By using our website, you agree to the use of cookies as described in our Cookie Policy

Blog

Quarterly Market Commentary

First Quarter 2022 Key Takeaways

Inflation, war, and COVID. Perhaps the world could have returned to pre‐COVID days if it faced only one of these challenges, but we hit the trifecta this past quarter. In the wake of such headwinds, markets stumbled out of the gate this year, but remained out of correction territory at quarter’s end. Given the highest inflation rate in decades, the brutal Russian invasion of Ukraine, and new COVID‐induced shutdowns in China, we could argue that the first quarter numbers could have been significantly worse. Of course, the cynic would argue that the worst is yet to come, but given the market’s resurgence over the past 2 years, the optimist’s take would be that the market is coming in for a soft landing that will let some of the air out of high valuations. Unfortunately, our crystal ball isn’t telling us who is correct, so we have been working to maintain portfolio resiliency that can accommodate a variety of macroeconomic and market conditions—with a substantial portion of domestic and international equities should this market hiccup prove transitory, along with a liquid alternatives sleeve in case 2022 ends the year more grimly than it began.

Many areas of the market were underwater for the first quarter of 2022. The S&P 500 was down almost 5%, developed markets fell 6%, emerging markets dropped 7%, and the Russell 2000 slid 7.5%. There wasn’t much differentiation—the pullback was broad based, across countries and firm size.

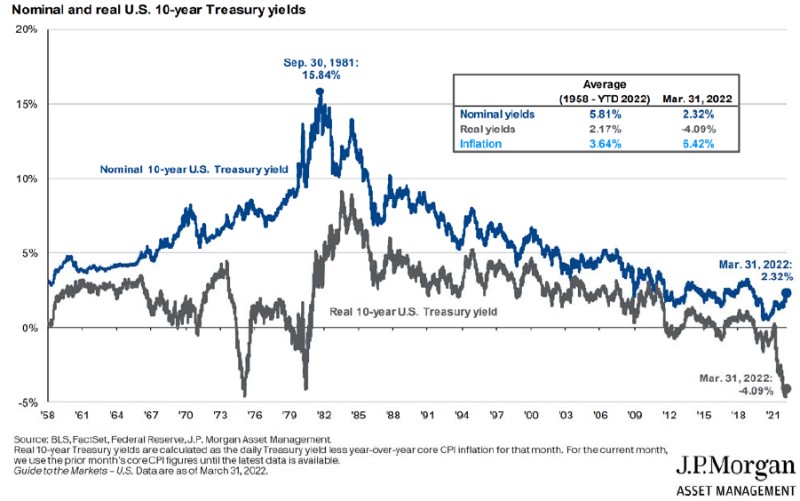

Fixed income, unsurprisingly, struggled mightily as it became increasingly clear that the rising rate environment would begin in Q1, and that it would likely involve more rate hikes than previously anticipated. The US agg fell nearly 6% for the quarter, while the global agg dropped over 6%. Short‐term treasury rates rose sharply in Q1, with the 2‐year rate increasing from 0.73% to 2.28%. Longer‐term rates were up as well—the 10‐year rate climbed from 1.52% to 2.32%, and the 30‐year rate rose from 1.90% to 2.44%. Credit markets fell as well, but less sharply, with high yield down almost 4%, and floating rate down just 55bp.

On the macroeconomic side, the GDP outlook is positive, employment recovery has once again been strong, but the resurgence of inflation perhaps even stronger. In other words, we are in an overheated economy that the Fed is attempting to cool over the coming months. As of March the unemployment rate fell to 3.6%, but the headlines have understandably gone to the continued rise of inflation, which increased to 8.5% in March. President Biden’s “Build Back Better” plan appears dead, as it is unlikely to gain Senator Joe Manchin’s support in this inflationary environment; there remains a possibility that certain pieces of the plan could be passed as separate legislation, but there is currently nothing near imminent.

