By using our website, you agree to the use of cookies as described in our Cookie Policy

Blog

Quarterly Market Commentary

Fourth Quarter 2021 Key Takeaways

If the market resurgence paused in the 3rd quarter of 2021, it then rebounded in the 4th quarter, at least for the headline‐grabbing domestic large caps. Neither supply chain concerns, commodity price challenges, a new coronavirus variant, nor rising inflation would hold back the S&P 500 in Q4 2021 (though we’ll note that some of these issues, particularly inflation, have come to a head in January 2022). Other areas of the market, however, stayed relatively flat. The overall picture is markets in limbo—with the S&P 500 undergoing a rally that has appeared rather fragile in January, and many other areas of the market staying relatively flat in Q4 2021. Markets don’t always echo life, but in this case there are similarities: COVID vaccines and treatments have been developed at an astonishing pace, but a new variant has emerged to once again slow normalization of life and the economy. President Biden signed an infrastructure bill, but his “Build Back Better” plan faces an uncertain fate. Employment recovery has occurred with incredible speed, but inflation has been stubbornly persistent. The market rally the past two years has been stunning, but it may be running out of steam. Overall, perhaps the more things change, the more they stay the same—while we appreciate the swift market recovery from the COVID downturn, the fundamental question still remains: how do you make money in an environment with relatively high valuations and low bond yields?

During the fourth quarter many segments of the equities market diverged in performance. As noted, the S&P 500 rose sharply, by over 11%, but the Russell 2000 gained only 2%; developed markets climbed 3%, but emerging markets fell 1%. Q4 sharply enlarged the performance differentials that were more muted in the first 9 months of 2021, with the S&P 500 again leading the way in 2021 with a 28.71% return, the Russell 2000 gaining 14.82%, developed markets rising 11.26%, and emerging markets falling 2.54%.

Fixed income was roughly flat for the last quarter of 2021, with the US agg gaining 0.01%, and the global agg declining 0.67%. After a poor first quarter in a rising rate environment, these areas of fixed income proved unable to recover their losses, with each finishing in negative territory for the year—the US agg lost 1.54%, and the global agg 4.71%. While short‐term Treasury rates rose in Q4, likely anticipating rate hikes, longer term Treasury rates remained largely unaffected, with the 10‐year rate staying flat at 1.52%, and the 30‐year rate falling to 1.90%. Credit markets finished the year positively, with high yield and floating rate each gaining 0.49% in Q4, and each concluding 2021 with gains in the 4‐5% range.

On the macroeconomic front, GDP recovery has continued to impress, as the Commerce Department estimated GDP annualized growth to be 2.3% for Q3 2021 and 6.9% for Q4; GDP growth for all of 2021 is estimated to be 5.7%, the highest mark since 1984. Unemployment numbers have also continued to improve, as the unemployment rate dipped from 4.8% to 3.9% in Q4. The overall economic picture is one of strong recovery combined with significant concerns, with persistently high inflation continuing to serve as the fly in the economic ointment.

