By using our website, you agree to the use of cookies as described in our Cookie Policy

Blog

Quarterly Market Commentary 2023

First Quarter 2023 Key Takeaways

Markets steamed ahead in the first month of 2023, continuing the recovery that began in the 4th quarter of last year. Unfortunately, the rebound then stalled amidst stubborn inflation and the possibility of further monetary tightening. Both stocks and bonds are in a better place than they were a few months ago, but they have still only partially recovered from their double digit losses in 2022. Further recovery faces headwinds from the fallout of the fight against inflation, and here we see a dilemma—if inflation is curbed via a recession, then markets may struggle due to the cooling of the economy. But if inflation isn’t tamed via a recession, then the Fed may maintain higher rates or raise rates even further, which again will pose challenges for markets. There is potentially the happy medium of falling inflation with minimal macroeconomic decline, but that prospect appears increasing challenging as inflation has stayed higher for longer than many, including the Fed, anticipated. And although inflation is once again the centerpiece of discussion, there are always other concerns at hand, including fallout from Silicon Valley Bank’s collapse, strained relations with China, the Russian invasion of Ukraine, a potential debt ceiling standoff, and a potential looming recession and its fallout on markets and the economy.

Markets steamed ahead in the first month of 2023, continuing the recovery that began in the 4th quarter of last year. Unfortunately, the rebound then stalled amidst stubborn inflation and the possibility of further monetary tightening. Both stocks and bonds are in a better place than they were a few months ago, but they have still only partially recovered from their double digit losses in 2022. Further recovery faces headwinds from the fallout of the fight against inflation, and here we see a dilemma—if inflation is curbed via a recession, then markets may struggle due to the cooling of the economy. But if inflation isn’t tamed via a recession, then the Fed may maintain higher rates or raise rates even further, which again will pose challenges for markets. There is potentially the happy medium of falling inflation with minimal macroeconomic decline, but that prospect appears increasing challenging as inflation has stayed higher for longer than many, including the Fed, anticipated. And although inflation is once again the centerpiece of discussion, there are always other concerns at hand, including fallout from Silicon Valley Bank’s collapse, strained relations with China, the Russian invasion of Ukraine, a potential debt ceiling standoff, and a potential looming recession and its fallout on markets and the economy.

Despite numerous predictions of an impending recession, the US economy has so far managed to avoid that fate. Despite an increase of 4.75% in the federal funds rate in the past 13 months, Q3 GDP growth was an annualized 3.2%, and Q4 GDP growth was an annualized 2.6%. Current estimates for Q1 2023 show growth slowing but still remaining in positive territory. The labor market has also continued to remain tight, with the unemployment rate ending the quarter right where it started, at 3.5%. Inflation has fallen from its peak, but core inflation’s downward path has stalled over recent months.

The fundamental question remains as to how difficult it will be for the Fed to push core inflation down to near the 2% mark, and how far the Fed will be willing to go to achieve that objective. A recession is still possible, and perhaps even probable. The Fed may be nearing the end of its hiking cycle, but it has signaled its intention to leave rates high for some time. The path ahead is still murky, and although we are pleased that markets have been recovering nicely for the last 6 months, the remaining road out of this bear market may yet be a bumpy ride.

First Quarter 2023 Investment Letter

The first quarter of 2023 has been a continuation of the uptick begun in the fourth quarter of 2022. The Fed is still raising rates, but only at a 25bp clip most recently. Headline inflation has fallen sharply, and while core inflation remains mired well above target, it is still down from its peak. The regional bank panic sparked by Silicon Valley Bank’s collapse appears to be contained. We are once again hopeful that the worst is well behind us; however, the timing and extent of a deeper equity and bond market recovery is significantly contingent on the path of inflation over the coming months.

First Quarter 2023 Market Update

The first quarter of 2023 built on the progress begun in the fourth quarter of 2022. The S&P 500 gained 7.5%, developed international 8.6%, emerging markets 4.0%, and the Russell 2000 2.7%. In terms of style, growth stocks, which bore the brunt of the bear market, performed most strongly in Q1, with large growth, midcap growth, and small growth rising 14.4%, 9.1%, and 6.1%, respectively. Value was flat in Q1, with large and mid value posting 1% gains, and small value suffering a 1% loss. Technology and communication services were the best performing sectors, with each rising over 20% for the quarter, while financials and energy fared the worst, with each losing about 5%.

After a horrific 2022, bond markets continued their upward climb that began late last year. The US agg rose 3.0% and developed international bonds added 3.5%. High yield and municipal bonds posted similar gains at 3.6% and 2.8%, respectively. The rising rate environment may have crushed bonds last year, but the resulting higher yields means bonds can become a significantly better source of steady income, pending further reductions in inflation. Volatility for the quarter was mild, as the VIX was generally in the low to mid 20s during the first quarter, and even when Silicon Valley Bank failed, the VIX remained below 30.