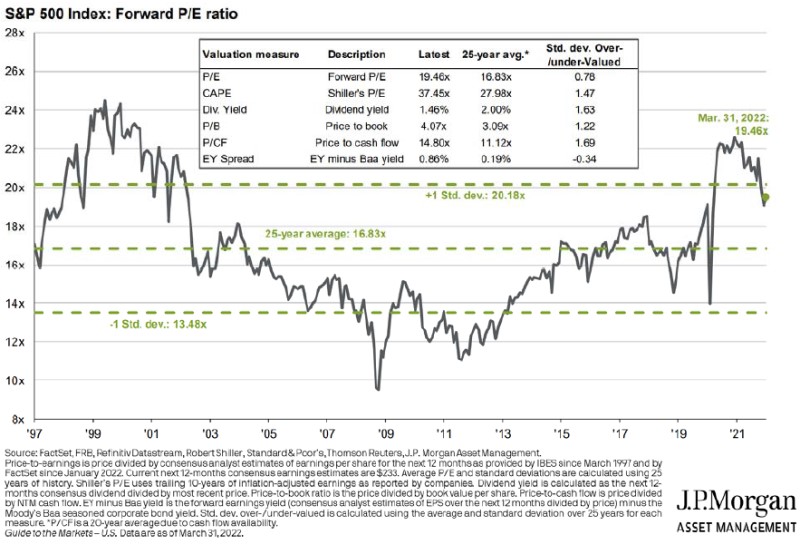

One silver lining to the market pullback is that equity valuations have become less frothy. Unfortunately, the somewhat greater appeal of equities has been accompanied by a rising rate environment that is likely to occur much more aggressively than was anticipated even three months ago. The bond market may have more appeal once interest rates become more normalized, but in the interim, rising rates means that currently held bonds with low yields remain unappetizing. Overall, amidst an equities pullback, geopolitical tensions, COVID aftershocks, and high inflation, the investment environment remains challenging. Still, markets have shown remarkable resiliency over the long run, so we are not inclined to stray too far from a balanced portfolio—but with a tilt of equities over bonds, and a liquid alternative sleeve that seeks the 3‐6% return traditionally gleaned from bonds, while providing a degree of downside protection should the market’s struggles in 2022 continue.

First Quarter 2022 Investment Letter

The S&P 500 more than doubled between its nadir on March 23rd, 2020, and the end of 2021. The market slide in 2022, painful as it is, has erased only a fraction of those gains. Unfortunately, though, the world has changed in 2022 in ways that make the market’s fall quite understandable, and that may justify a further move into correction territory. This is not doomsaying, but an acknowledgment that global uncertainty has increased— Russia’s invasion of Ukraine has shaken the geopolitical order (perhaps for the better!—but it’s much too early to tell); China’s continued zero‐COVID policy amidst the ever‐more‐contagious omicron variant has yielded intensified lockdowns and may result in slowed growth and supply chain woes; inflation, once downplayed as transitory, has vaulted higher and proven more persistent than anticipated by the Fed, which has announced its expectation that more aggressive measures will be needed to contain it. There’s simply more risk in the world than there was 3 months ago, and the rise in market volatility reflects that reality. We’re not in crisis mode—the VIX, for example, has been persistently higher, but nowhere near its peak during the 2020 selloff—but we are living in a moment of greater uncertainty.

First Quarter 2022 Market Update

The decline in US equities was broad‐based in Q1 2022, with small, mid, and large cap indices posting mid single digit losses. Large caps held up slightly better than small caps, but the greater differential was growth vs value— large growth posted a 9% loss, while large value lost less than 1%; small growth declined over 12%, but small value only 2.4%. Most US sectors fell modestly as well in the first quarter, with most areas dropping between 1% and 12%; the two exceptions were utilities, up 4.8%, and, of course, energy, which climbed nearly 40%. The S&P 500 fell 4.6%, the Russell 2000 7.5%, developed markets 5.9%, and emerging markets 7%.