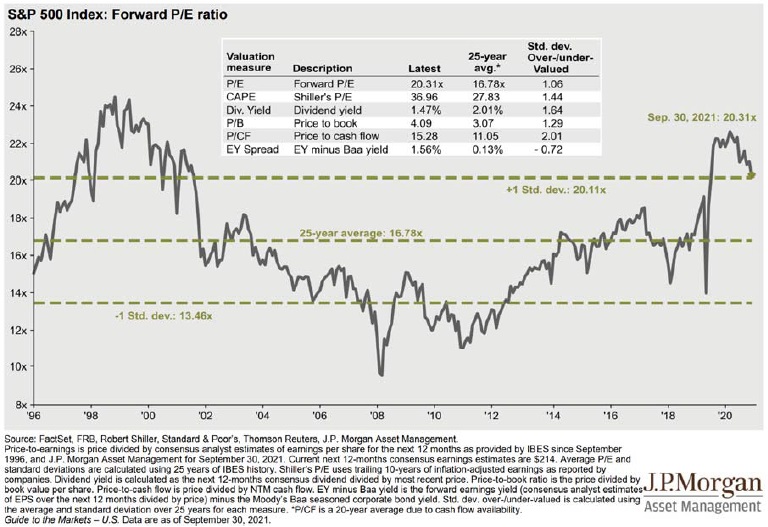

Domestic valuations were already elevated prior to Q4, and the S&P runup over the last 3 months of the year stretched valuations even further. We appreciate the dynamic US market recovery, but note that it leaves a challenging investment environment going forward—low yields, impending rate hikes, and expensive equities combine to leave us with modest expectations going forward. We reiterate our belief in a careful, balanced approach, with a mix of domestic and international stocks and bonds, in case markets gain a third wind, along with a sleeve of liquid alternatives that seek the 3‐6% return historically derived from fixed income portfolios, while providing a degree of downside protection from events such as January’s decline.

Fourth Quarter 2021 Investment Letter

As much as Q3 2021 has been anxiety inducing, we would be remiss not to issue the reminder that the S&P 500 has nearly doubled since its nadir on March 23rd, 2020. As bad as COVID has been, vaccine development has helped prevent an even greater catastrophe. As much as we are concerned about supply chains, stock valuations, China, and inflation, we are fortunate that we have the luxury of these concerns instead of, say, discussing how we hope the world emerges from a global depression.

But as markets are forward looking, they have gobbled up all of this optimism and run. The challenge of how to invest in a world with low yields and high valuations remains. The astounding fiscal and monetary support for the US and global economy is likely to taper off—the Fed is hinting at scaling back asset purchases, and many pandemic aid programs are expiring. Any infrastructure bill passed by Congress would be spread out over 10 years, limiting its immediate impact. Economies are still adjusting to the widespread disruption caused by COVID, labor market by labor market, and sector by sector. In the face of so much economic turbulence, we expect the Fed to be patient, to try to understand the economic terrain before taking any dramatic action. From an investment standpoint, we would also advocate patience and a portfolio that can thrive in many market environments—now is not the time to get out over our skis.

Fourth 2021 Market Update

Equities growth has generally been broad based in 2021. In 2020 large growth firms, particularly tech companies, provided the lion’s share of the US market upswing, as both value and small cap companies lagged far behind. This year, after value had a strong start, growth had its own run, and we ended the third quarter with large value and large growth returns comparable, at 16.1% and 14.3%, respectively. For small caps, though, value remained well ahead of growth, at 22.9% vs 2.8%. Sector performance was surprisingly level across the board during Q3 2021; the gap between the biggest gainer (utilities at 1.8%) and the biggest loser (industrials at 4.2%) was only 6%. For the year, energy still leads the field with a 43.2% gain, benefitting from the economic rebound from COVID, and utilities are the laggard with a 4.2% return. Despite a subpar third quarter, the S&P 500 is still up nearly 16% this year, the Russell 2000 over 12%, developed markets over 8%, and emerging markets down, but only a little over 1%.

Bond markets were relatively flat in Q3, as were US Treasury Yields. The US agg rose 0.05%, the global agg fell 0.88%, the 10‐year rate increased 0.07% to 1.52%, and the 3‐year rate increased 0.02%, to 2.08%. US core bonds and the global agg remain underwater for the year, at ‐1.55% and ‐4.06%, respectively. Rates are still quite low by historical measures, which presents a conundrum—in order to get higher bond yields, interest rates need to rise, but that process comes with its own financial pain as current bonds with low interest rates then fall in value. Rising inflation may force the Fed’s hand with respect to interest rates, but it’s still too early to tell. Volatility, as measured by the VIX, spiked to 25 during September’s selloff, and closed the quarter at 23.14. These were not alarming numbers, though, and by mid‐October the VIX fell to 16.30.

Update on the Macro Outlook

GDP growth has been good, but a cooldown is likely going forward. GDP increased 6.3% in Q1 and 6.7% in Q2, but economists are anticipating a slowdown to about 4% this quarter. The last couple of unemployment reports fell well short of expectations in terms of jobs added, yet the unemployment rate itself declined from 5.9% to 4.8% over the quarter. What’s going on? Well, the labor force participation rate’s recovery has stalled:

