By using our website, you agree to the use of cookies as described in our Cookie Policy

Blog

The Deficit and Interest Rates

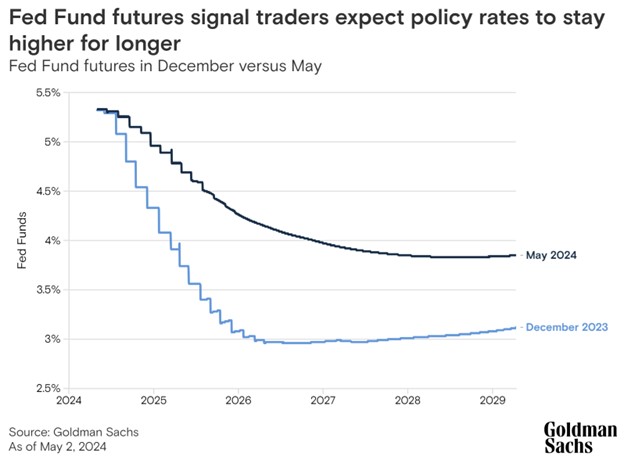

Annual federal budget deficits have increased sharply in recent years. Interest rates have risen sharply as well. Is rapid debt accumulation the cause of higher interest rates? Jonny Fine of Goldman Sachs argues that Federal Reserve policy has been the primary driver of higher yields. As disinflation has stagnated, and the Fed has in turn maintained a cautious approach to rate cuts, markets have adjusted their expectations in recent months:

Alec Phillips, Chief US Political Economist at Goldman Sachs, comments that deficits are likely to be larger under unified government than divided government—if Republicans control Congress and the Presidency, they are likely to cut taxes, whereas Democrats with full control are likely to increase spending. Divided government may actually reduce the deficit as various legislation is set to expire, including portions of the Trump tax cuts.

As Phillips notes, the larger fiscal question for the US is what action it will take during the next recession. The current combination of a strong economy with high deficits is unusual, and there’s no precedent that can tell us the extent to which the government will be willing or able to provide fiscal relief in the event of an economic downturn.

JMS Capital Group Wealth Services LLC

417 Thorn Street, Suite 300 | Sewickley, PA | 15143 | 412‐415‐1177 | jmscapitalgroup.com

An SEC‐registered investment advisor.

This material is not intended as an offer or solicitation for the purchase or sale of any financial instrument or investment strategy. This material has been prepared for informational purposes only, and is not intended to be or interpreted as a recommendation. Any forecasts contained herein are for illustrative purposes only and are not to be relied upon as advice.

‹ Back