By using our website, you agree to the use of cookies as described in our Cookie Policy

Blog

Quarterly Market Commentary

3rd Quarter 2024 - Key Takeaways

Markets continued their journey onward and upward in the third quarter of 2024, with broadly distributed gains throughout numerous segments of the market. Economic growth remained strong despite the headwinds of elevated interest rates, while the labor market cooled but didn’t crumble. Inflation continued to ease, and is now within shouting distance of the Fed’s 2% target. The Fed’s long anticipated dovish turn kicked off in September with a 50bp cut to the federal funds rate. It’s looking more and more likely that the Fed will be able to stick the soft landing of taming inflation without inducing a recession. Of course, as benign economic news has already been priced into the market, there is still the question going forward as to whether or to what extent the good times can continue. One promising sign is that the 3rd quarter’s bull run came from many areas of the market instead of being concentrated in a handful of tech stocks. On the other hand, elevated valuations would suggest less room for stocks to continue to grow.

The S&P 500 rose another 5.9% in Q3 2024, while developed international, emerging markets, and small caps climbed 7.3%, 8.8%, and 9.3%, respectively. All four of these market areas are up double digits for the year. Bonds, fueled by the promise of rate cuts, also posted excellent marks, with the US agg rising 4.4% in the quarter, and international developed bonds gaining 9.6%. Treasury rates fell during Q3 2024, with the 2-year rate dropping sharply (which was hardly surprising, given expectations of rate cuts over that span) and long term rates falling nearly 50bp as well.

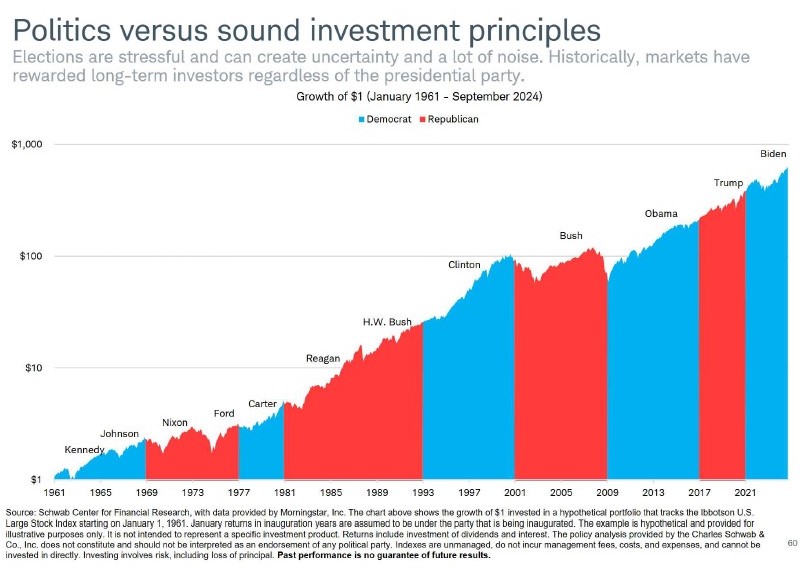

GDP has remained strong, as it grew 3.0% in the second quarter of 2024 and is anticipated to show an increase of 2%-3% in the third quarter of 2024. Labor markets cooled a bit further, with the unemployment rate rising slightly to 4.2%, but job growth continued to be robust. Core inflation fell slightly over the past three months but remained moderately elevated at 3.3%. Even with the 50bp September cut, the Fed’s policy is restrictive, and the Fed can certainly slow or halt rate cuts should disinflation stagnate. The Presidential and Congressional Elections will take place in the coming days. The Presidential race is a tossup, as is control of the House of Representatives; Republicans are strongly favored to gain control of the Senate. Given that Republicans are more likely to gain complete control of the Presidency and Congress than Democrats (and that Republican appointees hold 6 of 9 seats on the Supreme Court), a Trump presidency would likely have greater consequences than a Harris presidency, which would struggle to pass major legislation without control of the Senate. Still, high deficits and elevated long-term interest rates will likely constrain fiscal legislation next year to an extent no matter who wins the election. As for markets, we’d reiterate that markets usually rise (and sometimes fall) no matter which party is in power, so we caution against letting politics guide your portfolio. And while it is good that the impetus behind the S&P 500’s continued surge has broadened beyond a handful of giant tech stocks, earnings will need to show continued strength to justify high valuations.

