By using our website, you agree to the use of cookies as described in our Cookie Policy

Blog

Quarterly Market Commentary

Second Quarter 2021 Key Takeaways

The second quarter of 2021 for equities marked a continuation of the remarkable recovery since the COVID downturn in early 2020. The themes of Q2 2021 are thus similar to those of Q1 2021. First, vaccine implementation has enabled most of life’s domestic errands to function without the need for masks, though globally the delta virus variant is wreaking havoc in numerous countries and posing some degree of risk to highly vaccinated countries in the coming months. Second, macroeconomic conditions have been improving strongly and steadily with respect to both unemployment numbers and growth projections. Finally, the continued stock surge has left us seeking to balance participation in the runup with ballast in the event of a correction of markets’ currently high valuations. Once again, the question for investors is: how much of this economic optimism has already been priced into current asset prices, and how much further do markets still have to run?

During the second quarter the S&P 500 picked up where it left off at the end of the first quarter, gaining over 8% as of June 30th, while the Russell 2000 cooled off somewhat but still posted an increase of over 4%. Global stocks also had a strong quarter, with both developed markets and emerging markets rising over 5% for Q2 2021.

Fixed income markets rebounded significantly this spring after an unusually poor first quarter. After falling over 3% in the first quarter, core US bonds rose 1.8% in Q2 2021; the global agg, which had dropped over 4%, rebounded by 1.3%. Just as the first quarter decline was spurred by a rise in long term yields, the partial recovery stemmed from a fall in interest rates, as the 10‐year rate slipped from 1.74% to 1.45%, and the 30‐year rate dipped from 2.41% to 2.06%. While we do have increased inflation concerns, it is noteworthy that yields are largely shrugging off inflation risk, as rates declined this spring and are still quite low by historical measures. Credit markets continued their good year in Q2, with high yield up 2.5% and floating rate up over 1%.

On the macroeconomic front, GDP has been reviving rapidly, which was necessary given the economy shrunk 31.4% on an annualized basis in the second quarter of 2020 (meaning about 8% for the quarter). GDP grew 4.3% in Q4 2020 and 6.5% in Q1 2021, and is projected by the Federal Reserve to rise 7.0% overall in 2021. Macroeconomic catchup growth in 2021 is thus currently living up to the high expectations that came from continued fiscal relief, dovish monetary policy, and widespread vaccine distribution. On the labor front, while the US unemployment rate has fallen considerably from its peak, recent progress has slowed, as the unemployment rate fell from 6.0% to just 5.9% over the past 3 months. However, after unexpected shortfalls in April and May, the economy did add 850,000 jobs in June, so the labor market recovery may simply need more time.

Overall, despite a few stumbles in the labor market, the economy has been rebounding largely as expected, and low interest rates, pent‐up consumer demand, and the $1.9 trillion COVID relief bill from March should continue to make the economy run hot. There is also the possibility of one or two infrastructure bills passing Congress later this year, which could add trillions more in spending. Inflation has risen sharply, but much of the increase is likely to be temporary; the tricky challenge for the Fed is separating transitory inflation, which a minor concern, from persistent inflation, which would loom as a much more significant problem.

While we believe the market’s optimism has been largely justified, we are increasingly concerned about current valuations. What should an investor do when equities are increasingly expensive, and bonds have low yields and some risk of interest rate increases? While we are continuing to utilize a mix of domestic and international stocks and bonds, to ensure participation should the equities rally march apace, we have added ballast in many portfolios in the form of liquid alternatives. We believe this basket of liquid alternatives should provide a 3‐6% return much like we have historically expected from fixed income portfolios. However, they achieve their returns in a different manner. Additionally, they should provide good protection to the downside if equity markets correct significantly.

Second Quarter 2021 Investment Letter

Since bottoming out on March 23rd, 2020, at 2,237.40, the S&P 500 has nearly doubled in value, as it closed a 4,297.50 on June 30th, 2021. Q2 2021 continued this surge, with emerging markets and international developed markets up over 5% for the quarter, and the S&P 500 up over 8.5%. For additional perspective, we note that the pre‐pandemic record S&P high was under 3,400, so we’ve eclipsed that high by over 25% in a little over a year. While we believe vaccine success and expansionary fiscal and monetary policy provided the fuel for this recovery, it has been impressive to witness in action.

But again, markets have incorporated all of this optimism, and we see the results in elevated valuations. Longer term returns to equities tend to be subdued when valuations are high, and unfortunately bond yields are low and thus not providing the income support of yesteryear. An infrastructure bill could stimulate even more growth, but could also precipitate action by the Fed to forestall inflation, though we expect the Fed to be watchful and patient given its increased tolerance for temporary inflation above 2%, and its plausible belief that many inflation hotspots will cool without intervention. We continue to recommend a well balanced portfolio that can prosper in many market environments.Given how quickly and strongly markets have run up, we have

concerns about the path of returns going forward.

