By using our website, you agree to the use of cookies as described in our Cookie Policy

Blog

Quarterly Market Commentary

First Quarter 2021 Key Takeaways

The market marches on. On the heels of its post-recession resurgence last year, stocks have continued their remarkable runup. As vaccine implementation accelerates, and as life begins to normalize, we find ourselves seeking balance, both respecting the role that continued fiscal and monetary stimulus can play in asset price increases, while taking precautions that the equities party may be ready to wind down. Macroeconomic conditions have started improving sharply, and growth forecasts for 2021 are optimistic for a strong recovery from the 2020 recession. The question for investors is: how much of this economic optimism has already been priced into current asset prices, and how much further do markets still have to run?

During the first quarter the S&P 500 picked up where it left off at the end of 2020, gaining over 6% as of March 31st, and the Russell 2000 retained its momentum with a nearly 13% increase. Global stocks also rose, with developed markets up over 3%, and emerging markets advancing over 2% for Q1 2020.

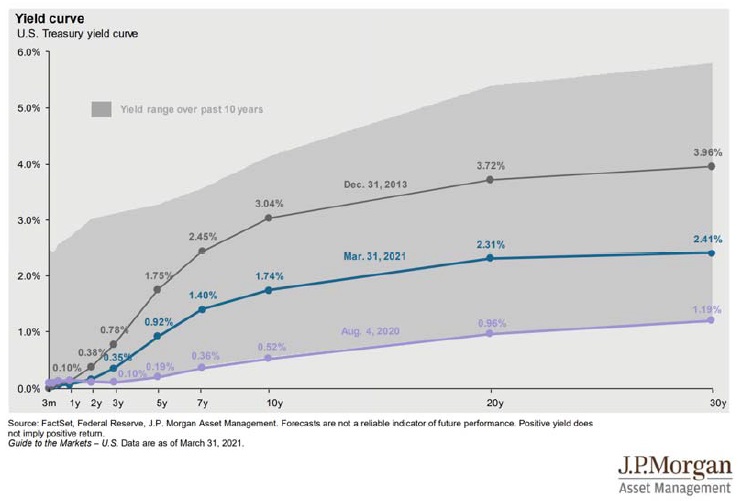

Fixed income markets, unfortunately, did not fare as well, suffering through their worst quarter since 1981. Core US bonds fell over 3% in the quarter, while the global agg dropped over 4%. The fall was spurred by a rise in long term yields, as the 10-year rate rose from 0.93% to 1.74%, and the 30-year yield increased from 1.65% to 2.41%. In turn, the increase in long-term yields likely derived in part from reflation, with continued dovish monetary policy combining with additional fiscal spending to spark concerns about longer-time increases in interest rates and inflation. It is still noteworthy that long-term rates remain low by historical measures; however, partial normalization of long-term rates means that low-interest Treasuries will lose some of their value. Credit markets posted gains in Q1 2020, with high yield and floating rate each up a little over 1%.

On the macroeconomic front, the economic damage from the coronavirus pandemic was severe. The commerce department reported that US GDP shrunk 31.4% on an annualized basis (meaning about 8% for the quarter) between April and June of 2020. Despite significant bounceback during the second half of the year, GDP growth still ended up negative for the year. However, macroeconomic catchup growth in 2021 is likely to be strong, given continued fiscal relief, dovish monetary policy, and widespread vaccine distribution. On the labor front, US unemployment has fallen considerably from its peak, but there is still considerable room for further progress, with the unemployment rate at 6.0%.

Given the demonstrated effectiveness of multiple vaccines and the decline in Covid cases, the economy appears well positioned for recovery as 2021 unfolds, and much recent economic data testifies to the likelihood of strong 2021 growth. Low interest rates, pent-up consumer demand, and another $1.9 trillion in COVID relief passed in March should combine to accelerate the recovery process. In a way, we are starting to move into a better class of problem—from “how can we aid the millions of unemployed and underemployed” to “is the economy running so hot that inflation may rear its pricey head.” On top of all this stimulus, there remains the further prospect of a massive infrastructure bill later in 2021.

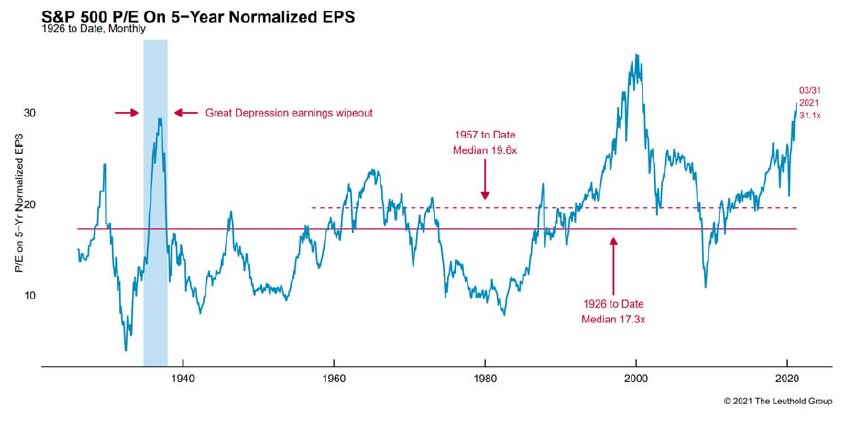

So as we noted last quarter, there are grounds for much of the market’s optimism, though again we must point out that valuations are becoming increasingly frothy.The challenge then becomes how to invest when equities are becoming increasingly expensive, and bonds are suffering both from low rates and interest rate rise fears. We believe that the economy will improve in 2021 as Covid’s reach declines, but want to be sure to advocate for a balanced portfolio, as so much optimism has already been priced into equities.