Bond markets, which had stabilized over the latter part of 2021, dropped sharply as the torrent of inflation showed little signs of easing. The US agg fell 5.93% and the global agg 6.16%, while the 10‐year rate rose 80bp to 2.32% and the 30‐year rate climbed 54bp to 2.44%. Credit markets performed less badly, with high yield falling just under 4% and floating rate losing less than 60bp. With the Fed’s initial hike of 25bp last month, we’ve started the march to higher rates, which over time should give bonds more attractive yields, albeit with current low‐yield bonds falling in value in the interim. Still, with rates still so low, the Fed has significant room to increase rates just to return them back to their historical norms. The VIX has generally been in the 20s for Q1 2022, up from the teens for most of 2021. The rise in the VIX is not particularly ominous, but arguably reflects that markets simply face more uncertainty and risk this year than last.

Update on the Macro Outlook

The recovery of equities since the start of the COVID crisis in early 2020 has been amazing. The employment rebound has been astoundingly rapid. The unemployment rate fell to 3.6% in March, nearing the February 2020 mark of 3.5%, which itself was the lowest unemployment rate since 1969. GDP growth has also been strong. But the elephant in the room has been inflation. Did Congress and Presidents Trump and Biden learn the lessons of the post‐Financial Crisis sluggish recovery too strongly? There’s always the temptation to fight the last war, and President Biden’s American Rescue Plan in 2021 may have been the proverbial cherry on top to an overstimulated economy. Of course the story is more complex than that—Russia’s invasion of Ukraine has caused oil and food prices to spike, and COVID has caused supply chain issues and disrupted the past balance of consumption between goods and services. European inflation is up as well, so inflation is a global problem as well as a domestic one. However, US inflation is running ahead of Europe’s; it may be the price we are paying for our aggressive fiscal and monetary support for the economy.

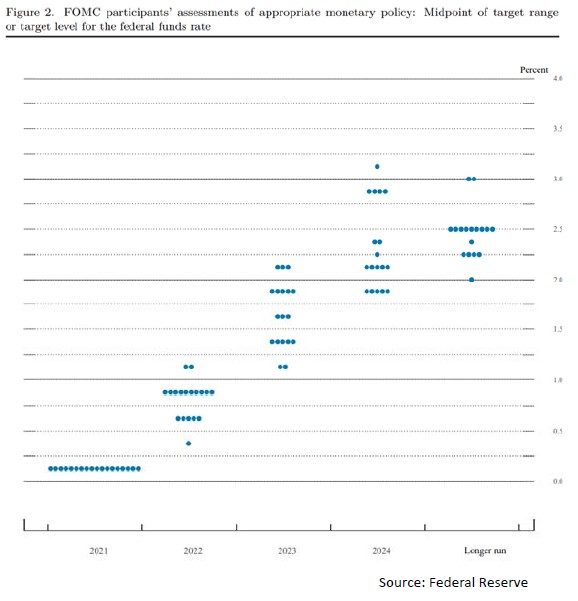

To see how much the Fed’s diagnosis of inflation has changed in just 3 months, we can look at their own projections of how fast they expected to raise interest rates.

First, as of December 15th, 2021:

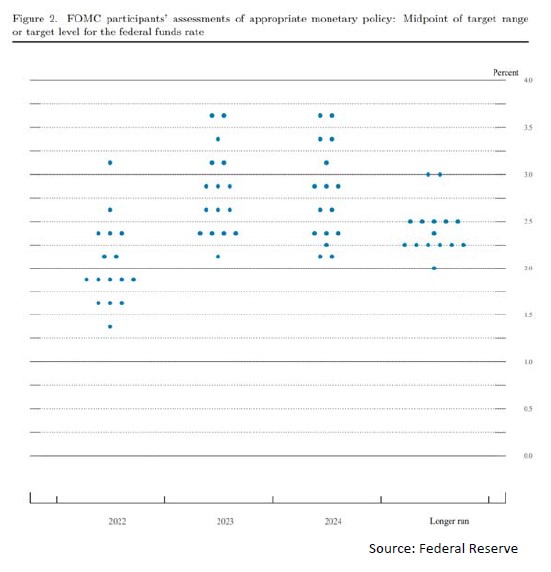

Next, the Fed forecast just 3 months later, on March 16th, 2022:

In December the Fed believed it would undertake rate hikes in a slow but steady fashion, with a 2% increase implemented gradually over the next 3 years, with an eventual additional 50bp increase in the longer run. The March dot plot has the median FOMC member expecting the federal funds rate to rise nearly 2% this year alone, including 1 rate hike already having occurred in March. After a 1.75% rate hike in 2022, the median member expects another 1% increase in 2023, before an eventual decline in the longer run to near 2.5%.

