By using our website, you agree to the use of cookies as described in our Cookie Policy

Blog

Q1 2017 Market Commentary

First Quarter 2017 Key Takeaways

Global equities greeted the new year with the same degree of élan with which they closed 2016.

Emerging‐market stocks led the way with double‐digit gains, followed closely by developed international and U.S. stocks.

Our portfolios benefited from their exposure to emerging‐market stocks, which outpace d U.S. stocks by over five percentage points for the quarter. Upward revisions to corporate earnings forecasts, GDP growth that far outstrips that of developed economies, and valuations that are still cheap compared with developed‐market stocks ll helped drive the strong gains.

In Europe, st ck gains also seemed to reflect a combination of bullish investor sentiment and positive economic data, including rising corporate earnings. Developed International stocks rose by 7.25% during the quarter.

Investors took the Federal Reserve’s widely anticipated rate hike on March 15 in stride, treating it as another indicator of the U .S. economy’s return to form. As FedChair Janet Yellen stated, “The simple message is the economy is doing well.” On March 3 , the Bureau of Economic Analysis released a revised GDP figure of 2.1% for the fourth quarter of 2016 versus an earlier estimate of 1.9%. While investor optimism seemed to leave no contingency for downside surprises in the first quarter, macro economic fundamentals were also boadly supportive across the globe.

Defensive assets turned in a solid performance, wit h core investment‐grade bonds making up some ground along with Treasurys in the latter half of March after the Fed’s announcement. However, that still wasn’t enough to outpace the flexible, actively man aged bond funds we own. Our absolute‐return oriented and flexible bond funds (which are fund ed primarily from the core bond allocation) delivered gains of 1%–3% versus core bonds’ 0.8 2% return. Our floating‐rate loan funds performed in line with core bonds.

It’s too soon to know what the second quarter hold s in store, b ut we remain alert to potentially policy‐ d riven political risk in the United States. In Europe, the outcome of upcoming elections in France and Germany may have unexpected impacts on markets. While to date investors have shown a remarkable degree of staying power, that does not mean they will continue to do so.

As we discuss in this quarter’s commentary, a quick survey of the economic landscape suggests the environment should remain supportive of stocks and other risk assets, at least over the next six to 12 months or so. Longer‐term, we continue to believe high current valuations will be a major headwind to U.S. stock market returns. Our portfolios are prepared for higher volatility should it arise, and we remain confident in our positioning and in our investment process. Our focus remains on prudently managing each of our client’s portfolios to achieve long‐term, risk‐adjusted returns consistent with their investment objectives.

First Quarter 2017 Investment Commentary

Global economic growth is in sync and improving. A quick survey of the economic landscape suggests the environment should remain supportive of stocks and other risk assets, at least over the next six to 12 months or so. We continue to believe high current valuations will be a major headwind to U.S. stock market returns looking out over the next five years. We also remain concerned about the unresolved risks stemming from the global debt build‐up and unprecedented central bank policies. But for the time being, the global macroeconomic backdrop offers reason for optimism that many of the reflationary trends that have benefited our portfolios in recent quarters can continue.

Across a wide range of measures, the global economy is in its best shape in many years. Economic growth in most countries and industries is in sync and has been accelerating, albeit modestly. Leading economic indicators suggest this trend can continue, and many of the respected economic research firms we follow agree. Global Manufacturing Purchasing Managers Indexes, which have been correlated with global equity returns over time, recently made new multiyear highs in the United States, the eurozone, and China. While unexpected macro shocks can occur at any time, causing at least a short‐term flight from risk assets, the likelihood of an incipient U.S. or global economic recession appears low. Without a recession, history suggests a bear market in stocks is unlikely.