The September labor force participation rate for workers age 25‐54 reached 83.0% in January 2020, fell to 79.8% by April 2020, and has rebounded to 81.6% as of September 2021—in other words, we’ve recovered a little over half the dip. We’ve seen numerous stories of employers desperate to fill jobs, and the declining unemployment rate reflects that fact, but the reluctance of many to return to the labor market is curtailing the growth in job numbers. Child care/elder care challenges, fear of COVID, or accumulated savings may all be contributing to the worker shortfall; while generous unemployment benefits have also been a scapegoat, they appear to be at most a modest factor, as the ending of enhanced federal benefits on Labor Day didn’t lead to a surge of job seekers. Higher demand and lower supply should mean higher wages, and indeed, private sector wages were up 4.6% year over year in September. Though the worst of it may be past, COVID has scrambled economies worldwide, with massive sectoral impacts, commodity impacts, supply chain impacts, and labor market impacts.

China’s struggles to rein in corporate debt while retaining a high growth rate also had a negative impact on the emerging market index. It is understandable that China wanted to curb financial excesses and not be held hostage by massive risk‐taking by large companies that were nonetheless deemed too big to fail. It is also a huge challenge to restructure credit markets nationwide, facilitating agreements between indebted companies and creditors without resorting to wholesale bailouts, yet limiting the spread of financial contagion to broader markets such as housing.

Supply chain challenges have also plagued numerous industries. Some such concerns have largely self corrected—lumber prices, for example, have fallen 50% since peaking in May. Other commodities, such as aluminum and lithium, have sustained sharp price increases. In some sense, the US economy has been a victim of its own economic success—COVID relief was so bountiful that pent‐up demand is now cascading throughout markets.

Of course, if wages are rising and production input prices are rising, then we would expect inflation to be rising as well, and such is indeed the case. Three months ago, inflation looked to be a phenomenon of a narrow subset of prices rising enormously (with hotel and used car prices as prominent examples), but with the majority of prices staying in check, as the median consumer price index was relatively flat.

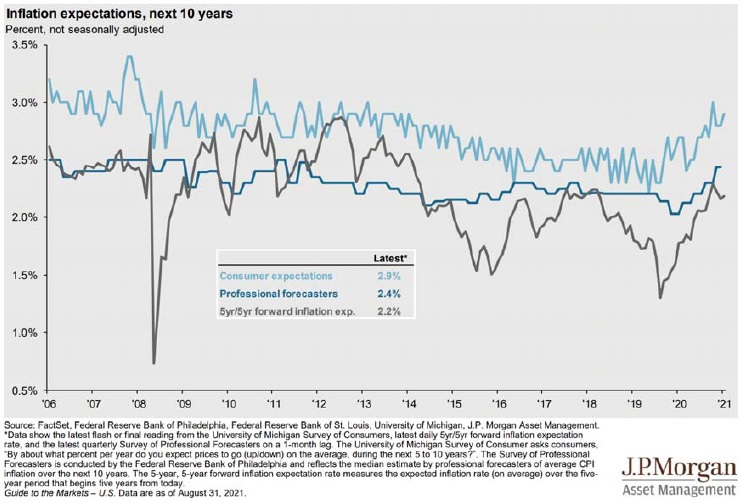

Now, though, while the average rate of change has fallen, the median rate has risen‐‐‐which suggests that inflation is currently more broad‐based than it had been previously. The potential danger is that if consumers, businesses, and employers expect high inflation, they will then act, price, and pay accordingly—in other words, a widespread expectation of high inflation could become a self‐fulfilling prophecy. Fortunately, this concern doesn’t appear to be an immediate threat:

The Fed’s dual mandate is maximizing employment and minimizing inflation. With respect to inflation, the Fed is trying to assess to what extent inflation is likely to be transitory, and to dissipate on its own. Moreover, the Fed needs to determine the causes of inflation, as the causes will affect the efficacy of potential remedies. Raising rates will likely be a better inflation‐controlling tool if the cause is general economic overheating rather than temporary mismatches of supply and demand across various sectors. Given that models of inflation are still limited, it’s understandable for the Fed to be patient, to collect more data, and to continually assess during this extraordinary period.