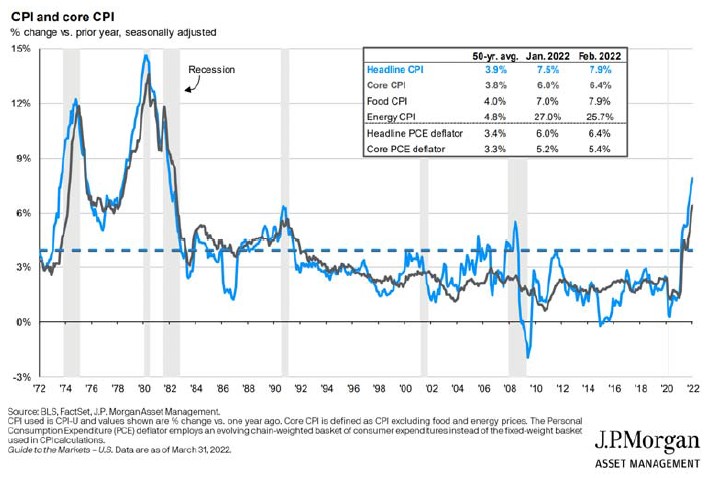

The Fed’s challenge is to tame inflation without pushing the economy into recession. It’s a difficult balancing act that’s become even more challenging as the inflation picture has unfolded:

This graph does not include March 2022, in which inflation rose yet again to 8.5%. A big question is to what extent the inflation spike is likely to be permanent (absent intervention) or transitory. It is true that energy and food prices may cool, though given that part of this surge is tied into the Russian invasion of Ukraine, it’s hard to make any confident predictions. Even if food and energy prices fall, core inflation is still historically well above normal, at 6.4% for February and 6.5% in March.

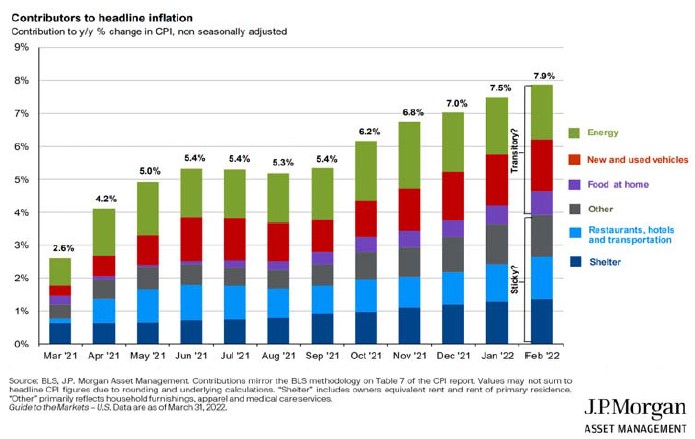

JPMorgan separated out inflation into individual components, and speculated on which pieces could be transitory and which could prove sticky:

We don’t know how well the components of inflation can be delinated into permanent vs temporary; for example, restaurant, hotel, and transportation prices may simply be showing catch‐up growth after they were hit hard by the pandemic. What we do see, though, is that inflation is broadly distributed, and while supply chain snarls are probably a piece of the puzzle, it seems unlikely that they are the main driver of inflation.

