By using our website, you agree to the use of cookies as described in our Cookie Policy

Blog

The S&P 500 and its Market Cap Giants

By the end of the third quarter of 2020, the S&P 500 had completed a remarkable recovery and, after more than a 30% loss in March, closed up 5% YTD. You might think that the rising equities tide lifted all boats, or at least all large caps. As it happened, the recovery was very much concentrated in a few particular stocks, the FANMAG stocks (Facebook, Apple, Netflix, Microsoft, Amazon, and Google). Given that these companies hold 5 of the top 6 spots in market capitalization (Netflix is the lone exception), their performance would have an outsized effect on overall S&P 500 performance.

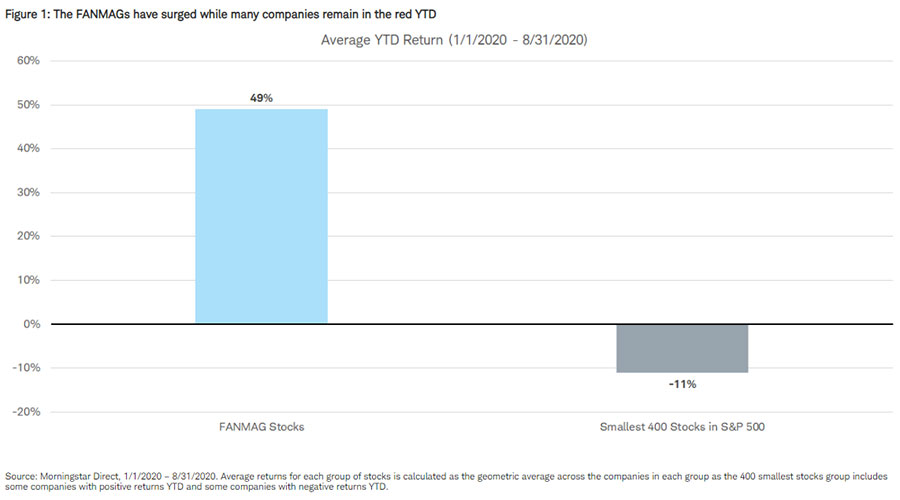

So how large was the performance discrepancy between FANMAG stocks and the bottom 400 of the S&P 500?

The performance discrepancy is massive. The bottom 400 out of 500 stocks in the S&P 500 were still down an average of 11% as of the end of Q3. It was FANMAGs near 50% growth that powered the market’s rise and recovery this year.

Do we expect FANMAG outperformance to continue? Or are we building up to another tech bubble, as we had in 2000?

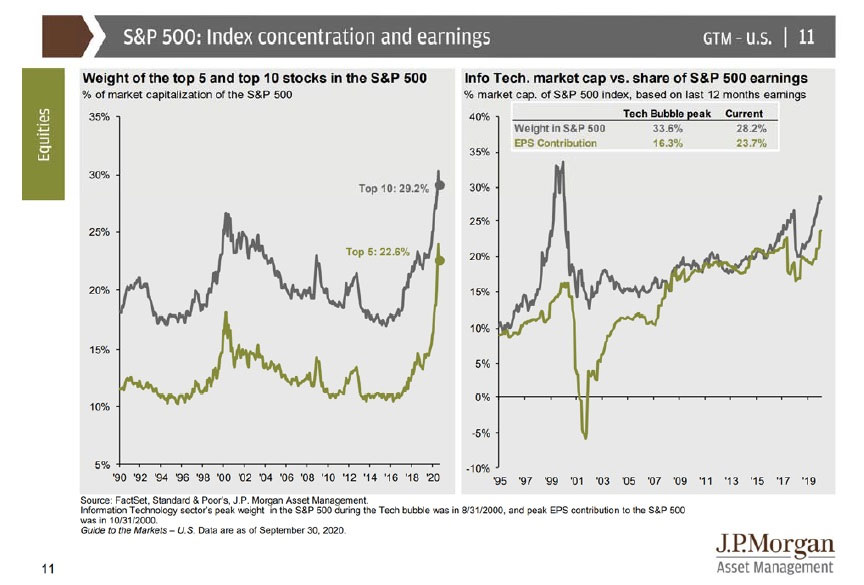

Market concentration in the S&P 500 is even more pronounced than it was during the tech bubble of 2000. There’s definitely greater exposure of the index to a slippage in FANMAG stocks. On the other hand, while the 2000 tech bubble was characterized by high valuations without high earnings per share, as of the end of Q3 2020, tech stocks have an EPS contribution that, while below their market weight, aren’t severely out of alignment.

This is all to say that while we have more subdued expectations of FANMAG stocks going forward, we are not fleeing for the hills. There are other areas in the market with more attractive valuations—small caps, value stocks, energy, financials, international, and EM stocks come to mind. But although we expect many of these categories to rebound, the timing of recovery is highly uncertain—for instance, an oil glut needs to clear in the energy sector, and COVID-19 as well as additional stimulus questions hamper the financial sector. Given the performance discrepancy between the FANMAG giants and the other names in the S&P, we believe it is prudent to rebalance and reduce some exposure in favor of names that show better value and have not run as hard in recent months.

JMS Capital Group Wealth Services LLC

4900 Perry Highway, Suite 300 | Pittsburgh, PA | 15229 | 412‐415‐1177 | jmscapitalgroup.com

An SEC‐registered investment advisor. Securities may be offered through PWA Securities, Inc. Member FINRA/SIPC.

This material is not intended as an offer or solicitation for the purchase or sale of any financial instrument or investment strategy. Certain material in this work is proprietary to and copyrighted by Peak Advisor Alliance and is used by JMS Capital Group Wealth Services LLC with permission. This material has been prepared for informational purposes only, and is not intended to provide, and should not be relied on for, accounting and legal or tax advice. Any forecasts contained herein are for illustrative purposes only and are not to be relied upon as advice or interpreted as a recommendation.

‹ Back