By using our website, you agree to the use of cookies as described in our Cookie Policy

Blog

Quarterly Market Commentary

2nd Quarter 2024 - Key Takeaways

The remarkable ascent of US large cap tech stocks continued in the second quarter of 2024, as this segment of the market powered the S&P 500 to another positive quarter in this continuing bull market. The economy has continued to grow despite ongoing high interest rates, and while unemployment has ticked up a notch, inflation finally showed further signs of cooling over the past month. The Fed’s long anticipated dovish turn is widely expected to begin in September, with multiple rate cuts likely in the next year. Of course, markets have already priced in the promise of lower rates, so we’re left with the question of the path and magnitude of rate cuts, and the mega question of whether the largest tech stocks can maintain their momentum, or whether these firms sink under the weight of high valuations. It also remains to be seen whether broader markets, overshadowed by Nvidia and its brethren, can catch up to the behemoths, or at least provide ballast in the event of a tech correction. Inflation still needs to fall further, ideally without the economy falling into recession. And, of course, there are additional x-factors, both known and unknown. International conflicts in Eastern Europe and the Middle East are still raging, and the US presidential election has already seen a series of dramatic events.

Although the S&P 500 had another good quarter, equity performance in other areas was mixed. The S&P 500 gained 4.3% for the quarter, and was up 15.3% for the year as of June 30th. Emerging markets also posted a strong gain of 5.0%, but developed international lost 0.2% and the Russell 2000 finished Q2 down 3.3%. Bonds also had a mixed performance, with high yield up up 1.1%, developed international down 3.0%, and the US agg flat (up 0.1) for the quarter, as the Fed maintained its holding pattern with respect to rates. Medium and long-term Treasury rates rose modestly during Q2, with the 2-year, 10-year, and 30-year rates each rising between 10bp-20bp over that span.

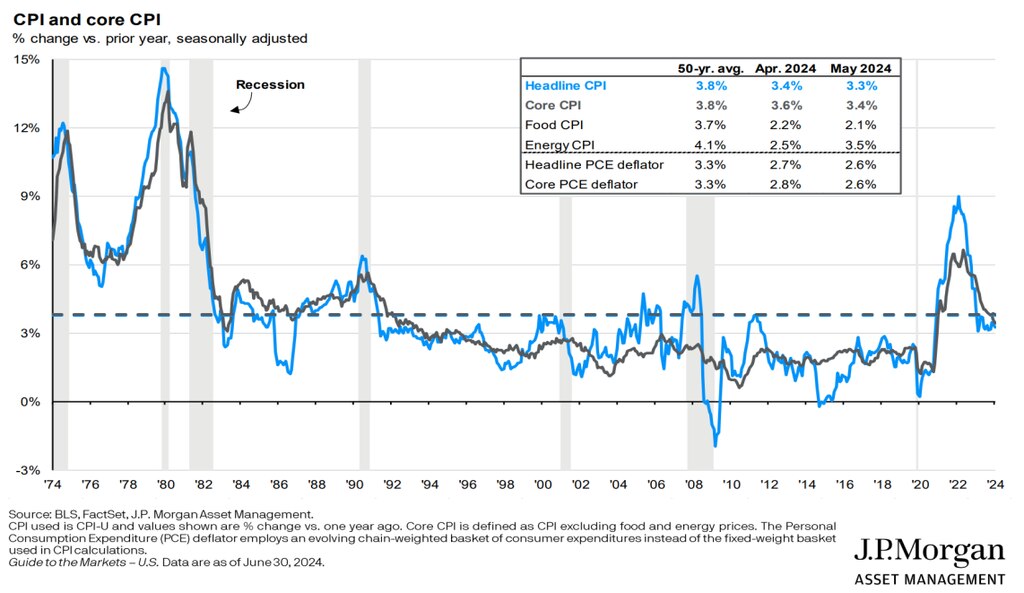

GDP continued to defy recession indicators and doomsayers, as GDP grew at a 1.4% annual rate in Q1 and a 2.8% annual rate in Q2. The labor market has cooled somewhat, as the unemployment rate ticked up to 4.0%, but job growth has remained robust. Core inflation fell over the past quarter from 3.8% to 3.4%, and more recent reports have shown additional progress towards the 2% goal.