The runup in inflation has been brutal for bond markets—there’s no sugarcoating a ‐4% return on 10‐year treasuries. But, as we like to repeat, markets are forward looking, so as bad as inflation has been, what do markets think it will look like in the future? The picture, while darkening over the last quarter, isn’t unduly alarming:

The 10‐year inflation rate, which is a measure of expected inflation derived from 10‐year Treasury spreads, shows market participants expect inflation over the next 10 years to be, on average, about 2.9%. At the end of 2021 this number was about 2.4%, so expected inflation over the next 10 years has risen by 0.5%. In part this is because the high inflation baseline (which means high expected inflation for this year) is pushing up the average. However, this increase also brings two other interesting possibilities. First, it may take more time than previously expected for the Fed to bring down inflation—considering inflation is at 8.5%, it has a long way to fall to hit the 2% target. Second, it may be more difficult than expected to bring inflation down to 2%. The Fed is currently telegraphing a rapid rate hike regime, but if in 2024 interest rates are above normal and inflation has cooled to 3%, is the Fed going to feel compelled to slow the economy down, risking recession, to wring out the last 1% of excess inflation?

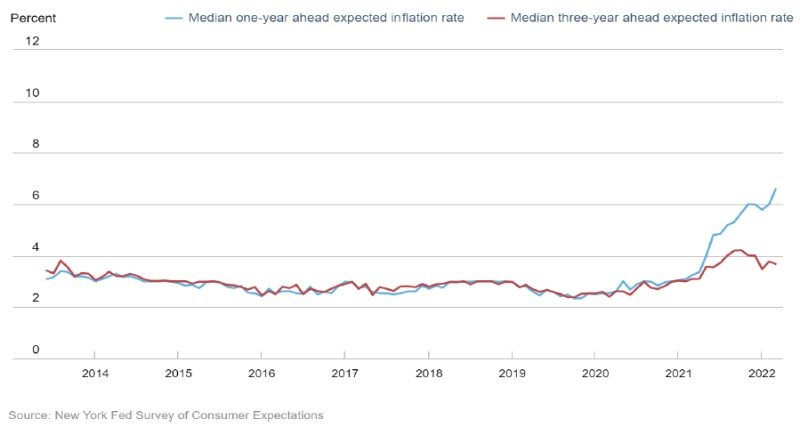

There’s too many unknowns to confidently forecast the path of inflation. Consumer surveys do offer a reassuring gloss:

Again, we have the pattern in which inflation is expected to be high in 2022, but to cool afterwards‐‐to under 4% within the next 3 years. The question is how robust these survey results are. It’s easy to project low inflation when inflation has been low for many years. Now that inflation is a more salient issue for consumers, it’s unclear how they will view inflation as time passes. If inflation is at 6% at year’s end, will people view this outcome as the glass half‐full (inflation is declining) or half‐empty (inflation is much higher than normal)? We can’t know right now how the trajectory of inflation is going to affect consumer beliefs as to the future—for anyone under 40 in the US, this is their first experience with high inflation.

The bottom line is that the Fed has revolved to curb inflation; we believe that they will have some success doing so, but to what extent and at what cost? A recession would not be a surprise, but it is not preordained.

Despite the long discussion, we should note that there is more to the macroeconomic world than just US inflation; we will touch very briefly on two other topics. First, China’s adherence to its zero‐COVID policy in the midst of the highly contagious omicron variant has meant numerous lockdowns across the country; the overall effect on 2022 Chinese growth and supply chains will be negative, though the size of the effect is still unknown. Second, Russia’s invasion of Ukraine has contributed to energy and food price increases; while there may be a future silver lining if Europe fast‐tracks renewable energy development to reduce dependence on Russian oil and gas, the present is more challenging, with an increased risk of stagflation—stagnant growth and high inflation. There’s also the unanswerable question of how the world changes if Russia’s frustration at being stymied in Ukraine results in their escalation to the use of nuclear weapons.

Portfolio Positioning

Even though valuations are less inflated due to the market’s dip in the first quarter, they still remain elevated. The current investment environment is challenging. Recession risks are higher since the Fed now will be undertaking more aggressive rate hikes to curb inflation. Bonds may become more attractive, but not until inflation cools considerably. If we do undergo a stagflationary period, then stocks and bonds are likely to movedownwards at the same time. Liquid alternatives may give an opportunity to better diversify portfolios and provide a more durable set of lower‐risk investments while we wait for interest rates to find a near‐term equilibrium.