First Quarter 2021 Investment Letter

While coronavirus is still with us, the March 2020 downturn is starting to become a receding memory. US and global markets have recovered their losses and then some. Expansionary fiscal and monetary policy, particularly in the US, paved the way for continued market gains in Q1 2020, with EM, international, and the S&P 500 all up between 2% and 6% for the quarter. After a 30% decline in a record 30 days in the first quarter, US stocks climbed over 75% since bottoming out on March 23rd.

Given how quickly and strongly markets have run up, we have concerns about the path of returns going forward. US valuations are high, and bond yields remain relatively low. Additional stimulus via the COVID relief bill should spark accelerated growth, but comes with the risk of rising long-term inflation. Vaccine effectiveness is high, which is excellent news, but markets have already priced in lofty expectations of the future, so future gains may be more constrained for the remainder of 2021. Given this uncertainty, we would argue that it’s important than ever to be prepared for various states of the world, and that is best done with a well balanced, well diversified portfolio.

First Quarter 2021 Market Update

As noted, the S&P 500 gained over 6% in Q1 2021, extending its rapid year-long recovery. What’s been different about recent gains is where they came from—for much of 2020 the market surge was driven by large growth firms, especially technology stocks like Facebook, Amazon, Netflix, and Google. In the past 3-6 months we’ve witnessed a rotation out of large growth into small caps and value—for example, small value was up over 21% through March 31st, while large growth rose less than 1%. The Russell 2000 also gained nearly 13% in the first quarter. International and emerging markets also continued their upswing, with developed markets up over 3% and emerging markets exceeding 2%. Rotation also occurred between sectors—after stampeding through 2020, technology and consumer discretionary posted small gains, whereas energy was up over 30% for the quarter, with financials and industrials also turning in double digit returns for Q1.

Both the global and US aggregate bond indices suffered negative returns in Q1 2021, down over 4% and 3%, respectively, as continued stimulus, especially in the US, led to a rise in long-term interest rates and revived previously dormant inflation fears. The 10-year rate rose for the quarter from 0.93% to 1.74% at the end of March. Still, as shown below, rates remain midway between their low point last August and a more typical level as measured in 2013. Volatility, as measured by the VIX, spiked briefly in late January, but overall declined relatively steadily through the quarter, falling below 20 by March 31st.

Update on the Macro Outlook

4th quarter 2020 GDP growth of 4.1% was not enough to overcome the winter/spring recession, as US GDP still suffered a 3.5% decline for the year. Still, the proverbial glass is at least half full, as growth in the second half of 2020 was strong, and is expected to remain high in 2021. Overall, although the economy is rapidly reviving, and unemployment is falling, we still have room for improvement. The Fed’s monetary support, the March 2020 stimulus bill, the additional COVID relief bill in December, and yet another relief bill in March, have combined to alleviate much of the recessionary pain; in fact, many households are financially better off than they were at the beginning of 2020. The recovery has been uneven, with some sectors, such as restaurants, bars, and energy, being the first to suffer, and the last to recover.The unemployment rate continues to improve, but at 6.0% remains well above the unemployment rate of a year ago.

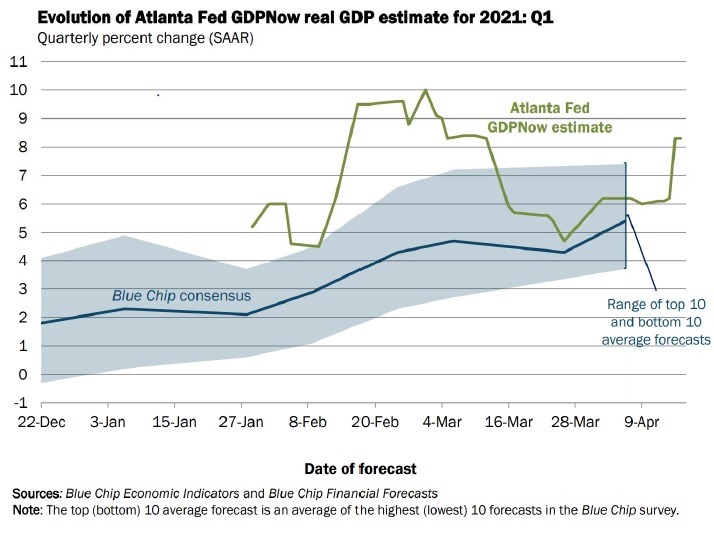

Vaccine distribution has ramped up in 2021; as of this writing, about half of US adults have received at least one COVID-19 shot. And increased immunity is helping to set the stage for a strong recovery, with growth estimates projecting much optimism for 2021:

Of course, with expansionary fiscal and monetary policy, we do need to remain vigilant about an inflation revival. Fed chair Jerome Powell has stated that the Fed will not have a knee-jerk reaction to any transitory inflation in 2021, so markets are not expecting any interest rate hikes this year. Moreover, given that inflation remained around 2% even after the Trump tax cuts, it is understandable that the Fed wants to see how much employment and economic growth can accrue before long-run inflation threatens to exceed a 2% average. So, the Fed has opted to be reactive to price changes rather than hiking rates to effectively preempt them. This policy may be good for employment, but it does mean inflation needs to be carefully monitored.

Portfolio Positioning

The market’s recovery, both in the US and around the world, has been remarkable. Vaccine breakthroughs, monetary easing, and fiscal stimulus have helped create a world in which financial markets are running hot, while the economy is catching up as well. As much as dovish policy helped to limit the recession’s impact and promote economic revival, it has also contributed to high asset prices, as pictured below:

The investing dilemma is: do you invest in equities, knowing they are expensive; do you invest in bonds, knowing that interest rates are low; do you hold cash, knowing that cash earns you nothing?

High valuations tend to lead to subdued future returns. While we believe that central bank and government policies are supportive of asset prices, so that equities still may have some room to run, we believe that additional diversification is in order. But diversification into what? Bond yields are still low, and credit spreads have tightened. International and emerging markets are useful diversifiers; although no longer cheap, they are cheap relative to the US.

We’ve always advocated for a balanced portfolio, and continue to invest in a mix of US and global equities, and US and global bonds. But given our concerns about a simple stock/bond mix, we have sought to add alternative investments, to provide greater balance to portfolios, as well as ballast in case equities find themselves out over their skis.

We have researched and backtested a batch of liquid alternative investments, paying close attention to investment strategies, correlation between these strategies, overall performance, and performance during market slippages. We believe this basket of funds can serve as a bond substitute, with the potential of steady returns that hold low correlation with broader stock market indices.

We thus seek to integrate a set of alternative funds into portfolios, as a supplement to the typical stock/bond mix. Our goal for alternatives is to facilitate positive, steady returns, with downside protection that mitigates (but does not eliminate) losses in the event of a market correction. We believe that with equities’ valuations stretched and interest rates diminished for the foreseeable future, the relative appeal of alternatives is enhanced. If markets cool slightly, alternatives offer an outlet for mid-single digit upside returns. If markets undergo a correction and alternatives hold up well, we have the flexibility to shift from alternatives to buying stocks at more attractive levels. Overall, while we are maintaining reasonable participation in equities due to their potential upside, we feel that additional diversification is in order in the event of the rally losing steam, and that alternatives provide a fit alongside the traditional mix of stocks and bonds.

Closing Thoughts

While we are optimistic about continued economic recovery, particularly in the United States, elevated stock valuations force us to remain at least somewhat cautious in the short term. Given the more attractive valuations in smaller capitalization US stocks and foreign stocks, we believe this diversification within an equity portfolio is prudent. Low interest rates, coupled with tighter credit spreads, have made the fixed income market increasingly difficult to navigate. A mix of shorter duration, high quality bonds, and various multisector approaches for more attractive yield, should provide flexibility in the coming months. The addition of lower risk, liquid alternative strategies allows for increased diversification opportunities outside of stocks, and should provide increased flexibility to be proactive in various future market environments.

—JMS Team

JMS Capital Group Wealth Services LLC

417 Thorn Street, Suite 300 | Sewickley, PA | 15143 | 412‐415‐1177 | jmscapitalgroup.com

An SEC‐registered investment advisor.

This material is not intended as an offer or solicitation for the purchase or sale of any financial instrument or investment strategy. Certain material in this work is proprietary to and copyrighted by Litman Gregory Analytics and is used by JMS Capital Group Wealth Services LLC with permission. This material has been prepared for informational purposes only, and is not intended to provide, and should not be relied on for, accounting, legal or tax advice. Any references to future returns are not promises - or even estimates - of actual returns a client portfolio may achieve. Any forecasts contained herein are for illustrative purposes only and are not to be relied upon as advice or interpreted as a recommendation for a specific investment.Past performance is not a guarantee of future results.

With the exception of historical matters, the items discussed are forward-looking statements that involve risks and uncertainties that could cause actual results to differ materially from projected results. We have based these projections on our current expectations and assumptions about current and future events - as of the time of this writing. While we consider these expectations and assumptions to be reasonable, they are inherently subject to significant business, economic, competitive, regulatory and other risks, contingencies and uncertainties, most of which are difficult to predict and many of which are beyond our control. There can be no assurances that any returns presented will be achieved.

‹ Back