By using our website, you agree to the use of cookies as described in our Cookie Policy

Blog

The Gold / Stock Correlation

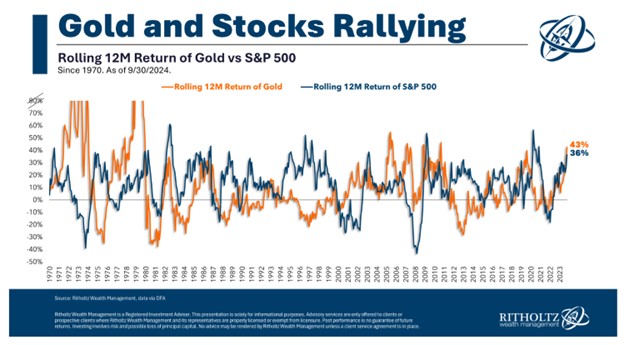

Ben Carlson reviews the history of gold and stocks in addressing the question as to whether gold serves as a hedge that will help a portfolio when equities falter. The surprise this year is that gold and stocks have moved in tandem over the past year--Carlson shows that such a relationship is not historically typical:

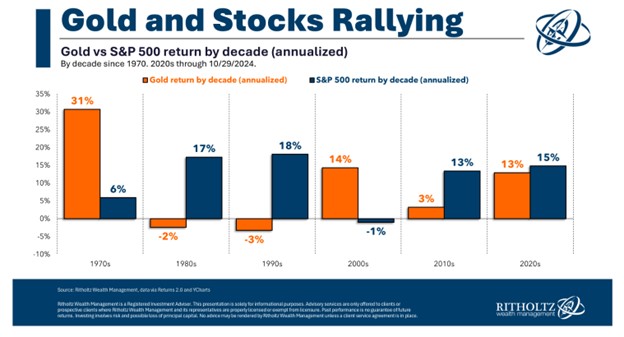

There’s not an obvious pattern here. Sometimes gold and stocks move in the same direction, and sometimes they move in opposite directions. Carlson also asserts that if you look at monthly correlations, there no relationship between S&P 500 performance and gold performance. Carlson provides another chart that shows returns over 10-year periods:

If you look by decade, gold historically did best when stocks struggled, and vice versa. But that pattern has been broken in this decade. Carlson notes that gold wasn’t an inflation hedge—in 2022 when inflation spiked, gold was flat. This year, as inflation has fallen, gold has jumped. Why? Carlson resists the urge to craft a narrative, arguing that explanations are usually backfilled after the event, and not offered as a prediction beforehand. Carlson argues that gold has risen this year because large institutions have been buying it heavily, for whatever reason. And that’s his point—for a quirky, uncorrelated asset like gold, investors should have tolerance for unpredictable movements.

JMS Capital Group Wealth Services LLC

417 Thorn Street, Suite 300 | Sewickley, PA | 15143 | 412‐415‐1177 | jmscapitalgroup.com

An SEC‐registered investment advisor.

This material is not intended as an offer or solicitation for the purchase or sale of any financial instrument or investment strategy. This material has been prepared for informational purposes only, and is not intended to be or interpreted as a recommendation. Any forecasts contained herein are for illustrative purposes only and are not to be relied upon as advice.

‹ Back