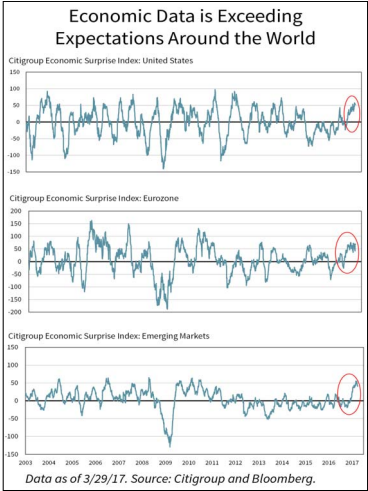

Macroeconomic fundamentals appear reasonably solid and are improving from cyclically depressed levels in many regions outside the United States. But financial markets respond to new data, information, and events that differ from consensus expectations already discounted in prices. The Citi Economic Surprise Indexes are meant to capture whether and to what extent new economic data points are exceeding or disappointing consensus expectations. These indexes have rebounded sharply over the past year. In fact, the Surprise indexes for Europe and emerging markets both recently hit seven‐year highs.

Portfolio Positioning & Outlook

Fixed‐Income

For the quarter, most of our active traditional fixed‐income funds as well as our absolute‐return‐oriented and flexible bond funds outperformed the core bond fund’s 0.9% return (the Vanguard Total Bond Market Index), continuing 2016’s trend. Our floating‐rate loan funds performed in line with the core bond fund. Our exposure encompasses what we believe is a prudent amount of credit risk and modest interest‐rate risk (duration). It also offers a meaningful yield and expected‐return advantage versus the core bond fund. We continue to believe that over the next several years the most likely direction for U.S. interest rates is higher, although the path will likely be bumpy. That would be consistent with the evidence of global economic reflation. In that scenario, the core bond fund’s annualized returns will be extremely low (potentially negative over a 12‐month period). In contrast, we believe our actively managed flexible bond funds and floating‐rate loan funds can generate mid‐single‐digit‐type annualized returns.

U.S. Stocks

On the heels of a fourth straight year of underperformance for foreign stocks versus U.S. stocks, the consensus view was for more of the same this year. The consensus view has been wrong so far. International and emerging‐market stocks have beaten U.S. stocks. This reversal was helpful to our portfolios in the first quarter, given our exposure to non‐U.S. stocks.

Over the longer term, our analysis continues to indicate the U.S. stock market is broadly overvalued. Specifically, our estimate of the expected annualized total return for U.S. stocks (including dividends) in our base case scenario is in the low single digits over the next five years. For U.S. stocks to be priced in what we consider to be a “fair value” range, that is, to at a minimum compensate investors for the risks they incur owning them, their expected return would be at least in the upper single digits. Since we are well below that hurdle rate in our base case scenario, we remain less than fully invested in U.S. stocks.

On several measures the U.S. stock market is as expensive as it has ever been in the past 50 years, with one exception: the dot‐com stock bubble of the late 1990s, from which the S&P 500 Index plunged nearly 50%. We don’t believe this time is different. We do believe valuation matters. When stock market valuations are high, the odds are future market returns will be low. We remain somewhat underweight to U.S. equities in favor of (1) foreign stocks with much better return prospects and (2) select alternative strategies we believe offer at least as attractive returns as U.S. stocks do, with much less risk.

Developed International Stocks

Our portfolios have meaningful exposure to developed international markets. These positions added value in the first quarter, and we continue to be confident developed international stocks will outperform their U.S. counterparts over the next several years.

Primarily due to the onset of a regional debt crisis in 2011, European corporate earnings have barely grown since the 2008–2009 financial crisis. Fiscal and monetary policies have not been stimulative enough to offset this. Meanwhile, U.S. company earnings have grown strongly, exceeding prior cyclical highs due to historically high profit margins, stock buybacks, and low interest expenses. This divergence in earnings trends is the key reason we view developed international stocks as more attractive looking forward.

We estimate that over the next five years, European companies will likely grow earnings at a much faster rate than their U.S. counterparts; this would lead to outperformance by European stocks. We believe European earnings are cyclically depressed, while U.S. earnings are near cyclical highs. We do not believe this condition is adequately reflected in their respective valuations. We don’t know the precise timing or exactly what catalyst will lead investors to close the gap, especially now, when political uncertainty in Europe is high. Yet, there are reasons for optimism.

Last year, for the first time since the 2008–2009 financial crisis, Europe’s economy grew faster than that of the United States. Improving economic growth ultimately leads to better sales growth and gets consumers and corporations to borrow and spend, furthering the cycle. According to the Bank Credit Analyst, private sector credit growth in Europe is up at the fastest rate since the financial crisis.

