By using our website, you agree to the use of cookies as described in our Cookie Policy

Blog

This Economy is as Clear as Mud

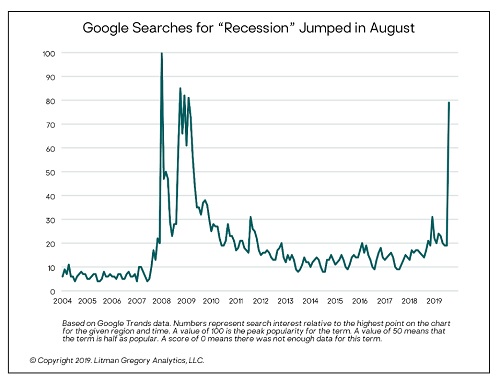

With markets on a record bull run and the US economy at over 10 years without a recession, it is not surprising that pessimists are reading various economic tea leaves as pronouncing an impending recession. In our polarized political age, it is equally unsurprising that the President and his supporters are touting strong economic statistics to counter negative facets of the economy decried by his opponents. Who’s right? Who knows? Right now, this is a smorgasbord economy, with support for every pundit’s view. But since interest in recessions is rapidly picking up steam, as illustrated below, we thought we’d give our take on our current economic pulse1.

Rather than make some dubious predictions, we are going to lay out several positive and several negative factors with respect to the economy. Positive indicators for the economy are:

- Unemployment is still low at 3.7% in August. Employment growth has slowed somewhat but remains solid, at an average of 158,000 additional jobs per month for 2019. Wages also grew 3.2% over the past year. The big picture is that although the job market may be cooling, it is still expanding at a solid, steady pace2.

- Consumer spending is still strong. Retail spending rose by 0.7% in July after increasing 0.3% in June3. Consumers’ “present situation gauge” was in August at its highest level since 20004. Though it declined in August, consumer confidence is still high by historical norms5.

- Services are doing well, with the ISM Non‐Manufacturing index at 53.7, still solidly in expansion territory6.

- Stimulus may be on the way. Though the US is unlikely to pass any near‐term fiscal stimulus, such is not necessarily the case in the rest of the world. China is expected to increase stimulus efforts in the next few months, perhaps to mitigate fallout from the US‐China trade war. Fiscal policy in the EU has also shown signs of easing. In the US, rate cuts by the Fed are likely to continue.

However, there are several negative signs for the economy as well.

- The yield curve is inverted. The 3‐month rate has been higher than the 10‐year rate for several months; recently, the 2‐year rate has exceeded the 10‐year rate as well. This inverted yield curve has traditionally been a harbinger of a recession; however, widespread quantitative easing (QE) and interest rate cuts by a dovish Fed may blunt this signal’s impact.

- Weak manufacturing data. Slowing global growth, a strong dollar, and the trade war with China have all hampered US manufacturing activity. The ISM Manufacturing index fell to 51.2 in July, from 61 in August 2018. This number is not contractionary, as it is still above 50, but it does indicate decelerating growth. Other manufacturing data, including the IHS Markit “Flash” Manufacturing PMI for the US, have echoed this sector’s weakness7.

- Weak growth in capital expenditures. The tax cuts of 2017 led primarily to share buybacks rather than capex growth. As companies already were awash in excess cash, this result was not a surprise. Amidst high policy uncertainty due to trade disputes, and declining CEO confidence, companies have retrenched with respect to investment.

- Policy uncertainty. Time will tell whether the US‐China trade war ends up as a worthwhile endeavor. However, the on‐again, off‐again nature of the imposition of tariffs imposes costs to businesses by complicating investment plans—it’s harder to justify capital expenditures for promoting exports if there’s a significant chance that China will impose retaliatory tariffs on your products. JP Morgan researchers also contributed a clever review that analyzed the costs of the interest rate volatility created by Trump’s tweeting8.

So even though recession was the new buzzword of August, the signals emanating from the economy are decidedly mixed. We are at higher risk of recession than we have been for some years, but that risk is still moderate at this point. However, given the length of the bull market, lack of overly compelling valuations, and heightened political risks, we believe it is prudent to begin scaling back risk within most portfolios.

Sources

- https://advisorintelligence.com/member/researchitem/september‐2019‐monthly‐market‐update_1822

- https://www.cnn.com/2019/09/06/economy/jobs‐report‐august/index.html

- https://www.cnbc.com/2019/08/15/us‐retail‐sales‐‐‐july‐2019.html

- https://www.cnbc.com/2019/08/27/us‐consumer‐confidence‐august‐2019‐index‐dips.html

- https://www.advisorperspectives.com/dshort/updates/2019/08/27/consumer‐confidence‐declines‐marginally‐in‐august

- https://advisorintelligence.com/member/researchitem/the‐minutes‐august‐22‐2019_1814

- https://advisorintelligence.com/member/researchitem/the‐minutes‐august‐22‐2019_1814

- http://nymag.com/intelligencer/2019/09/heres‐why‐jp‐morgans‐volfefe‐trump‐twitter‐index‐matters.html

JMS Capital Group Wealth Services LLC

417 Thorn Street, Suite 300 | Sewickley, PA | 15143 | 412‐415‐1177 | jmscapitalgroup.com

An SEC‐registered investment advisor.

This material is not intended as an offer or solicitation for the purchase or sale of any financial instrument or investment strategy. This material has been prepared for informational purposes only, and is not intended to provide, and should not be relied on for, accounting, legal or tax advice. Any references to future returns are not promises ‐ or even estimates ‐ of actual returns a client portfolio may achieve. Any forecasts contained herein are for illustrative purposes only and are not to be relied upon as advice or interpreted as a recommendation for a specific investment. Past performance is not a guarantee of future results.

‹ Back