By using our website, you agree to the use of cookies as described in our Cookie Policy

Blog

The Magnificent Seven

The S&P 500 is up about 20% this year. Most of the gains have come from a handful of stocks that have been dubbed the “Magnificent Seven,” which is comprised of Alphabet, Amazon, Apple, Meta, Microsoft, Nvidia, and Tesla. These stocks have approximately doubled in value in 2023, while the remaining 493 stocks in the S&P 500 are up only about 7%. Going forward, what does such a concentrated market portend? Will the rest of the field show catch-up growth to the tech giants, or will Magnificent Seven slide back to the pack?

Michael Batnick analyzes past instances of concentrated performance. For context, he points out that tech stocks got crushed in 2022, so that 2023’s gains essentially balance out the prior year—it’s possible that 2022 was the aberration and 2023 represents a return to normalcy. On the other hand, 1999 featured a similar gap between the cap weighted S&P 500 and the equal weighted S&P 500, and shortly thereafter the tech bubble burst.

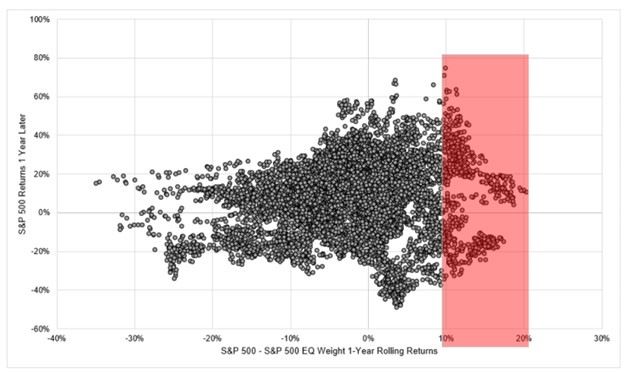

Batnick creates a graph plotting 1-year returns versus the difference between the cap weighted and equal weighted S&P 500 indexes:

Source: Michael Batnick, The Irrelevant Investor

Source: Michael Batnick, The Irrelevant Investor

When the S&P’s gains are highly concentrated (the area in red), returns 1 year later are…not bad. Not great, and perhaps more volatile than for broader markets, but not alarming in and of itself. While some degree of profit taking would probably be wise, the overall picture seems to enforce the idea that the S&P 500 has tended to rise over time, and even with concerns about tech concentration, there is still room for the S&P 500 in a balanced portfolio.

###

JMS Capital Group Wealth Services LLC

417 Thorn Street, Suite 300 | Sewickley, PA | 15143 | 412‐415‐1177 | jmscapitalgroup.com

An SEC‐registered investment advisor.

This material is not intended as an offer or solicitation for the purchase or sale of any financial instrument or investment strategy. This material has been prepared for informational purposes only, and is not intended to be or interpreted as a recommendation. Any forecasts contained herein are for illustrative purposes only and are not to be relied upon as advice.

‹ Back