Update on the Macro Outlook

Until it is well and truly cooled, inflation will remain a topic, if not the topic, impacting the macroeconomy and markets. We are hoping that we will not be perpetually providing progress reports on this topic, but for now, that’s the reality we’re living in. So, after a first quarter in which the Fed raised the federal funds rate another 50bp, to 4.75%-5.00%, what’s the current status of inflation?

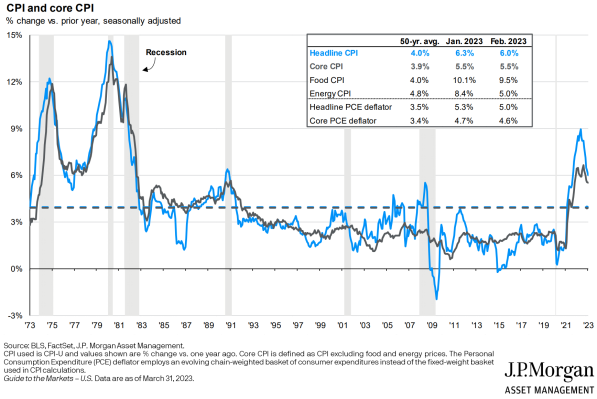

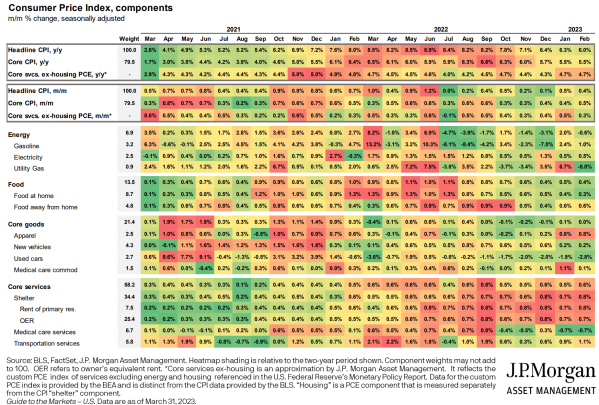

Headline inflation has come down, in large part thanks to falling energy prices. Core inflation appears to be falling slowly. Fed Chair Jerome Powell has emphasized the Fed’s willingness to maintain high rates to curb inflation; a heatmap from JPMorgan nicely illustrates possible Fed concerns that inflation, in addition to being well above the 2% target, has been entirely too sticky as well:

The third line of the chart shows JPMorgan’s calculations of another core inflation measure that excludes more volatile food, energy, and housing prices, and notes that inflation has remained fairly steady over the past year, confined to the narrow range of 4.2%-4.9% since January of 2022. From a consumer perspective, it’s great that gas prices have fallen, but from the Fed’s perspective, the more stable core subset of prices has nonetheless been rising at a 4-5% year over year clip

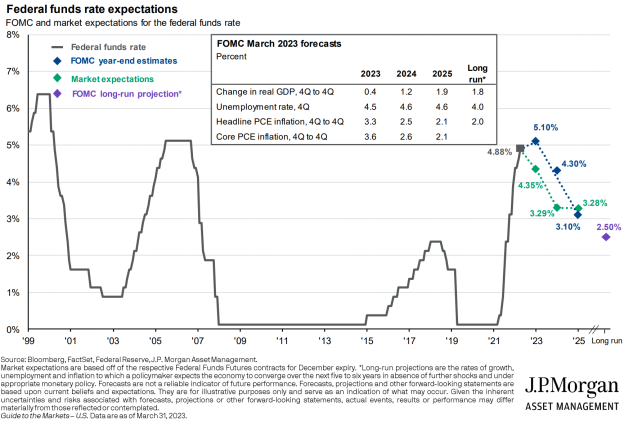

How will the Fed respond? Markets expect the Fed to raise rates another 25bp in May, and possibly another 25bp in June, but both markets and the Fed currently project that the Fed is nearing the end of its hiking cycle. The Fed may also get some inflation-fighting help from the fallout of Silicon Valley Bank’s failure, as banks are likely to tighten credit in response. The Fed’s main thrust is maintaining elevated interest rates to cool the economy and reduce inflation over time. How long will rates remain high? Here, there is disagreement between the Fed and markets:

Markets and the Fed agree that the federal funds rate will fall over time, but they differ on the timing--markets project rates to drop to about 4.3% by the end of this year, whereas the Fed expects rates to reach that level by the end of 2024. Similarly, markets foresee the federal funds rate declining to about 3.3% by the close of 2024, whereas the Fed doesn’t view rates as dipping that low until the end of 2025. So, there is agreement on the endpoints, but assessments on the timing differ by about a year.

