By using our website, you agree to the use of cookies as described in our Cookie Policy

Blog

The Value of Vehicles

We’ve all witnessed the explosive growth of Tesla stock, which has reached a market capitalization of over $1 trillion:

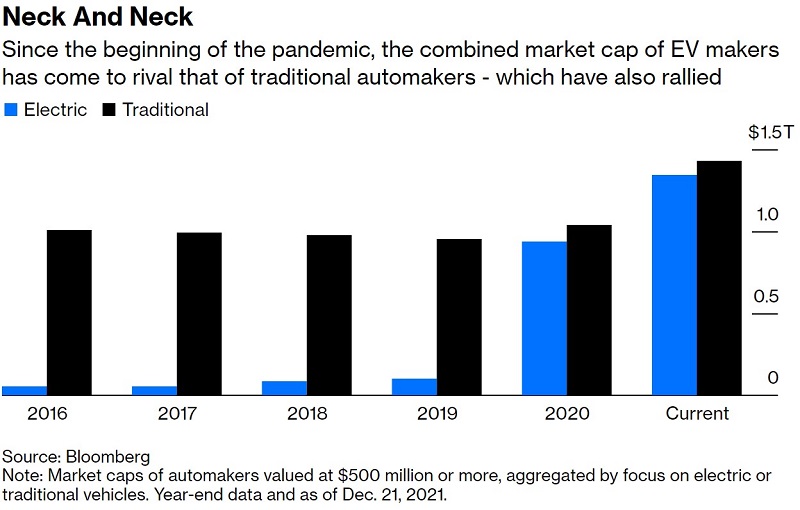

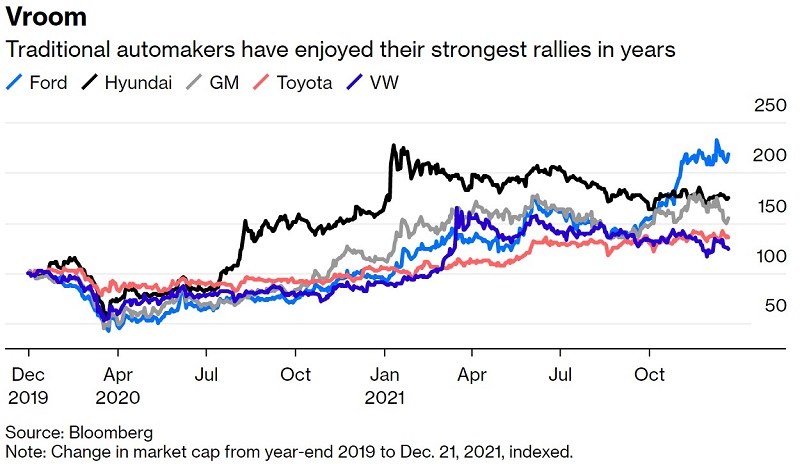

One theory of the automotive industry’s future is that Tesla and other electric vehicle companies are on the cusp of replacing the legacy car companies who are still mostly reliant on selling internal combustion engine vehicles. However, as Bloomberg’s Liam Denning observes, Tesla isn’t the only company that has seen its fortune rise over the past 2 years:

While Tesla has posted the bulk of the gains in EV market cap over the past 2 years, legacy firms have also seen their market caps rise sharply.

Instead of replacing internal combustion engine vehicles, electric vehicles seem to be complementing them, at least for the moment. The optimistic interpretation would be that technological advances are expected to make cars more valuable, whether electric or gasoline powered. The pessimistic view would note that the market caps of auto manufacturers has tripled, from $1 trillion to $3 trillion, in just 2 years, and that what goes up may come down.

In other words, valuations appear rather frothy. Denning suspects that if auto stock prices undergo a correction, then Tesla may be particularly vulnerable. In terms of relative valuations, while Ford has seen its Ebidta multiple rise to 5, Tesla has seen its multiple rise to 60. Besides a steeper earnings hill to climb, Tesla may also face the challenge of procuring enough minerals, a key component of its batteries, to manufacture cars on the scale it desires, or even disruption from other technology firms, such as Apple. While betting against Tesla would have been a fool’s errand in recent years, its sky-high stock valuation now carries the burden of high expectations already priced in—and we’ll see if Tesla can continue to justify the hype, as it just did with its terrific fourth quarter delivery numbers.

###

JMS Capital Group Wealth Services LLC

417 Thorn Street, Suite 300 | Sewickley, PA | 15143 | 412‐415‐1177 | jmscapitalgroup.com

An SEC‐registered investment advisor.

This material is not intended as an offer or solicitation for the purchase or sale of any financial instrument or investment strategy. This material has been prepared for informational purposes only, and is not intended to be or interpreted as a recommendation. Any forecasts contained herein are for illustrative purposes only and are not to be relied upon as advice.

‹ Back

Comments