The European Central Bank has revised upward both its inflation and growth projections for 2017–2018. We are also finally seeing better earnings from European companies. According to Ned Davis Research, the most beaten down sectors, such as financials and energy, are seeing the fastest earnings growth year over year in local‐currency terms. Europe has a relatively large exposure to these sectors and any improvement will reflect positively in index‐level earnings growth.

Emerging‐Market Stocks

Emerging‐market company earnings are cyclically depressed relative to earnings of U.S. companies, yet investors are essentially pricing that in as a permanent condition. Using what we believe are very conservative normalized earnings estimates, our analysis indicates emerging‐market stocks in aggregate are trading at a price‐to‐earnings multiple well below historical averages. Using Robert Shiller’s valuation methodology—another way of normalizing earnings—emerging‐market stocks are trading at around half the multiple of their U.S. counterparts. As emerging‐market earnings growth comes through, we expect investors to bid up prices and valuations, generating low double‐digit annualized returns.

There remains considerable uncertainty as to whether Trump’s stated policies on border taxes, import tariffs, etc., will actually be implemented in the manner he has proposed. Even assuming they will be, while they would be a near‐term negative for some emerging‐market countries, they may actually be worse for larger U.S. companies. That is because, among other things, protectionist policies would likely disrupt global supply chains for U.S. multinationals. This ability to conduct sourcing on a global basis has driven down operating costs and been important in pushing U.S. corporate margins higher.

Emerging markets are better positioned today to weather protectionism, higher U.S. interest rates, and a rising dollar than they were a few years ago. Many countries are implementing reforms and undergoing political change that could be positive longer term.

Alternative Strategies

We remain strong believers in the long‐term benefits of owning alternative strategies. Our expectations for our managed futures investments, in particular, are that they will enhance our balanced portfolios’ overall risk‐adjusted returns over the long term, with low or no correlation with equity returns. Additionally, there is a very good chance they will perform well—in both relative and absolute terms—in an equity bear market. Below we describe the basis for our conviction.

Trend‐following managed futures funds invest in dozens of markets across multiple asset classes, employing rules‐based quantitative models to detect and invest in price trends and benefit from time‐series momentum in financial markets. There are certainly no guarantees, but during periods of extended equity market losses, returns should be negatively correlated with equity returns. While short‐term performance can be volatile, and the sharp reversals in performance when trends stop and revert can be uncomfortable too, the funds we use actually show less volatility than stocks do when looking at long‐term average levels. Managed futures, as a category, was able to demonstrate the ability to offset overall portfolio volatility and generate significant profits when equity markets declined precipitously both in early 2016 and during June’s post‐Brexit market fluctuations.

Putting It All Together

Despite a high level of volatility emanating from U.S. politics in recent months, U.S. stock market volatility has remained very low. That is unlikely to last. Our portfolios are prepared for more oscillations, particularly downside risk to U.S. stocks. We remain confident in our positioning and in our investment process, both of which allow us to look past periods of uncertainty and keep our focus where it should be: on prudently managing our diversified portfolios to achieve long‐term, risk‐adjusted returns.

—JMS Team

Disclosure:

This material is not intended as an offer or solicitation for the purchase or sale of any financial instrument or investment strategy. Certain material in this work is proprietary to and copyrighted by Litman Gregory Analytics and is used by JMS Capital Group Wealth Services LLC with permission. This material has been prepared for informational purposes only, and is not intended to provide, and should not be relied on for, accounting, legal or tax advice. Any references to future returns are not promises ‐ or even estimates ‐ of actual returns a client portfolio may achieve. Any forecasts contained herein are for illustrative purposes only and are not to be relied upon as advice or interpreted as a recommendation for a specific investment. Past performance is not a guarantee of future results.

With the exception of historical matters, the items discussed are forward‐looking statements that involve risks and uncertainties that could cause actual results to differ materially from projected results. We have based these projections on our current expectations and assumptions about current and future events as of April 2017. While we consider these expectations and assumptions to be reasonable, they are inherently subject to significant business, economic, competitive, regulatory and other risks, contingencies and uncertainties, most of which are difficult to predict and many of which are beyond our control. There can be no assurances that any returns presented will be achieved.

‹ Back