By using our website, you agree to the use of cookies as described in our Cookie Policy

Blog

Quarterly Market Commentary 2024

4Q 2024 - Key Takeaways

Markets turned in a mixed performance during the fourth quarter of 2024, as domestic equities continued their upward climb, while foreign stocks and bonds largely stumbled. Economic growth and the labor market remained strong even in the face of elevated interest rates, but progress against inflation slowed. While the Fed cut rates again in November and December, it indicated that it would be taking a cautious approach to future rate cuts. The Fed may be in a holding pattern for much of 2025, watching inflation and the labor market, and waiting to see what tariffs and tax cuts the Trump Administration and Congress will enact. The broadening of the bull market in Q3 dissipated somewhat in Q4, and it remains to be seen whether large cap tech stocks can maintain their momentum, or whether other market segments can enhance their participation in the ongoing rally. Valuations in many market areas are elevated after two years of sharp price increases, again raising the question of how much more room the bulls have left to run.

The S&P 500 rose another 2.4% in Q4 2024, and finished the year with a 25.0% gain. Small caps increased 0.3% and ended 2024 up 11.5%. Developed international and emerging markets plunged 8.1% and 7.9%, respectively, in the fourth quarter, but ended the year with moderate gains of 4.3% and 7.9%, respectively. Domestic bonds suffered from a rise in rates, as well as the Fed’s more cautious approach to rate cuts, as the US agg fell 3.1% in Q4. Treasury rates jumped in the fourth quarter, with the 2-year rate, 10-year rate, and 30- year rate all climbing 50-80bp.

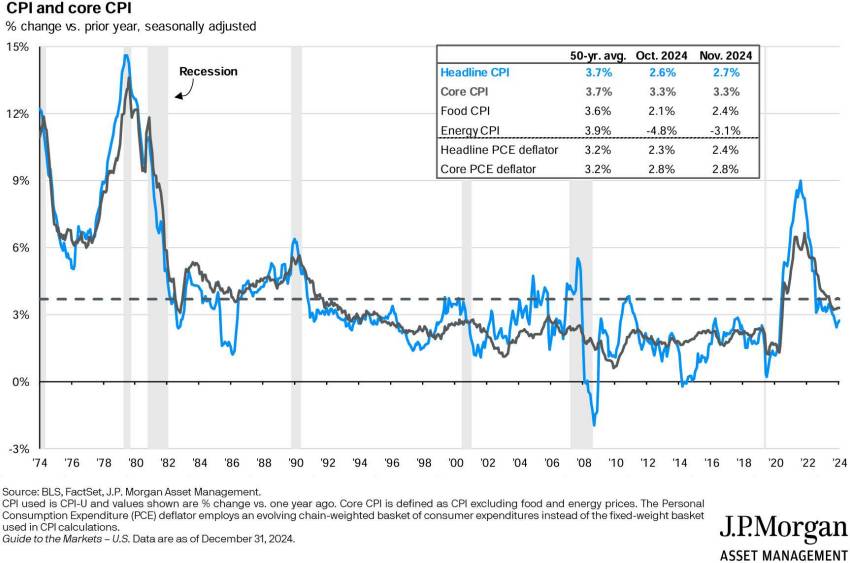

GDP has remained strong, as it grew at an annual rate of 3.1% in the third quarter of 2024 and is anticipated to show an increase of 2%-3% annualized in the fourth quarter of 2024. Labor market conditions continued to be benign, as the unemployment rate held steady at 4.2%, and job growth continued to be robust. Core inflation was unchanged over the past three months, remaining moderately elevated at 3.3%. Even with the 100bp in cuts since September, the Fed’s policy is restrictive, and the Fed can certainly slow or halt rate cuts should disinflation stagnate.