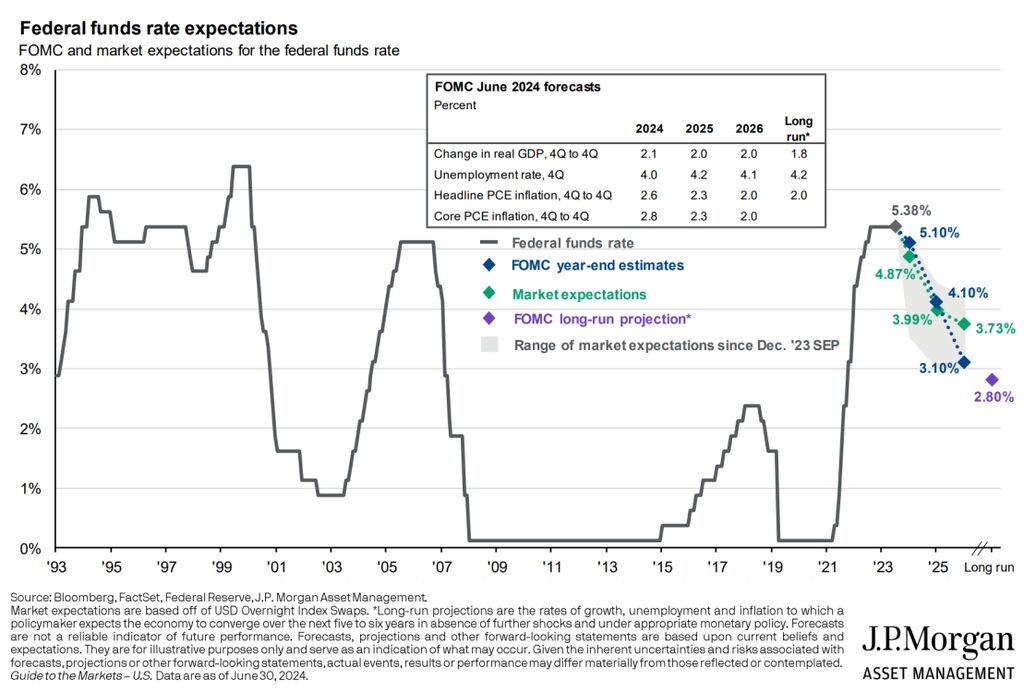

As of this writing, markets are expecting the Fed to initiate rate cuts starting in September. If the economy does tip into recession, the Fed has some runway to cut rates more aggressively, as inflation has neared a more normal range. Long-term rates remain much higher than they were just a few years ago; these elevated rates, with their impact upon the national debt, may force more fiscal discipline on whichever party wins the Presidential election in November—perhaps curtailing the scope of tax cuts should Trump win, and limiting new spending programs should Harris win. Markets themselves usually rise (and sometimes fall) no matter which party is in power, so we caution against letting politics guide your portfolio. Time will tell whether markets have gotten ahead of themselves, particularly with respect to the large tech stocks—hopefully any cooling on that front can be eased by improvement in some of the less trendy areas of the market.

Second Quarter 2024 Investment Letter

The second quarter of 2024 added to the progress made in the first quarter of 2024, which in turn built upon the considerable progress made in 2023, at least for equities. After slowing in Q1, disinflation has picked up in Q2, so that the soft landing of normalizing inflation without causing a recession remains a real possibility. Inflation has come down considerably without inducing the macroeconomic pain that many economists feared. A rate cutting regime appears very likely once we enter autumn, with the shape and speed of rate cuts yet to be determined. The S&P 500 has become even more concentrated, although strong earnings reports have kept valuations from slipping into frothier territory. There’s obviously significant risks and rewards with equities--the overperformance of a handful of tech stocks may crumble, dragging broader markets down with them, or a rising tide may lift many of those markets that have been left behind to an extent. Geopolitical concerns remain, from slowed Chinese growth to the potential escalation of tariffs to Russia’s ongoing war in Ukraine to conflict in the Middle East. And, of course, the US presidential election will take place in November in an atmosphere of partisan polarization.

Second Quarter 2024 Market Update

The second quarter of 2024 was positive for many market areas. The S&P 500 climbed 4.3%, and emerging markets rose 5.0%. On the other hand, the Russell 2000 fell 3.3%, while developed international also suffered a small loss of 0.2%. In terms of style, the second quarter was dominated by large cap growth stocks, which rose about 8%, whereas small growth, large value, and small value all fell about 2%-3% during that span. Through June 30th, large growth was up 20.7%, large value 6.6%, and small growth 4.4%, but small value was down 0.8%. As for sectors, while gains were broadly distributed in Q1, they were much more narrowly focused in Q2, with technology leading the way at 13.8%, followed by communications adding a healthy 9.4%. No other sector returned over 5%, while 6 sectors finished underwater for the quarter, with materials faring worst with a 4.5% loss.