Portfolio Positioning

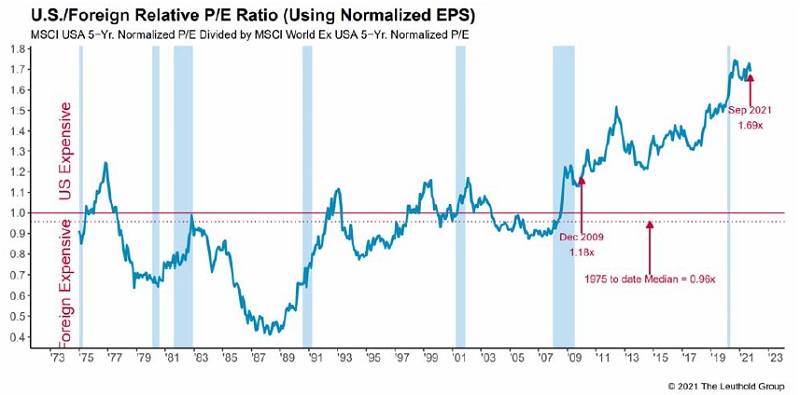

US stock valuations moderated somewhat during Q3 by several measures, but are still higher than normal. The investing dilemma remains: do you invest in equities, knowing they are expensive; do you invest in bonds, knowing that interest rates are low; do you hold cash, knowing that cash earns you nothing? One fortunate circumstance is that international stocks are more reasonably priced, on a relative basis. However, although quities prices in developed or emerging markets are attractive relative to those of the US, valuations are above average worldwide. Moreover, international stock valuations have appeared attractive for several years, yet have not delivered up to expectations. It now appears central banks will look to ease some support of asset prices as we are further away from the depths of the pandemic. While we have concerns regarding stock valuations, we are not largely underweight due to the potential of higher long‐term inflation and low but likely rising interest rates.

Earlier in the year, we redeployed assets into lower risk alternative funds in many portfolios strategies. This group of funds provides only modest income, but offers low correlation to the stock market, and limits losses in times of market stress. The additional lower‐risk strategies provide us with a more diverse group of levers to pull should stocks become more attractive in the coming months and we want to add to overall stock exposure.

Closing Thoughts

The third quarter of 2021 made clear that some market and economic risks, including inflation, supply chain bottlenecks, Chinese credit reform, and COVID, are likely to linger for some time—they may still be “transitory,” to quote Fed Chair Jerome Powell, but no longer temporary. Nonetheless, the broader portrait of equity and bond markets has not fundamentally changed. Economic recovery has continued, albeit more slowly than hoped; equity valuations remain elevated, though by some measures improving; bond yields remain low, and subject to principal loss should interest rates rise; credit spreads remain tight as well. Amidst this broad panoply of market risks, in these unprecedented economic times, we are cautious with respect to portfolio positioning. The opportunity set of investments simply is fairly unappetizing by historical measures, as even those areas of the market that are relatively attractive are not cheap. Under these circumstances, we are largely maintaining a balanced portfolio, with the added twist of a liquid alternative sleeve that can provide a degree of participation should markets exhibit a resurgence, and give ballast and financial flexibility going forward should markets undergo a correction.

—JMS Team

JMS Capital Group Wealth Services LLC

417 Thorn Street, Suite 300 | Sewickley, PA | 15143 | 412‐415‐1177 | jmscapitalgroup.com

An SEC‐registered investment advisor.

This material is not intended as an offer or solicitation for the purchase or sale of any financial instrument or investment strategy. Certain material in this work is proprietary to and copyrighted by Litman Gregory Analytics and is used by JMS Capital Group Wealth Services LLC with permission. This material has been prepared for informational purposes only, and is not intended to provide, and should not be relied on for, accounting, legal or tax advice. Any references to future returns are not promises ‐ or even estimates ‐ of actual returns a client portfolio may achieve. Any forecasts contained herein are for illustrative purposes only and are not to be relied upon as advice or interpreted as a recommendation for a specific investment. Past performance is not a guarantee of future results.

With the exception of historical matters, the items discussed are forward‐looking statements that involve risks and uncertainties that could cause actual results to differ materially from projected results. We have based these projections on our current expectations and assumptions about current and future events ‐ as of the time of this writing. While we consider these expectations and assumptions to be reasonable, they are inherently subject to significant business, economic, competitive, regulatory and other risks, contingencies and uncertainties, most of which are difficult to predict and many of which are beyond our control. There can be no assurances that any returns presented will be achieved.

‹ Back