By using our website, you agree to the use of cookies as described in our Cookie Policy

Blog

Q3 2016 Market Commentary

Key Takeaways

Despite numerous uncertainties, including a U.S. pesidential campaign that continues to unfold as the most unconventioal in recent memory, the S&P 500 Index rose by nearly 4% in the third quarter. Stock market volatility remained at extremely low levels through July and August. September seemed to usher in a change in tone. During the month, stock investors registered high anxiety, with markets rising and falling sharply in response to any oil‐related headlines and any suggestion of interest rate hikes by central banks.

Developed international stocks outperformed the &P 500 after the Brexit l ow and for t he third quarter.

They still trail U.S. stocks or the year (both in dollar‐hedged and unhedged currency terms). We continue to believe developed international stocks are cheap relative to U.S. stocks, based on normalized earnings power, and offer attractive relative returns over the coming market cycle.

Emerging‐market stock returns have been particularly striking, building upon their sharp rebound and outperformance versus other markets that began in late January. Emerging‐market stocks are now up over 15% for the year.

Yields on U.S . 10‐year Treasury bonds rose to as hi h as 1.75% during the quarter on worries over central bank policies, but the Federal Reserve s decision n t to raise interest rates i n September soothed markets.

Yields ended the quarter at 1.60%, still up from 1.46% on July 1. A December rate rise is potentially still on the table, and financial markets remain keenly attuned to this possibility. The core bond index gained just 0.4% for the quarter.

Rising rates pose a significant risk to c ore bond returns, which is one of the justifications behind our tactical positions in flexible fixed‐income funds, including high yield bonds and floating‐rate loans. Our portfolios benefited last quarter from both positions, as they contributed strong absolute and relative performance compared to core bonds.

In this quarter’s investment commentary, we briefly review portfolio performance and recap our cur rent asset class views, before discussing the importance of actual versus perceived diversification and why we choose not to run with the herd, especially during times of elevated market risk. In our view, making investment decisions based on short‐term market forecasts (gue sses) is a losing game. W have no confidence that this approach can be executed successfully over time.

Third Quarter 2016 Investment Commentary

Portfolio Positioning

U.S. Stocks

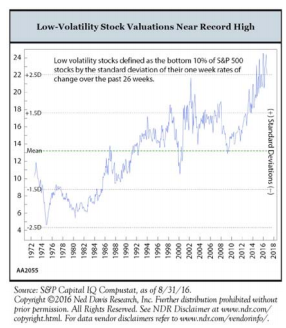

The S&P 500’s gain occurred in the context of a market that saw sharp intraday drops followed by swift reversals, as well as strong rotation into and out of sectors perceived to be “safe,” such as utilities, telecoms, and consumer staples. Financials remained pressured by low interest rates, a challenging regulatory environment, and poor investor sentiment—negative headlines surrounding Deutsche Bank and Wells Fargo have not helped. We continue to view U.S. stocks as overvalued and unattractive relative to the risks over the next five years. We remain underweight.

Developed International Stocks

Developed international stocks outperformed the S&P 500 after the Brexit low and for the third quarter. They still trail U.S. stocks for the year (both in dollar‐hedged and unhedged currency terms). We continue to believe they are cheap relative to U.S. stocks, based on normalized earnings power, and offer attractive relative returns over the coming market cycle.

There are any number of known and unknown catalysts that could result in an earnings recovery. One may be the European Central Bank’s continued efforts to keep borrowing costs down to stimulate lending and investment spending. The ECB recently started buying investment‐grade corporate bonds as part of its quantitative easing program. That may spur investment and lead to better economic growth. Or, it may spur financial engineering, with companies using the proceeds from issuing debt to buy back stock and boost earnings per share. Either outcome would bode well for future profits and stock prices.

Brexit, along with the rise of many right‐wing political parties, may serve as a wake‐up call that authorities need to generate better growth in the economic bloc soon. As a result, they may become more open to loosening the fiscal purse strings to assist the ECB’s reflation efforts.