Closing Thoughts

While we expected the first half of 2022 to be volatile, with the potential of double‐digit market downside due to the combination of rising interest rates and continued high inflation, the addition of the conflict in Ukraine has delivered even more uncertainty into markets. Unlike most downturns we have undergone over the last 5‐10 years, we now are experiencing significant weakness in both stocks and bonds. Thus far in 2022, we have seen subpar performance across most stock asset classes and market sectors. Growth stocks, which have led the market for over a decade and benefitted greatly from the stimulus brought upon by COVID, have now come under greater pressure than the broader market. As the cost of capital rises, many of these companies are finding it difficult to grow at the rate they did just a year or two ago. While the long‐term trajectory of the most important companies in the growth sectors may not have changed drastically, we would expect additional pain in the short‐term as they are forced to come down from their lofty valuation levels. Diversification into value segments of the market, across all market capitalizations, has helped to blunt the equity downside to some degree; it is likely that this will continue for at least the next quarter or two. As always, it is important to stay diversified and take profits from market segments that look rich. Foreign stocks, which had a promising start to the year, and remain significantly cheaper than US stocks, have once again succumbed to the selling pressure of the market and seem to be bearing more than their share of pressure from the Ukraine‐Russia conflict. While owning assets that are significantly discounted to their long‐term averages has historically benefitted portfolios over the ensuing 5‐7 period, it is unlikely we will see a large turnaround in foreign stocks in the coming quarters.

For most portfolio strategies, we have approximately 20% of equities dedicated to foreign stocks, with the remainder of the equity sleeve invested domestically across small, mid, and large cap stocks.

The fixed income markets have provided the same dilemma as stocks. While rapidly rising interest rates have pushed the aggregate bond index lower by 6% for the quarter, volatility in the capital markets has also hurt most credit bonds such as high yields, mortgage‐backed securities, and emerging market debt. The drawdown in bonds has put additional pressure on portfolios as they have not acted as a ballast to stock volatility as we have typically expected during downturns. The one bright spot in our portfolio strategies has been the implementation of liquid alternative funds, which were added in the spring of 2021. This mix of low volatility strategies has managed to hold up much better than the bond market and has been the only broad category (aside from cash) that has limited drawdowns this year.

We expect continued volatility heading into the summer of 2022 as the Fed works through its rate hikes and the market digests incoming inflation data. As we moved into April, we have witnessed a continued downturn, both in stocks and bonds, and it is unclear, absent positive news on the inflation front, what would cause a swift market reversal in the coming quarter. Therefore, we are not making sweeping changes in portfolios; we are rather looking to make adjustments on the fringes to better position portfolios for the second half of 2022.

—JMS Team

JMS Capital Group Wealth Services LLC

417 Thorn Street, Suite 300 | Sewickley, PA | 15143 | 412‐415‐1177 | jmscapitalgroup.com

An SEC‐registered investment advisor.

This material is not intended as an offer or solicitation for the purchase or sale of any financial instrument or investment strategy. Certain material in this work is proprietary to and copyrighted by Litman Gregory Analytics and is used by JMS Capital Group Wealth Services LLC with permission. This material has been prepared for informational purposes only, and is not intended to provide, and should not be relied on for, accounting, legal or tax advice. Any references to future returns are not promises ‐ or even estimates ‐ of actual returns a client portfolio may achieve. Any forecasts contained herein are for illustrative purposes only and are not to be relied upon as advice or interpreted as a recommendation for a specific investment. Past performance is not a guarantee of future results.

With the exception of historical matters, the items discussed are forward‐looking statements that involve risks and uncertainties that could cause actual results to differ materially from projected results. We have based these projections on our current expectations and assumptions about current and future events ‐ as of the time of this writing. While we consider these expectations and assumptions to be reasonable, they are inherently subject to significant business, economic, competitive, regulatory and other risks, contingencies and uncertainties, most of which are difficult to predict and many of which are beyond our control. There can be no assurances that any returns presented will be achieved.

‹ Back