US bond performance continued to be hampered by stubborn inflation, which delayed and diminished expectations for rate reductions. The US agg was flat for the quarter, but developed international bonds dropped 3.0%, High yield bonds climbed 1.1%, but municipal bonds were flat. Treasury rates rose in the first part of the quarter before falling in June, but still ended Q2 at higher levels, as the 2-year Treasury rate climbed from 4.59% to 4.71% , the 10-year Treasury rate rose from 4.20% to 4.36%, and the 30-year Treasury rate increased from 4.34% to 4.51%. Volatility was modest in Q2, remaining in the teens over that span.

Update on the Macro Outlook

After largely stalling out in Q1, progress against inflation picked up in Q2, particularly in the later stages of the quarter. Overall, headline inflation rose margianlly from 3.2% to 3.3%, but core inflation, which excludes more volatile food and energy, fell from 3.8% to 3.4% This number is still a significant 3 2Q 2024 Quarterly Market Commentary | JMS Capital Group Wealth Services LLC distance from the Fed’s 2% target, but it is moving at a respectable clip in the right direction.

The June CPI saw core inflation increase by just 0.1%, with year-over-year core inflation coming in at 3.3%. The personal consumption expenditures price index, a measure of inflation closely watched by the Fed, has also shown inflation approaching normal levels; the core June PCE year-over-year inflation number was 2.6%. While it would be premature to declare victory, inflation has likely moderated enough for the Fed to begin easing rates. With the economy’s continued resilience, the Fed and markets expect rate reductions to be gradual:

Two 25bp rate cuts this year, and about 3 25bp rate cuts next year; a long-run Fed projection of a federal funds rate of 2.80%. While a 2.80% rate seems normal—it’s probably about the average rate for the past 30 years—it’s notable that rates have very rarely been nestled in the 3% range—they’ve either been much higher (mostly pre-2008) or much lower (post Financial Crisis). We don’t have a crystal ball, but chances are that something will happen to necessitate a more aggressive movement in rates. A recession could usher in a period of low rates, or progress against inflation could stall, leading the Fed to maintain its higher rates for longer.

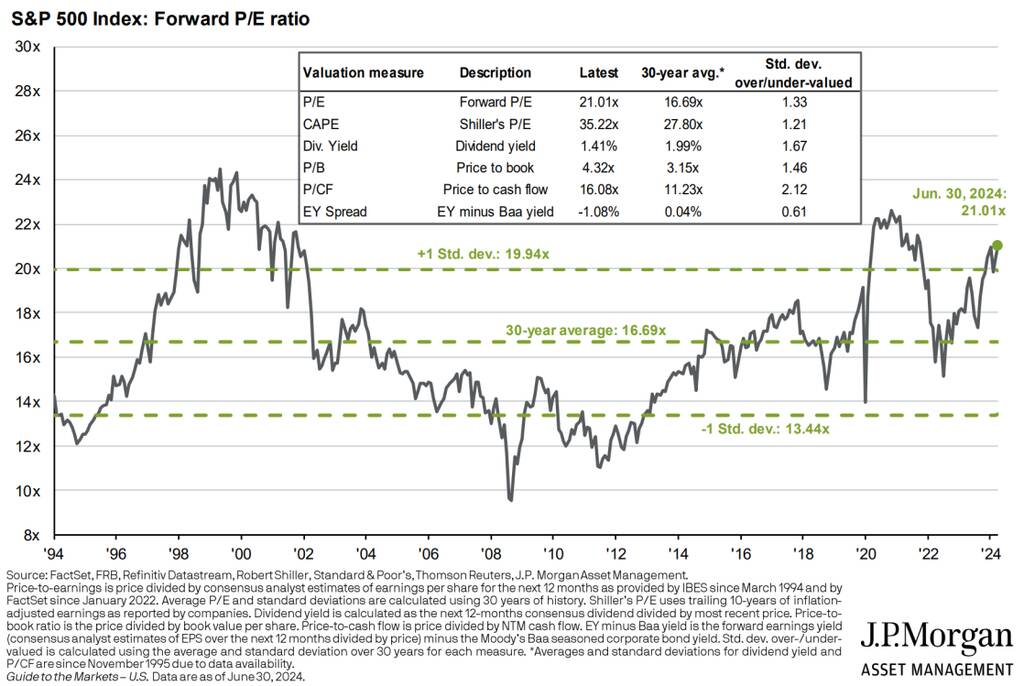

Portfolio Positioning and Closing Thoughts S&P 500 valuations remain elevated:

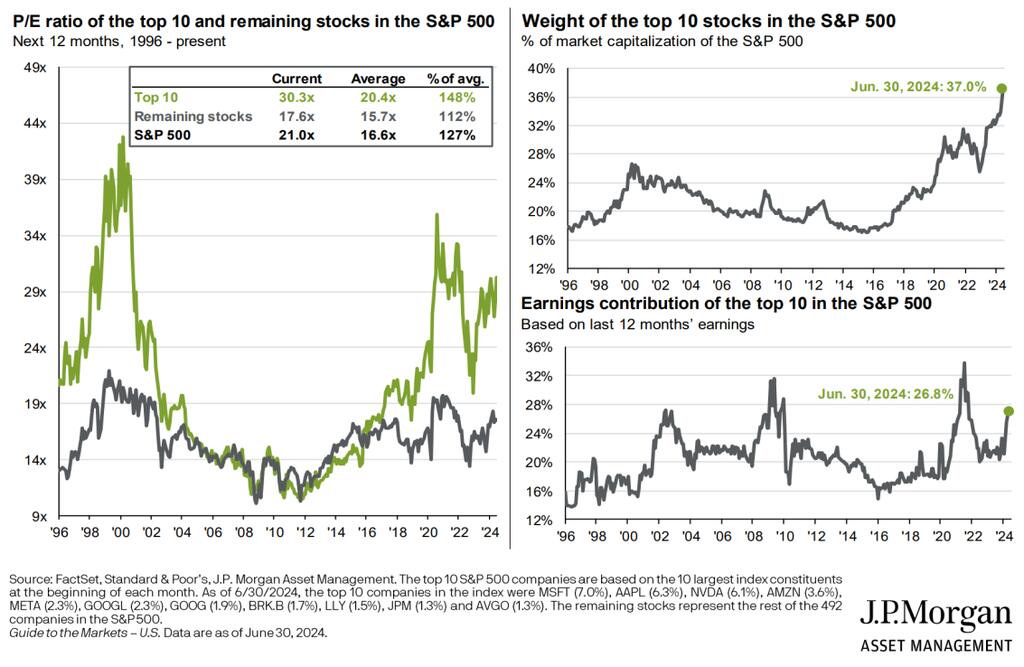

Market concentration has also become even more extreme

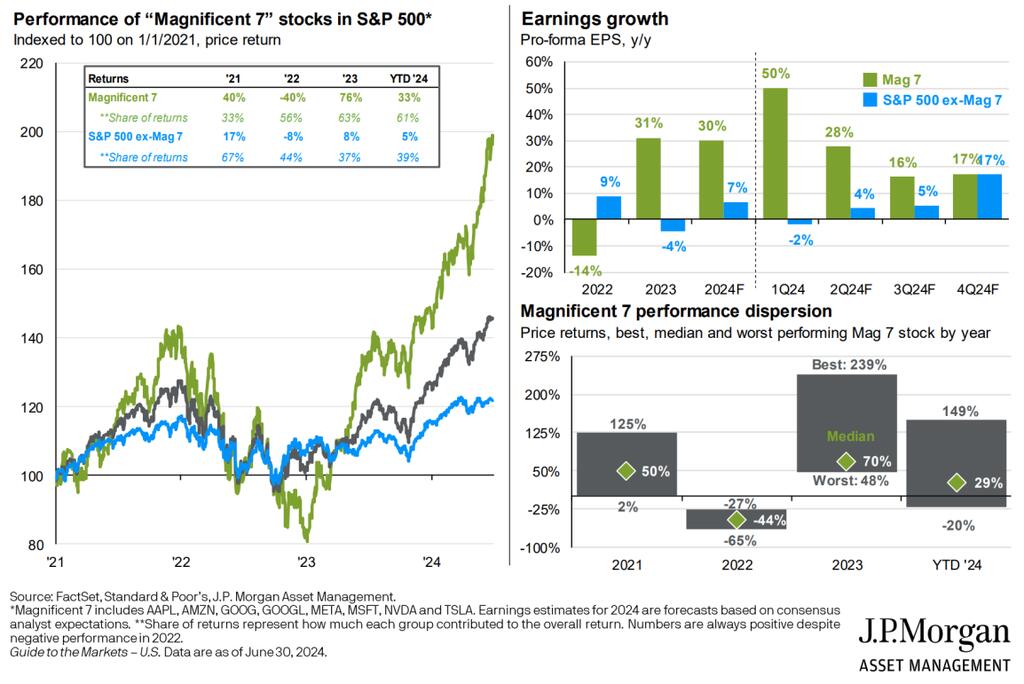

The top ten stocks now comprise 37% of the S&P 500’s market cap—this mark is now well above the dot-com bubble’s peak of around 27% in 2000-2001. The majority of the S&P 500’s gains in 2024 have also come from just 7 stocks—the so-called “Magnificent Seven” of Apple, Alphabet, Amazon, Meta, Microsoft, Nvidia, and Tesla:

The rest of the S&P 500 has been much more steady; with annualized returns in the 8%-10% range over the past 18 months the “less Magnificent 493” could provide some ballast in the event of a pullback in the top 7. With the S&P 500’s move higher in the first half of 2024, market valuations have become more rich. The forward price/earnings ratio of the S&P 500 sits at 21x – nearly 26% above the long-term average. History has shown us that moves into this territory can often move even higher and deliver additional gains, but with that said, any gains from this point forward will come with elevated risk. Large cap U.S. stocks have been the place to invest for the better part of 15 years – largely due to their typically high-quality nature and the impact of the largest (tech and consumer focused) stocks. When the market does correct, it is likely that the stocks which carried the market higher will be hit hardest. So, some diversification to other market sectors (and value stocks in general) probably makes sense give the current valuations in growth/technology.

Opportunities also remain outside of U.S. large cap stocks. Both small and mid sized companies look historically cheap today. Both categories are trading at levels not seen for a sustained period of time since the tech bubble at the turn of the century. Unfortunately, this is not a new story. Smaller sized companies have been relatively out of favor compared to large cap U.S. stocks since the financial crisis in 2008. These asset classes have a higher percentage of non-profitable companies than large cap U.S. stocks. So, while shifting some money to these areas makes sense on a valuation basis, they may struggle in a market downturn as much or more than their large counterparts. Coming out of market correction, we would expect the groups to do well and possibly outperform large caps.

Foreign stocks offer much of the same story - out of favor compared to U.S. large caps for many years with a cloud hanging over them after the European Debt Crisis of the early 2010s. Developed international indexes also have a lower exposure to the technology sector, so they have been somewhat less attractive as U.S. tech companies have driven markets higher. This dynamic may offer some downside help in a correction as developed foreign stocks may benefit from superior valuations and less (rich) technology exposure.

On the fixed income side of portfolios, our expectation is the Federal Reserve will begin to cut interest rates as data shows a slightly slowing economy and inflation nearing the desired level. It is difficult to predict the precise timing of cuts, but having some duration in bond portfolios should be beneficial. Duration should also help if we witness downside volatility in stocks in the second half of the year. Portfolios should continue to hold attractive, high-quality short-term bonds to take advantage of yield near 5%. These should be used in conjunction with core bonds - to add duration and an equity ballast – and multi-sector bonds to allow for the addition of opportunities in areas such as mortgaged backed securities and corporate bonds. We are negative on taxable high-yield bonds today. Spreads over Treasuries are extremely narrow and we do not believe investors are being properly rewarded for the added risk of these bonds. Moreover, default rates (currently 2% vs. a historical average of 3.5%) could move higher if the economic slowdown turns out to be a bit more severe than expected.

—JMS Team

JMS Capital Group Wealth Services LLC

417 Thorn Street, Suite 300 | Sewickley, PA | 15143 | 412‐415‐1177 | jmscapitalgroup.com

An SEC‐registered investment advisor.

This material is not intended as an offer or solicitation for the purchase or sale of any financial instrument or investment strategy. Certain material in this work is proprietary to and copyrighted by Litman Gregory Analytics and is used by JMS Capital Group Wealth Services LLC with permission. This material has been prepared for informational purposes only, and is not intended to provide, and should not be relied on for, accounting, legal or tax advice. Any references to future returns are not promises ‐ or even estimates ‐ of actual returns a client portfolio may achieve. Any forecasts contained herein are for illustrative purposes only and are not to be relied upon as advice or interpreted as a recommendation for a specific investment. Past performance is not a guarantee of future results.

With the exception of historical matters, the items discussed are forward‐looking statements that involve risks and uncertainties that could cause actual results to differ materially from projected results. We have based these projections on our current expectations and assumptions about current and future events ‐ as of the time of this writing. While we consider these expectations and assumptions to be reasonable, they are inherently subject to significant business, economic, competitive, regulatory and other risks, contingencies and uncertainties, most of which are difficult to predict and many of which are beyond our control. There can be no assurances that any returns presented will be achieved.

‹ Back