The exact timing is highly uncertain. It’s possible nothing much happens with fiscal stimulus until major elections are completed over the next year, meaning the ECB continues to do what it can and Europe muddles along. We believe normalization will take place over roughly the next five years.

Emerging‐Market Stocks

Returns have been particularly striking, building upon their sharp rebound and outperformance that began in late January. They are now up over 15% for the year. Returns have been driven primarily by expanding P/E multiples rather than a strong upturn in earnings growth, which is not (yet) apparent in the market‐level data we follow.

Our modest tactical overweight versus U.S. stocks is based on our view that their expected returns over the next five years are comparatively attractive. We believe we are using reasonably conservative earnings growth and valuation assumptions. However, we don’t have a strong view about a near‐term earnings rebound which is why we are not further overweight the asset class. The political and economic risks, including the very rapid growth of debt in China in particular, are well known. These risks carry meaningful weight in our overall assessment of emerging‐market stocks, which has tempered our enthusiasm a bit. That said, our positions were solid contributors for the quarter.

Flexible Fixed‐Income Funds

Our portfolios also benefited from our positions in flexible fixed‐income funds, which had very strong absolute and relative performance compared to core bonds. After trailing core bonds earlier in the year, these positions were meaningfully ahead of the index for the quarter.

Our non‐core bond holdings do have more risk than core bonds in certain macroeconomic scenarios. However, we believe the added credit risk is more than offset by our meaningful underweight to U.S. stocks and our preference to not take on significant interest rate risk within bond portfolios. From a longer‐term return perspective, these positions should meaningfully outperform core bonds in either a flat or rising rate environment.

Liquid Alternative Strategies

All in all, our liquid alternatives posted flat returns for the quarter. Our multialternative funds generated positive returns in the third quarter. Our market neutral and managed futures positions posted negative returns for the quarter but have provided beneficial portfolio diversification during market selloffs. Our thesis for the alternative funds and strategies we own remains intact. We expect them to provide diversification (risk‐ reduction) benefits at the overall portfolio level stemming from their distinctive approaches and different performance drivers.

We are pleased many of our tactical positions and active managers added value in the third quarter, but reiterate our exposure is based on our longer‐term time horizon and assessment of their potential returns and risks. This is particularly true for emerging‐markets, developed international, and other higher‐risk/higher‐ volatility positions. Over the shorter term, we never know precisely when we will get paid for our investments. But we are confident that over a full market cycle we will be compensated for the risks in owning them. Therefore, we need to remain patient and disciplined to ride out any shorter‐term volatility or negative performance in the interim.

Perception Versus Reality: Managing Risk

While we spend time analyzing each of our individual positions and holdings, in portfolio management, the whole is much more than simply the sum of its parts. By definition, a well‐diversified portfolio (i.e., one with investments that do not all move together in the same direction) will contain some laggards during any given measurement period, particularly over shorter‐term periods. But it’s at least as important to focus on the overall portfolio, how the pieces fit together and perform relative to each other, and whether that performance is consistent with the original rationale for owning them.

Successfully managing portfolios also requires the discipline to resist trading based on emotion, rather than on long‐term return drivers such as valuations, yield, and earnings growth. Even in an advanced economy such as the United States, the stock market has fallen by at least 10% every 16 months on average since 1950. Bear markets (20% or greater declines) in the United States have happened about every seven years on average. In most cases you can’t predict what the exact cause of the volatility will be or exactly when it will hit. Even if you could successfully call it, you’d need to also successfully time your re‐entry so as not to miss out on the subsequent gains—and do so consistently and repeatedly over an investment lifetime. That is not realistic, which is why our tactical investment approach is based on a range of potential outcomes and a longer‐term time frame.