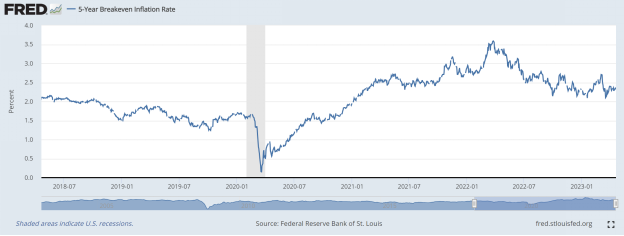

The Fed believes core inflation will fall to 3.6% by the end of the year, to 2.6% by the end of 2024, and to 2.1% by the end of 2025. Market expectations, as illustrated by the 5-year breakeven inflation rate, support the belief that inflation will normalize:

The 5-year breakeven inflation rate is 2.3%, which is only marginally above the Fed’s target.

So both the Fed and market participants expect the inflation problem to be dissipated in the medium term, but at what cost? The Fed’s March meeting minutes indicate that it expects a recession, albeit a mild one. Economist surveys also show a recession is more likely than not, but again, such a recession is not expected to be severe. The Fed’s unemployment projections only have unemployment rising about 1%, from 3.5% now to 4.5% by year end and 4.6% by the end of 2024. However, there are economists, such as Larry Summers, who believe that an economic soft landing is unlikely, and that a deeper recession that entails unemployment increasing to around 6% is a more likely scenario. Considering that markets and the Fed have underestimated the depth and breadth of inflation for the past 2 years, we should be cognizant of the tail risks to markets and the economy should inflation continue to be surprisingly sticky.

Debt ceiling brinkmanship is also a concern over the next few months; the US is currently expected to hit its debt limit sometime this summer. Republicans in the House of Representatives have outlined a proposal to raise the debt ceiling in exchange for spending cuts, but it is unclear whether this plan has the votes to simultaneously satisfy enough Republican hardliners and Republican moderates for it to pass. The Biden Administration is insisting on a clean debt hike with no strings attached; while it is possible that stance will soften, there’s little reason to change course until Republicans show they can pass something in the House.

Portfolio Positioning

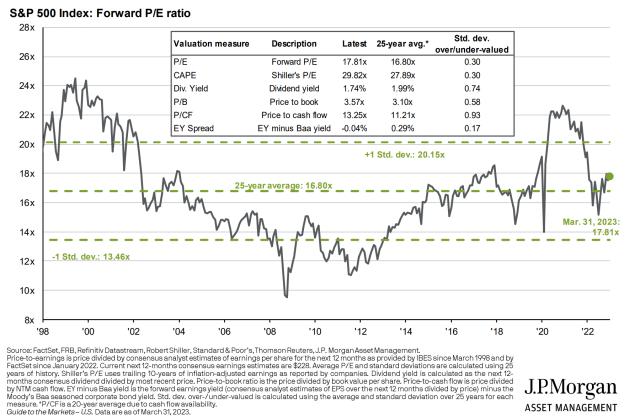

After reverting to historically normal levels in 2022, US equity valuations have begun to shift into overvalued territory, though not alarmingly so. We wouldn’t yet characterize US stocks as expensive, but they are not cheap.

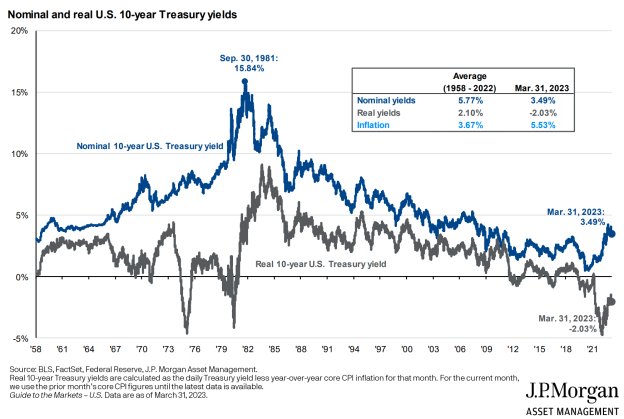

While yields have risen significantly for bonds, inflation is currently eroding all of those gains, as the chart below illustrates:

The nominal yield, which is the interest rate paid to the bond purchaser, has risen as the Fed has raised rates, but inflation has spiked so sharply that the real yield, which equals the nominal yield minus inflation, has unfortunately turned negative. Increased yields mean bonds have the potential to be more useful going forward, but until inflation cools they suffer from that large headwind.