Third Quarter 2024 Investment Letter

The S&P 500 is up more than 60% over the past two years, making the downturn of 2022 an increasingly distant memory. It’s increasingly likely that the economy will make the proverbial soft landing—normalizing inflation without enduring the pain of a recession. The Fed expects to make several rate cuts over the next two years, which should help buttress markets and the economy. On the other hand, it’s highly unlikely that the S&P 500 can continue to post 30% annual returns over the longer term. It’s possible that markets and valuations have overshot the mark. Despite improvement over the past quarter, market concentration is still high, so that if tech stocks cough, the S&P 500 catches a cold. On a global scale, geopolitical violence has flared up in recent years, and the United States now faces a turbulent election with a highly polarized electorate. We could be witnessing the calm before the storm.

Third Quarter 2024 Market Update

The third quarter of 2024 was strong almost across the board. The S&P 500 climbed 5.9%, and finished the quarter up 22.1% year-to-date. Developed international and emerging markets had even better quarters, with returns of 7.3% and 8.8%, respectively, and year-to-date returns of 13.4% and 17.1%, respectively. In terms of style, value and small caps closed the gap on their large growth brethren with a strong quarter. Through June 30th, large growth was up 20.7%, large value 6.6%, and small growth 4.4%, while small value was down 0.8%. But through September 30th, large growth was up 24.5%, large value 16.7%, small growth 13.2%, and small value 9.2%. Essentially, large growth rose about 4%, while small or value indices rose about 10% for the quarter. As for sectors, utilities led the way with a gain of over 19% in Q3 2024, while energy was the only loser, down 2.3%. For the year, while technology and communication services have posted gains of nearly 30%, utilities have joined the top tier with a 30.1% increase through September 30th.

The Fed’s dovish turn amidst stabilizing inflation helped US bonds post strong gains. The US agg rose 5.2% in Q3, while developed international bonds jumped 9.6%, High yield bonds climbed 5.3%, and municipal bonds gained 2.7%. The Fed’s shift to an easing stance helped Treasury rates fall in the third quarter of 2024, as the 2-year Treasury rate dropped from 4.71% to 3.66%, the 10-year Treasury rate dipped from 4.36% to 3.81%, and the 30-year Treasury rate tumbled from 4.51% to 4.14%. Volatility rose in Q2 but was generally moderate and under 20, aside

from a brief spike in August into the upper 30s.

Update on the Macro Outlook

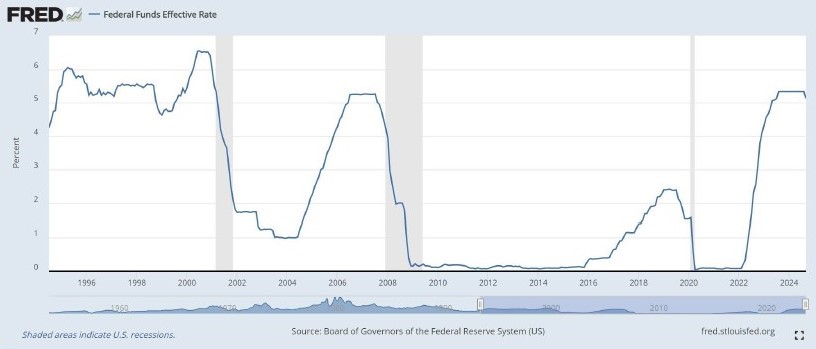

The Fed finally made its long-anticipated dovish turn, slashing the federal funds rate by 50bp in September. As of August headline inflation was down to 2.6%, and core inflation to 3.2%. The personal consumption expenditures price index, an inflation measure closely watched by the Fed, rose by only 2.2% year-over-year in August. Overall, the Fed’s assessment of its balance of risks changed, as it grew less concerned with elevated (but easing) inflation, and more concerned with a cooling labor market. And so with the Fed’s hiking cycle apparently at its end, we thought we’d take a look back at a recent history of interest rates. First, the Fed’s rate hikes started up fast and furious in 2022:

