By using our website, you agree to the use of cookies as described in our Cookie Policy

Blog

Shutdown Deferred

The United States managed to avoid an October 1st government shutdown, as the House of Representatives passed a bipartisan bill that funds the government through November 17th. The Senate and White House quickly signed off on it, so that the budgetary can has been kicked down the road for another few weeks.

What are the likely consequences of a government shutdown, should there be an impasse come November? Lord Abbett’s Joseph Graham and Timothy Paulson tackle the question, and suggest a shutdown is unlikely to be a major cause for concern.

Shutdowns historically have been more of a nuisance than a long-term problem. Many government employees are furloughed as nonessential services are halted. Though about 2-3 million workers would not receive paychecks during that time, they typically receive back pay once the shutdown ends. Some government functions experience delays; others, such as tourism services in national parks, may close during a shutdown. Graham and Paulson cite a JP Morgan estimate of an economic activity impact of 0.1% to 0.2% of GDP per week, but most of that activity is recouped when the shutdown ends.

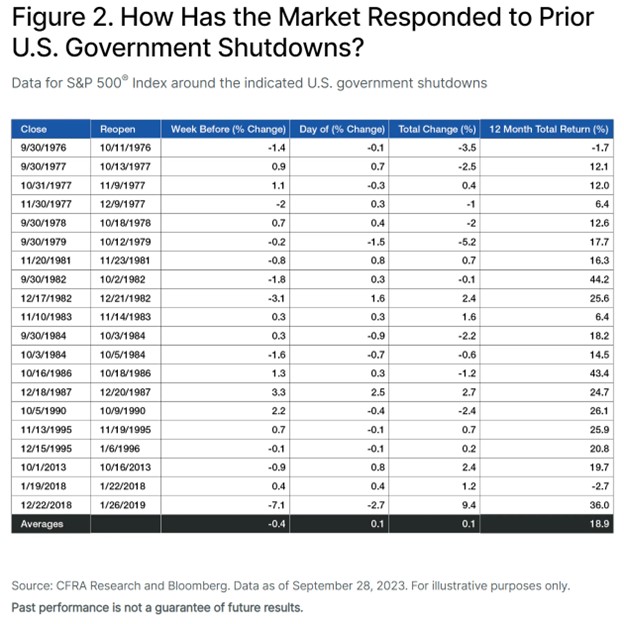

Market impact of shutdowns has historically been negligible. Graham and Paulson have a useful graph showing S&P 500 movements from past shutdown events:

Could this time be different? There is that possibility. The good news is that House Speaker Kevin McCarthy passed a short-term funding bill with both Republican and Democratic votes. The bad news is that several hardline conservatives appear poised to join with Democratic members to oust Kevin McCarthy from his leadership position.

As Graham and Paulson note, due to the narrow Republican majority in the House of Representatives, legislation is vulnerable to interest group demands—in this case, demands from a handful of Republican members for large spending cuts. While government shutdowns have typically ended within a few days, shutdowns in 2013 and 2018 lasted for 16 and 34 days, respectively. In addition to short-term market volatility, Graham and Paulson tie a possible shutdown to Fitch’s August downgrading of US debt, which occurred in part due to governance concerns. Although history suggests minimal long-term burdens of government shutdowns, there is the possibility that we are entering new territory, with potential chaos in the House of Representatives as the Speaker drama unfolds, and the potential for a longer-term shutdown that takes us beyond historical precedent.

###

JMS Capital Group Wealth Services LLC

417 Thorn Street, Suite 300 | Sewickley, PA | 15143 | 412‐415‐1177 | jmscapitalgroup.com

An SEC‐registered investment advisor.

This material is not intended as an offer or solicitation for the purchase or sale of any financial instrument or investment strategy. This material has been prepared for informational purposes only, and is not intended to be or interpreted as a recommendation. Any forecasts contained herein are for illustrative purposes only and are not to be relied upon as advice.

‹ Back