For stocks, we still carry a slight bias towards value over growth, given their valuation versus growth stocks. Large cap growth has rallied a bit to start 2023, erasing a portion of their large losses from the prior year. Given the Federal Reserve’s inclination to continue to raise rates in the short term, growth stocks could face headwinds in the coming months. We do believe there is an opportunity to shift some funds from large cap US stocks to both small cap US stocks and developed international stocks. Small cap stocks remain at severely discounted levels, approximately 32% below their long term median premium relationship to large caps. This should provide the ability for outperformance over the coming market cycle. As for international stocks, they remain inexpensive compared to their domestic counterparts. Though the last 18 months has erased a portion of the discount that existed post-COVID, they remain attractive and are a reasonable place to allocate additional funds. Overall, the stock market will be looking to the Fed’s decision on rates and the ripple effects of the Silicon Valley Bank default to find direction going into the second half of 2023.

On the bond side, we are pleased to see nominal yields moving back towards more historic norms and away from the zero interest rate quagmire that hampered savers for over a decade. With that said, inflation needs to be tamed for these yields to be meaningful for fixed income investors. We continue to favor short-term bonds over core intermediate-term bonds; intermediate-term bonds have had a nice rally, as the 10-year rate moved from 4.25% in October 2022 to 3.48% by the end of the first quarter of 2023. We would anticipate some upward pressure in yields in the coming months and prefer to focus on lower duration bonds in the near term. To complement those positions, we continue to employ various multisector strategies that can augment yield and be more nimble as market dynamics shift. We believe there are opportunities in corporate credit, various mortgage securities, and higher-yielding emerging market bonds. These strategies are able to target these areas and adjust exposure as they see fit. The strong economic data to start 2023 implies the Fed can move rates higher, so we continue to believe a diversified bond portfolio makes the most sense.

Closing Thoughts

We’re hoping for a goldilocks scenario in which the economy remains strong but not so strong as to maintain high inflation, and the labor market softens but doesn’t sour. But fairy tales are fiction, and we can’t rely on them coming true. Inflation has consistently overstayed its welcome in recent months, and for all we admire the economy’s resilience, the Fed will continue in its efforts to bend-but-not-break the economy as it seeks to grind inflation closer to its 2% target. We are also concerned about the approaching debt ceiling standoff, as the US may hit its debt ceiling by early June. Republicans’ narrow House majority means that Speaker McCarthy has to either pass a bipartisan bill with Democrats, which many Republicans would loathe, or thread the needle with a bill that finds near-unanimous support among both moderate Republicans and hardline conservatives. And even if he accomplishes that goal, he then has to reach an agreement with the White House and a Democratic Senate. Granted, the two parties have always found a way to increase the debt limit, and it’s likely they’ll do so again once default becomes imminent, but higher volatility and market heartburn may be in store in the meantime. We do expect markets to expand on their recovery over the longer term, but over the coming months they still face inflation, the debt ceiling, banking sector tightness, and other headwinds. In addition, the rapis rise in interest rates could have a greater impact on economic tightening than anticipated and prvide more downside in the markets. As always, and perhaps with even greater emphasis in a year with many contingencies, we advocate for portfolios that are well diversified and reasonably prepared for a wide variety of future market conditions.

—JMS Team

JMS Capital Group Wealth Services LLC

417 Thorn Street, Suite 300 | Sewickley, PA | 15143 | 412‐415‐1177 | jmscapitalgroup.com

An SEC-registered investment advisor

This material is not intended as an offer or solicitation for the purchase or sale of any financial instrument or investment strategy. Certain material in this work is proprietary to and copyrighted by Litman Gregory Analytics and is used by JMS Capital Group Wealth Services LLC with permission. This material has been prepared for informational purposes only, and is not intended to provide, and should not be relied on for, accounting, legal or tax advice. Any references to future returns are not promises - or even estimates - of actual returns a client portfolio may achieve. Any forecasts contained herein are for illustrative purposes only and are not to be relied upon as advice or interpreted as a recommendation for a specific investment. Past performance is not a guarantee of future results.

With the exception of historical matters, the items discussed are forward-looking statements that involve risks and uncertainties that could cause actual results to differ materially from projected results. We have based these projections on our current expectations and assumptions about current and future events - as of the time of this writing. While we consider these expectations and assumptions to be reasonable, they are inherently subject to significant business, economic, competitive, regulatory and other risks, contingencies and uncertainties, most of which are difficult to predict and many of which are beyond our control. There can be no assurances that any returns presented will be achieved.

‹ Back