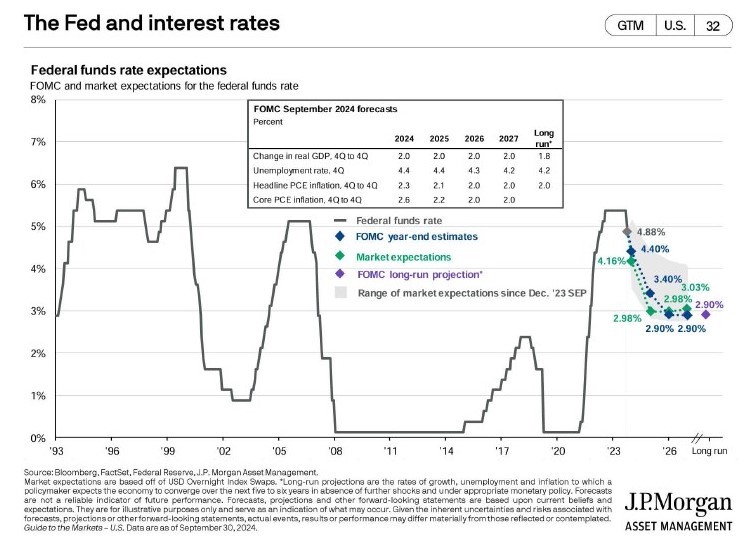

The steepness of the spike in 2022-2023 testifies to the fact that the 5.25% increase in the federal funds target rate was the most aggressive set of rate increases in decades. Going forward, markets and the Fed expect rates to decline, but not to the ultra-low rates of the 2010s:

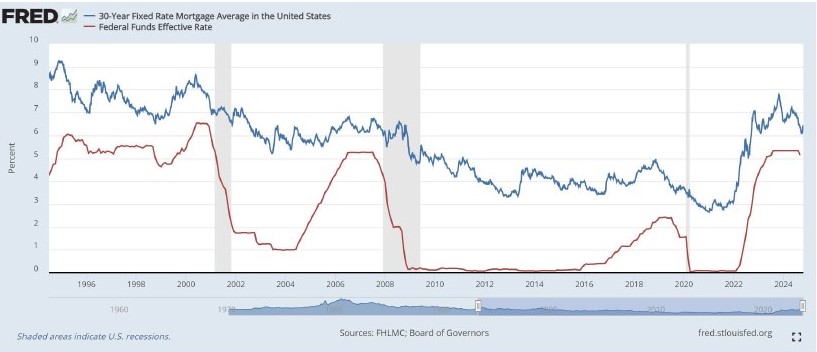

Both markets and the Fed forecast the federal funds rate to decline to about 3% by 2026, with markets anticipating a slightly more aggressive downward path than does the Federal Open Market Committee. But markets are forward looking, so we’ve already seen significant downward movement in longer-term rates as it became increasingly clear that rate cuts were coming. For example, we can look at the history of mortgage rates in conjunction with the federal funds effective rate:

While the federal funds rate and mortgage rates have tended to move in tandem, steep movements in the federal funds rate have typically been accompanied by more modest movements in mortgage rates. If the Fed cuts rates an additional 2% by 2026, we would project longer-term rates to fall by a smaller amount. Longer-term rates may also be pushed up by high government borrowing stemming from high deficits:

The deficit to GDP ratio is unusually high, given that the COVID recession is well in the rear-view mirror. Campaign promises by both Kamala Harris and Donald Trump would pile on even more debt, though Harris’s plans are less likely to be enacted, given that Republicans are favored to gain control of the Senate. As for markets and the election, we would again advise not letting your politics dictate your portfolio. Markets typically grow no matter which party is in power:

Portfolio Positioning and Closing Thoughts

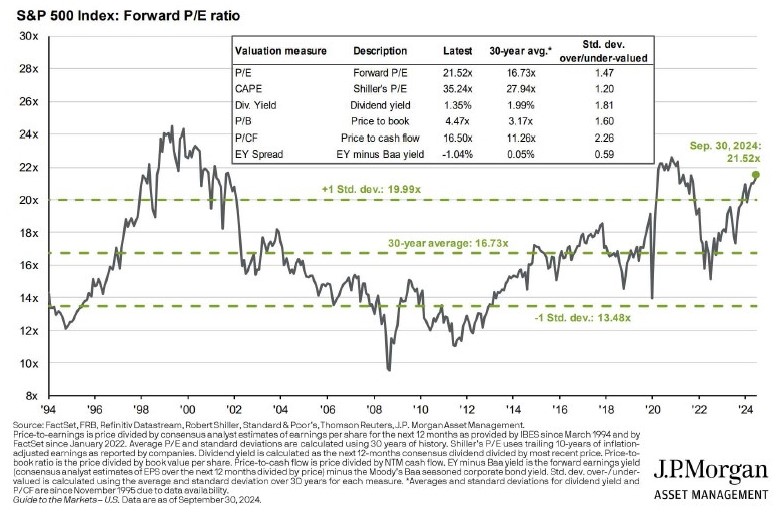

While we were heartened that in Q3 the S&P 500 rally broadened beyond the Magnificent Seven stocks of Alphabet, Amazon, Apple, Meta, Microsoft, Nvidia, and Tesla, we still have concerns going forward about elevated valuations:

