demonstrate $52 billion in government spending spurring much more private investment:

So it appears that there’s been some initial success for the US in decoupling from China and increasing its own manufacturing base. However, as Lovely and Yan note, it may now be more difficult for the US and Europe to agree on a joint natural security and technology policy with respect to Chinese imports, as increased EU dependence on China may mean US and EU interests have diverged to an extent.

JMS Capital Group Wealth Services LLC

417 Thorn Street, Suite 300 | Sewickley, PA | 15143 | 412‐415‐1177 | jmscapitalgroup.com

An SEC‐registered investment advisor.

This material is not intended as an offer or solicitation for the purchase or sale of any financial instrument or investment strategy. This material has been prepared for informational purposes only, and is not intended to be or interpreted as a recommendation. Any forecasts contained herein are for illustrative purposes only and are not to be relied upon as advice.

‹ Back