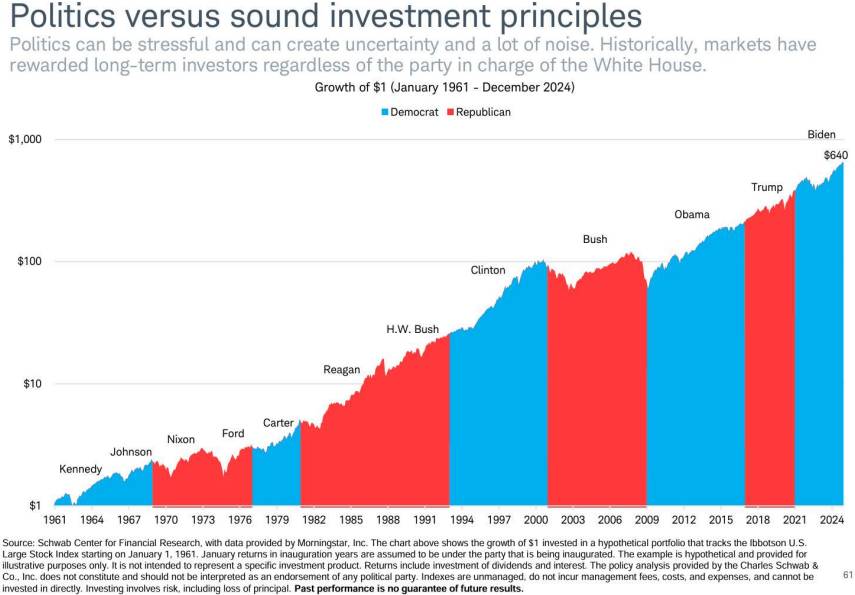

Republicans swept the Presidency, the House, and the Senate, although their margin in the House is extremely narrow. While we would expect President Trump to implement tariffs, the scope and breadth of them, as well as possible exemptions or carveouts, remains unclear. Extension and potential expansion of the Trump tax cuts of 2017 is also likely, along with some spending cuts. Still, high deficits and elevated long-term interest rates may constrain fiscal legislation to an extent. We won’t pretend to have detailed insights on how Trump policies, which are evolving, will affect various market sectors, but we would reiterate that markets usually rise (and sometimes fall) no matter which party is in power, so we caution against letting politics guide your portfolio. Continued 25%+ annual growth of the S&P 500 may be too much to hope for, but if so there still is the potential for other market areas to pick up the slack; moreover, while valuations are high, earnings reports have been strong. As is so often the case, there is both significant upside and downside potential for markets, and portfolios should seek an appropriate balance between risk and reward.

4Q 2024 Investment Letter

The S&P 500 is up more than 60% over the past two years, making the downturn of 2022 an increasingly distant memory. The economy has already made a semi-soft landing—inflation has fallen and stayed under 4% without the accompanying pain of a recession. The Fed has scaled back its expectations of future rate cuts, in part because inflation hasn’t moved much in recent months, but also because the economy has shown sufficient strength for the Fed to feel comfortable keeping rates high. We still have concerns about valuations and market concentration; we would also add that uncertainty about Trump policy and implementation poses its own set of risks and rewards. Furthermore, it’s highly unlikely that the S&P 500 can continue to post 25% annual returns over the longer term. Given the record highs of the past two years, our expectations going forward are somewhat subdued, with both continued tech stock strength and a correction well within the realm of possibility.

4Q 2024 Market Update

The fourth quarter of 2024 yielded mixed results. On the plus side, the S&P 500 climbed 2.4%, and finished the quarter up 25.0% year-to-date. Developed international and emerging markets did not fare as well, suffering losses for the quarter of 8.1% and 7.9%, respectively, that lowered 2024 returns to 4.3% and 7.9%, respectively. In terms of style, the 4th quarter’s gains came predominantly from large caps, which were up 24.5% at the end of Q3 but 33.4% by the end of the year. Small growth rose slightly in Q4 and posted a gain of 15.2% for the year, while large value and small value each fell about 1%-2% in Q4, but finished the year up 14.4% and 8.1%, respectively. As for sectors, financials, consumer discretionary, technology, and communication services led the way both in the fourth quarter and for the year, with 2024 returns of 30.6%, 30.1%, 36.6%, and 40.2%, respectively. Materials and health care had double digit losses for the quarter, but no sector finished underwater for the year.