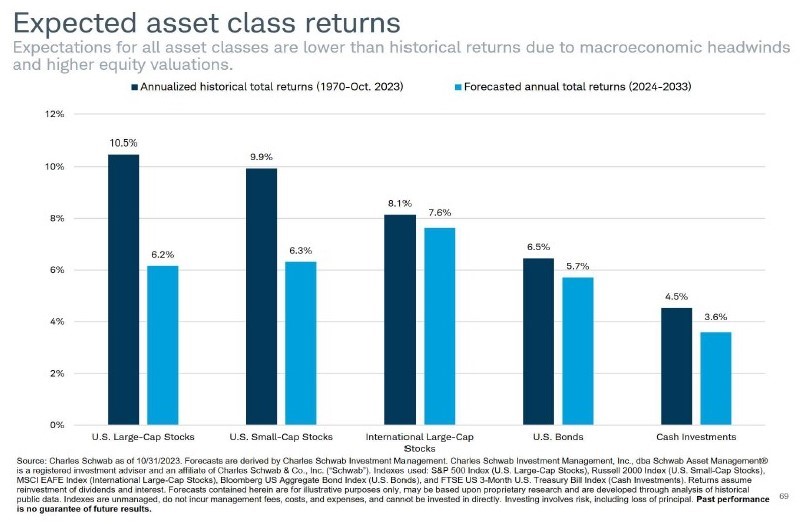

With valuations high, return expectations going forward should be somewhat subdued:

We remain in a situation in which large cap performance is heavily dependent on a handful of tech stocks. It’s possible that artificial intelligence developments will raise these companies to new heights, but it’s also possible that these companies will disappoint, and there is a good bit of optimism already baked into the valuations cake. One promising sign is that earnings growth and profit margins have been strong:

As we move into the final months of 2024, we are in a reasonably good position market wise in terms of returns. Stocks have provided surprisingly strong numbers – and the participation has been better than 2023. Although the “Magnificent 7” are still a large driving force for stock prices, their contribution is less this year. We’ve seen better results from large cap value stocks and decent participation from the diversifying categories (small cap, mid cap, international and emerging markets). The valuation story has not changed very much from recent quarters. The excellent performance from large U.S. companies has kept their valuations elevated. At the end of the third quarter, large caps sat nearly 30% above their long-term average valuation. Bull markets tend to run for reasonable long periods, so these valuations do not suggest short-term downside is likely. However, these elevated valuations do lower expectations going forward. U.S. large caps are expected to deliver returns about 40% below the long-term average of 10.5% over the next decade based on current valuation levels. Even though small cap stocks and international stocks are more attractive on a valuation basis, their returns are expected to be more muted as well. So, our expectations may need at least a minor reset as we move forward.

On the bond side, we would expect more average returns in coming years. The Fed has begun their rate cut process. So, we will need to adjust a bit over the next few years as we will not be able to rely as heavily on money markets and short-term bonds as we did over the last two years. The set up is better for core bonds. They should benefit as rates most likely move a bit lower over the next year or two – although we would not be surprised to see the 10-year surprise and move higher at times. Multi-sector bonds should be an environment that allows them to balance their approaches between high-quality bonds - in a possibly falling interest rate environment – with credit opportunities to boost yield. The one area we are most cautious about is the junk bond market. The yield spreads over Treasuries is near low levels – meaning investors are not being compensated for risk. At the same time, defaults are low due to strong economic conditions. If those conditions soften, default rates could spike and harm junk bonds. We prefer to get any exposure to corporate high-yield bonds through our multi-sector approaches that can rachet exposure up and down based on market conditions.

JMS Capital Group Wealth Services LLC

417 Thorn Street, Suite 300 | Sewickley, PA | 15143 | 412‐415‐1177 | jmscapitalgroup.com

An SEC‐registered investment advisor.

This material is not intended as an offer or solicitation for the purchase or sale of any financial instrument or investment strategy. This material has been prepared for informational purposes only, and is not intended to be or interpreted as a recommendation. Any forecasts contained herein are for illustrative purposes only and are not to be relied upon as advice.

‹ Back