To take just one example of why making investment decisions based on short‐term market forecasts (guesses) is a losing game, we turn to the U.S. presidential election. We are being asked about the election even more than usual this year. While the specific circumstances of any given election are always unique, our approach remains the same. To the extent a particular result is widely expected, current asset prices will reflect the market consensus. There is too much uncertainty and too many variables that impact investment outcomes for us to likely see any value in positioning our portfolio for a particular result. Instead, we stick to our longer‐term analytical framework, in which we consider and weigh multiple macro scenarios, and assess the potential risks and returns for investments in each.

Along with the U.S. presidential election, central banks’ policies, particularly the Fed’s, remain a key near‐term wildcard for financial markets. At its September 21 meeting, the Fed remained on hold but signaled it is on course to raise rates later this year, likely in December. It also lowered its longer‐term forecast of rate hikes yet again. It now forecasts just two in 2017, down from the three forecasted at the June meeting and the four forecasted at the March meeting. Financial markets responded positively.

Investors are effectively being forced out of low‐risk, extremely low‐yielding, core bonds into riskier assets that offer higher current yields (still quite low compared to historical levels). Many investors appear to be “reaching for yield” as well as perceived safety in traditionally “defensive” yield‐oriented sectors of the stock market, such as utilities, telecoms, consumer staples, and REITs. Valuations have soared. But these trades can unwind quickly and momentum can work in reverse. It certainly seems “defensive” plays are vulnerable to any hint of interest rate increases and are potentially higher‐risk right now than the broad stock market, not to mention bonds.

To the extent the “buy ‘bond‐like’ and dividend‐yield stocks” theme remains in play, it will likely be a headwind for our actively managed funds overall. When that trend reverses, our managers and portfolios should benefit. We saw that happen in the third quarter, as the yield on the 10‐year Treasury bottomed at 1.37% on July 5 and closed the quarter at 1.60%.

While ultralow interest rates are supportive of financial asset prices, we continue to view them as unsustainable and inconsistent with longer‐term economic growth. Trying to anticipate the markets’ reaction to each Fed governor utterance or Fed policy statement is a short‐term guessing game that we simply won’t play with our investment portfolios.

Putting It All Together

Our decision‐making is anchored in our long‐term fundamental and valuation‐driven approach. We and our clients need to be psychologically and financially prepared for periods of market stress and able to ride them out on the path to achieving long‐term investment and financial goals. Investors who can’t stomach a given level of volatility or downside risk should reallocate into a portfolio with a lower targeted risk level. The time to do so is before a period of volatility, not during or right after it when they would be selling their riskier assets at lower prices and buying more defensive assets at higher prices.

We structure our balanced portfolios across a well‐diversified mix of investments, each with a distinct role. We expect them to be resilient and to perform at least reasonably well across a wide range of outcomes, balancing our objective of long‐term capital appreciation with shorter‐term downside risk management appropriate for each client’s risk tolerance.

While July and August were unusually calm months for the markets, volatility picked up in early September. We’re prepared for more volatility heading into (and potentially coming out of) the November election, as well as an increased likelihood of a Fed rate hike in December.

Disclosure:

This material is not intended as an offer or solicitation for the purchase or sale of any financial instrument or investment strategy. Certain material in this work is proprietary to and copyrighted by Litman Gregory Analytics and is used by JMS Capital Group Wealth Services LLC

with permission. This material has been prepared for informational purposes only. References to future returns are not promises ‐ or even estimates ‐ of actual returns a client portfolio may achieve. Any forecasts contained herein are for illustrative purposes only and are

not to be relied upon as advice or interpreted as a recommendation for a specific investment. Past performance is not a guarantee of future results.

With the exception of historical matters, the items discussed are forward‐looking statements that involve risks and uncertainties that could cause actual results to differ materially from projected results. We have based these projections on our current expectations and

assumptions about current and future events as of October 2016. While we consider these expectations and assumptions to be reasonable, they are inherently subject to significant business, economic, competitive, regulatory and other risks, contingencies and

uncertainties, most of which are difficult to predict and many of which are beyond our control. There can be no assurances that any returns presented will be achieved.

‹ Back