Stubborn inflation and continued macroeconomic strength led the Fed to shift rate cut projections; while the Fed cut rates 1% since September, the pace of rate cuts is expected to slow in 2024. Bonds took this less dovish stance on the chin, with many areas of fixed income posting losses amidst rising longer-term rates. In Q4 the US agg slid 3.1%, municipal bonds dropped 1.2%, and developed international bonds fell 8.0%, while high yield bonds posted a minimal 0.2% gain. For the year, high yield bonds led the way with a 8.2% gain, with the US agg and municipal bonds also finishing in positive territory at 1.3% and 1.1%, respectively, while developed international bonds lost 6.0% Treasury rates also rose during Q4, as the 2-year Treasury rate jumped from 3.66% to 4.25%, the 10-year Treasury rate rose from 3.81% to 4.58%, and the 30-year Treasury rate climbed from 4.14% to 4.78%. Volatility was moderate in the quarter, mostly staying in the teens while peaking at under 30.

Update on the Macro Outlook

The US macroeconomy remains in solid shape, aside from moderately elevated inflation. It is the strength of the economy that has enabled the Fed to downshift its likely future path of rate cuts. Core inflation has been

relatively static recently at about 3.3%:

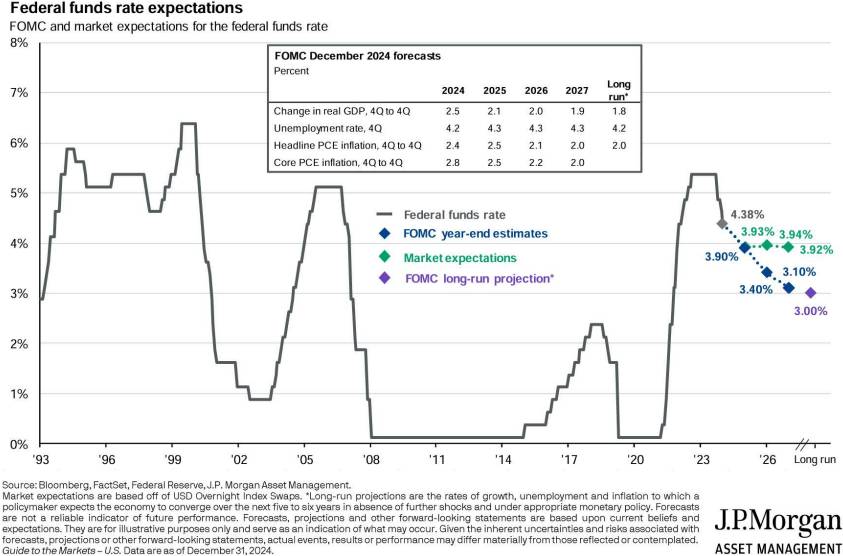

The Fed finally did make its long-anticipated dovish pivot as it slashed the federal funds rate by 50bp in September, then 25bp more in November and December. However, at this point the Fed isn’t expecting to do much cutting in 2024, while markets are anticipating even less movement in the federal funds rate:

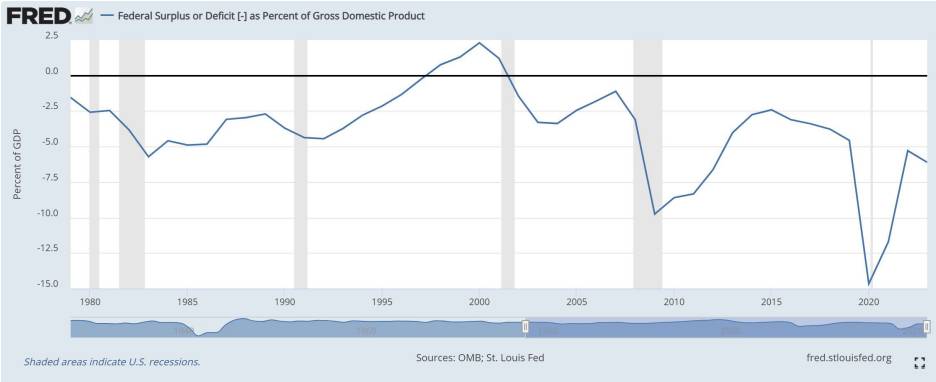

Both markets and the Fed forecast the federal funds rate to decline another 50bp or so in 2025…but then markets expect that rate to plateau at about 4%, while the Fed anticipates it falling to just over 3%. In the short run, the Fed may wait and see what the Trump Administration decides to do with respect to tariffs, and what fiscal legislation Republicans pass this year. It’s likely that much or all of the Trump tax cuts from 2017 will be extended, or made permanent. The Fed may have concerns that fiscal stimulus could threaten to reignite inflation, and may thereby proceed more cautiously with rate reductions. In the long run, high fiscal deficits (as shown below) and debt may put upward pressure on interest rates.