Second Quarter 2021 Market Update

Equities growth has been broad based in 2021. In 2020 large growth firms, particularly tech companies, provided the lion’s share of the US market upswing, as both value and small cap companies lagged far behind. During Q1 this year the script flipped, with small and value firms showing the largest increases; however, Q2 as seen the S&P gain 8.5%, whereas the Russell 2000 rose only 4.3%. For the year, market gains have been widely distributed, with small value rising 26.7%, small growth increasing 9.0%, and large value and growth gaining 17.0% and 13.0%. Aside from utilities, which lost 0.4%, all sectors were up in Q2 between 3.8% and 13.1%. For the year, energy has led the way with a 45.6% gain, as it completed its comeback from its market low in March of last year. Other sectors have risen from between 2% and 26%. International and emerging markets each rose over 5% this spring, so this really is a case of a rising stock tide lifting many boats.

Both the global and US aggregate bond indices rebounded in part from a very poor Q1; the US agg was up 1.8% for the quarter but was still down 1.6% for the year, and similarly, the global agg gained 1.3% in Q2 but was still in negative territory at ‐3.2% YTD. Bond performance was very much correlated with long‐term interest rates— as the 10‐year rate ballooned from 0.93% to 1.74%, US bonds fell, and as the 10‐year rate slid back to 1.45%, they partially recovered. Rates are still quite low by historical measures, which presents a conundrum—in order to get higher bond yields, interest rates need to rise, but that process comes with its own financial pain as current bonds with low interest rates then fall in value. Volatility, as measured by the VIX, has steadily fallen since the COVID crisis and plunged all the way to 15.83 by June 30th.

Update on the Macro Outlook

We’ve seen strong growth in Q4 2020 and Q1 2021; more of the same is expected for the rest of the year. Second quarter growth could near 10%, and overall, the Federal Reserve estimates 2021 GDP growth will be 7%, which would be the highest annual growth rate in decades. After the April and May job reports came in below expectations, the June report was strong, with a gain of 850,000 jobs for the month. While the unemployment rate only dipped marginally for the quarter, a separate figure that includes discouraged and part‐time workers had “real” unemployment dropping below 10% for the first time since the onset of the pandemic. Wage growth was 3.6% year over year in June. There is still significant room to run with respect to GDP and employment recovery, and although the April and May job reports may signal that the process may take longer than hoped, US economic numbers have mostly been on a positive path this year.

As of this writing about 2/3 of US adults have had at least one COVID‐19 shot, and vaccination rates among seniors are approaching 90%. However, vaccine uptake varies by region, and vaccine hesitancy may make further vaccine gains challenging. For adults age 18‐64 vaccination rates range by state from about 40% to almost 80%, so we have significant potential for COVID hotspots, particularly with the highly contagious delta variant. The delta variant poses a much larger threat worldwide, largely due to the disparity in vaccine access from country to country, and spillover effects could have a negative effect on the US economy.

Besides the delta variant, the other current fly in the economic ointment is inflation:

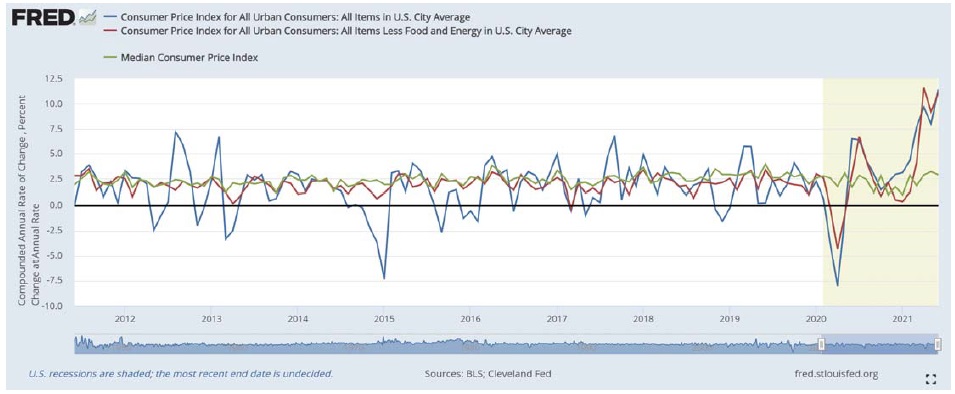

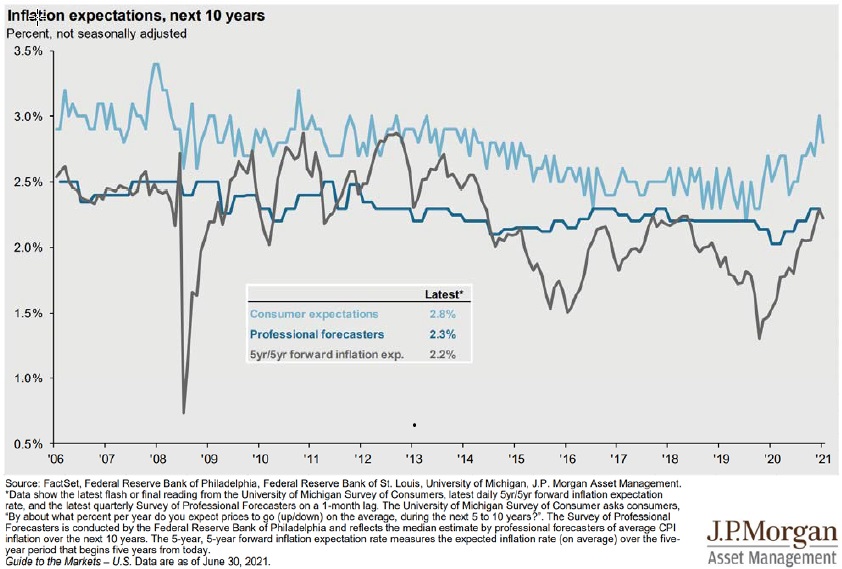

That’s a scary inflation chart. In the recent past, when inflation has bounced around it’s usually been because energy and food prices have fluctuated, while core inflation has remained stable. This year, however, both headline and core inflation have moved sharply higher in tandem. Why is this happening? A third line showing the median consumer price index provides a possible explanation. The median consumer price index has actually fallen in recent months; what this suggests is that the current inflation spike has been driven by a subset of items—for example, hotel prices and used cars (and lumber, before timber prices fell). The pandemic was incredibly disruptive to the global economy, and it is hardly surprising that we would see a bumpy recovery with semiconductor shortages for cars and readjustment of hotel prices. Fortunately, with respect to consumer and forecaster inflation expectations we are currently not in dangerous territory:

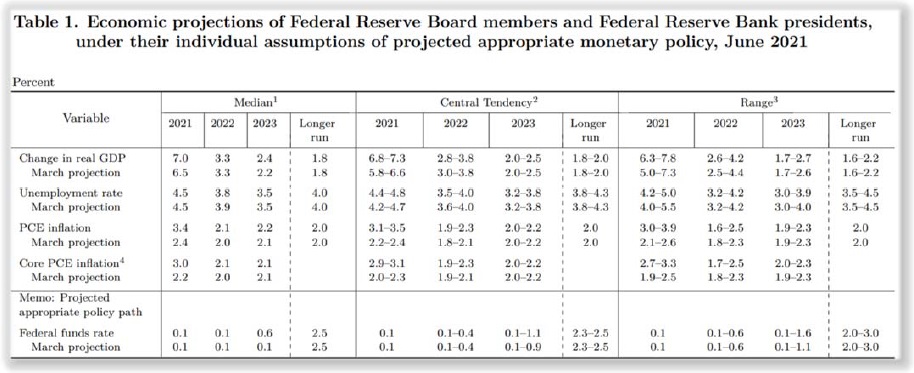

The Fed is probably right that much of current inflation is transitory, and it makes sense for the Fed to give some time for markets to sort themselves out rather than overreact. But the Fed has also taken note of recent events, in terms of it adjusting its expectations:

Source: Federal Reserve

The Fed’s median inflation projection for 2021 has risen from 2.4% to 3.4%, and core inflation from 2.2% to 3.0%. Post 2021, the Fed still expects inflation to settle at about 2%. As we observed earlier, the fact that interest rates haven’t spiked leads us to believe that markets have taken the inflation spike in stride, and that the Fed’s ability to scale back on its asset purchasing program and raise interest rates is likely to head off longterm inflation concerns. But the Fed could be wrong, markets could be wrong, and inflation certainly bears monitoring for the foreseeable future.

Portfolio Positioning

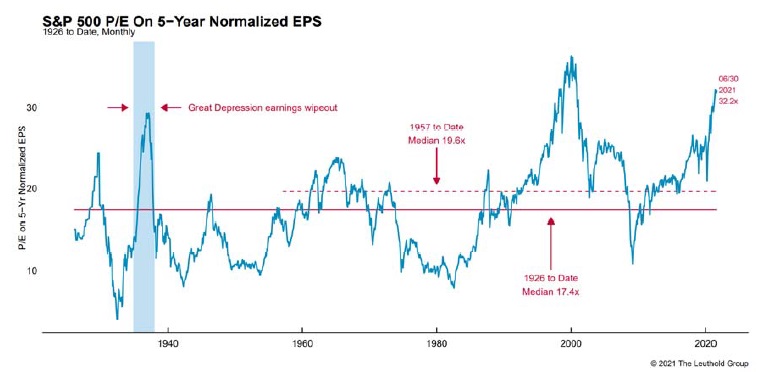

US stock valuations are still quite high:

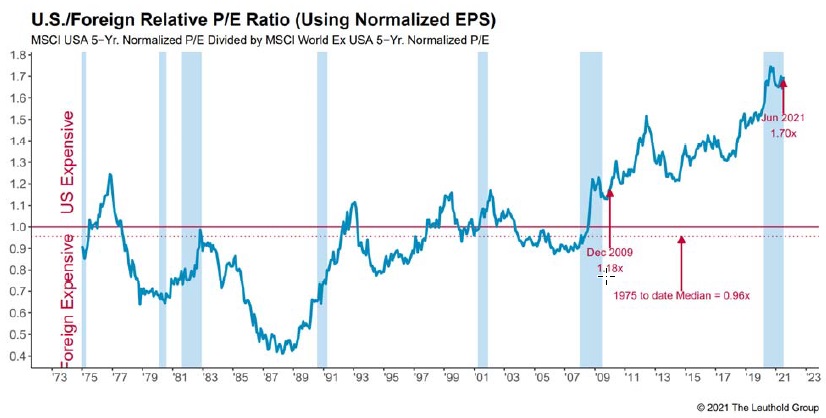

The investing dilemma is: do you invest in equities, knowing they are expensive; do you invest in bonds, knowing that interest rates are low; do you hold cash, knowing that cash earns you nothing? One fortunate circumstance is that international stocks are more reasonably priced, relatively speaking:

However, although equities prices in developed or emerging markets are attractive relative to those of the US, valuations are above average worldwide. Central bank and government policies have been quite supportive of asset prices, so despite our concerns, we are not largely underweight to stocks, even though high valuations have historically tended to lead to reduced future returns. Unfortunately, low bond yields and tightened credit spreads means that bonds are not likely to be as effective for portfolio diversification as in years past.

In order to provide additional portfolio diversification and supplement bond income (as described in the previous quarter’s newsletter), we have invested in a set of alternative funds in many portfolios. This basket of funds historically has provided some income, shown low correlation with stock market indices, and limited losses during market downturns. We view these funds largely as bond substitutes as we are unwilling to commit significantly more money to the bond market, given interest rate levels.

Closing Thoughts

While the economic recovery should continue for the remainder of 2021, we remain cautious in terms of portfolio positioning, given the numerous risks to the market. On the stock side, valuations remain elevated across nearly all asset classes; while relative value can be found in certain pockets of the market, such as foreign stocks, there are no corners of the stock market that we could call cheap at this point. The best case to be made for the stock market at this point can be made by directly comparing it to the bond market. Bonds offer, for the most part, paltry yields, coupled with the threat of principal loss as interest rates rise. Credit spreads remain historically low, so risk remains high in this area of the bond market as well. Adding more uncertainty to the mix, the delta variant is already causing COVID flareups in certain parts of the United States, with the threat of become a nationwide problem as vaccine uptake has slowed greatly this summer. Adding liquid alternatives to our portfolio mix gives us increased flexibility in portfolio management; moving forward this sleeve should provide some participation if the market continues to drift higher. On the flip side, if stocks take a significant hit, this basket will likely provide options to generate cash in order to purchase stocks at much more attractive levels. Contrasting the growing recovery with ongoing risks, we continue to believe that a well diversified portfolio will provide the flexibility to navigate the wide range of possible market outcomes over the coming year.

—JMS Team

JMS Capital Group Wealth Services LLC

417 Thorn Street, Suite 300 | Sewickley, PA | 15143 | 412‐415‐1177 | jmscapitalgroup.com

An SEC‐registered investment advisor.

This material is not intended as an offer or solicitation for the purchase or sale of any financial instrument or investment strategy. Certain material in this work is proprietary to and copyrighted by Litman Gregory Analytics and is used by JMS Capital Group Wealth Services LLC with permission. This material has been prepared for informational purposes only, and is not intended to provide, and should not be relied on for, accounting, legal or tax advice. Any references to future returns are not promises ‐ or even estimates ‐ of actual returns a client portfolio may achieve. Any forecasts contained herein are for illustrative purposes only and are not to be relied upon as advice or interpreted as a recommendation for a specific investment. Past performance is not a guarantee of future results.

With the exception of historical matters, the items discussed are forward‐looking statements that involve risks and uncertainties that could cause actual results to differ materially from projected results. We have based these projections on our current expectations and assumptions about current and future events ‐ as of the time of this writing. While we consider these expectations and assumptions to be reasonable, they are inherently subject to significant business, economic, competitive, regulatory and other risks, contingencies and uncertainties, most of which are difficult to predict and many of which are beyond our control. There can be no assurances that any returns presented will be achieved.

‹ Back