The Trump Administration has begin with a flurry of executive orders, and we would expect much activity over the coming months. While market impact is unclear, we again will mention that markets over time typically grow no matter which party is in power:

Portfolio Positioning and Closing Thoughts

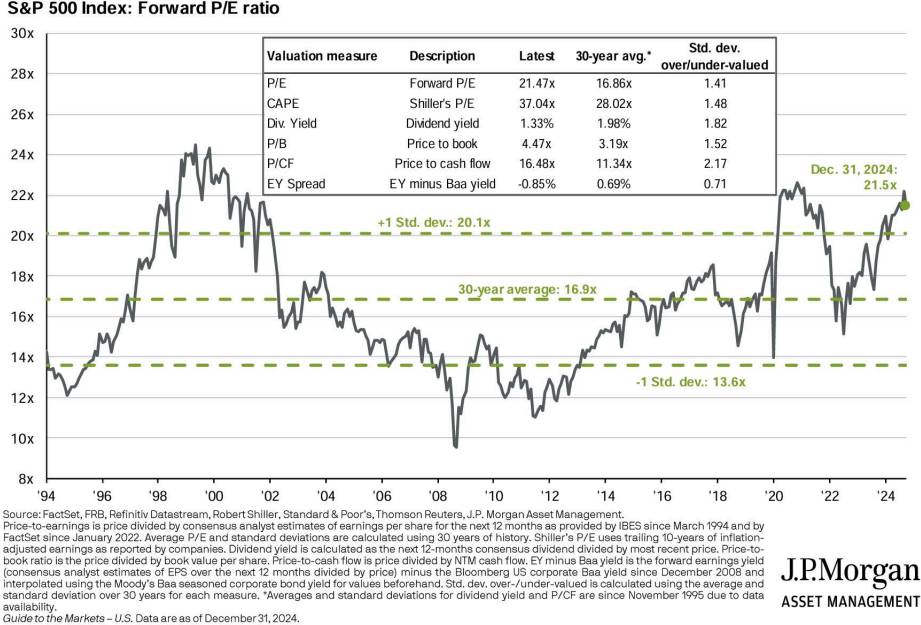

After this extended bull market, it is not surprising to see elevated valuations:

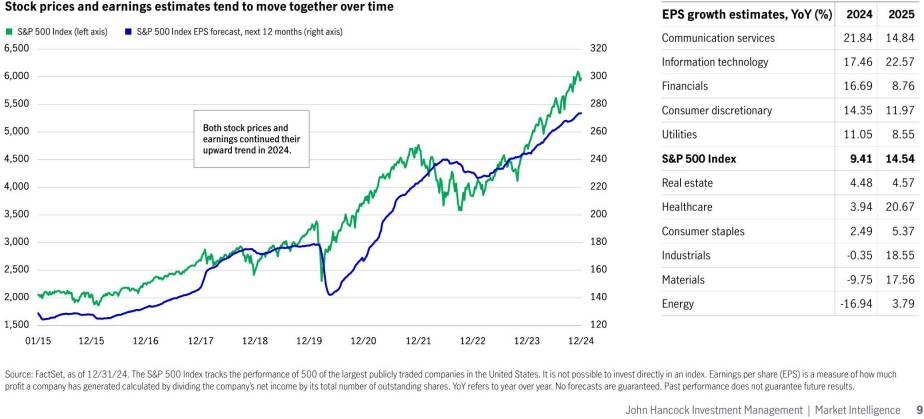

However, earnings have also been strong:

As we move into 2025, the conversation must transition a bit from the “Fed watch” we have been participating in since mid-2024 to economic policy moving forward. With a transition at the White House and the GOP controlling both bodies of Congress, we could see a significant shift in policy in the first half of 2025. At the top of the watch list will be tariffs. Throughout the campaign, President Trump focused on tariffs as a “magic elixir” that could solve a multitude of issues. Economists stand, in large part, in opposition to this view. This is especially the case when speaking in terms of broad, sweeping tariffs instead of targeted tariffs. It is too early to know how this will play out. If the tariffs are implemented as has been described, we will need to be aware of renewed upside risk to inflation as costs are passed along to consumers – not only in the United States, but abroad.

On the stock side of portfolios, we are looking at a very similar setup as the prior year in terms of returns and valuations. U.S. large cap stocks carried the day in 2024 – primarily on the back of technology, consumer discretionary and communications stocks. The “Magnificent 7” stocks drove returns of the category higher and saw their valuations climb again. The question for 2025 will be, can they continue their momentum or will their expensive price tag give the market pause? Much of the move higher in these stocks can be attributed to the push in Artificial Intelligence (AI). Companies see a need to significantly increase capital expenditures in the space to get ahead. However, given the nature of rapid change in AI, there are also large risks to these “tech” behemoths. We would advise a more neutral approach to large cap investment. Taking some profit from the huge winners and shifting funds toward “value” sectors of the market could help mitigate some risk while adding to the cheaper parts of the market. We are not advocating placing large bets on value. Instead, we believe it wise to lessen the growth exposure and become more neutral between the segments. While lower capitalization stocks and foreign stocks remain relatively attractive, we do not believe we will witness great outperformance from these asset classes. Smaller U.S. companies could continue to struggle a bit as interest rates remain elevated. Foreign stocks, on the other hand, will be in the crosshairs of possible tariff battles and could witness volatility. We believe portfolios should have exposure to these areas, but this is not the time to increase these diversifying categories.

For bonds, it seems that the election has brought new concerns and, possibly, a different path for interest rates. While economic growth has been strong and most metrics the Federal Reserve uses when determining shortterm rates have been trending positive, the cloudy policy path forward has brought about caution in terms of further reducing interest rates. Core bonds seemed poised to see positive flows based on the Fed’s path in Q3 2024. Now, with some concerns around inflation creeping higher again and rates not coming down substantially, we believe it is prudent to focus on two other parts of the bond market. Short-term bonds still offer quality yields – while greatly reducing interest rate risk in portfolios. Multi-sector bonds strategies allow managers to be more tactical and target area they feel are attractive and mispriced. A combination of these asset classes will provide a nice yield while keeping portfolio duration low. Emerging market bonds may see a bit of a boost if policy brings about short-term dollar weakness. We are avoiding high-yield bond strategies at the current time as historically low spreads over U.S. Treasuries do not justify the risk – especially if we see an uptick in defaults.

—JMS Team

JMS Capital Group Wealth Services LLC

417 Thorn Street, Suite 300 | Sewickley, PA | 15143 | 412‐415‐1177 | jmscapitalgroup.com

An SEC-registered investment advisor

This material is not intended as an offer or solicitation for the purchase or sale of any financial instrument or investment strategy. Certain material in this work is proprietary to and copyrighted by Litman Gregory Analytics and is used by JMS Capital Group Wealth Services LLC with permission. This material has been prepared for informational purposes only, and is not intended to provide, and should not be relied on for, accounting, legal or tax advice. Any references to future returns are not promises - or even estimates - of actual returns a client portfolio may achieve. Any forecasts contained herein are for illustrative purposes only and are not to be relied upon as advice or interpreted as a recommendation for a specific investment. Past performance is not a guarantee of future results.

With the exception of historical matters, the items discussed are forward-looking statements that involve risks and uncertainties that could cause actual results to differ materially from projected results. We have based these projections on our current expectations and assumptions about current and future events - as of the time of this writing. While we consider these expectations and assumptions to be reasonable, they are inherently subject to significant business, economic, competitive, regulatory and other risks, contingencies and uncertainties, most of which are difficult to predict and many of which are beyond our control. There can be no assurances that any returns presented will be achieved.

‹ Back