By using our website, you agree to the use of cookies as described in our Cookie Policy

Blog

Politics and Your Portfolio

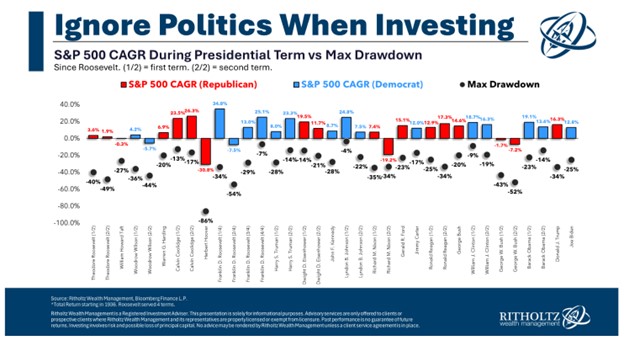

Election news has been coming in fast and furious this summer, but Ben Carlson issued a timely reminder that politics shouldn’t be driving your portfolio. A good rule of thumb is that markets tend to rise over time. A corollary of that is that markets tend to rise no matter which party is in power, as shown by a chart that Carlson provides:

S&P 500 compound annual growth rate has been in double digit territory for most presidential terms of the last 40 years (with George W. Bush the lone exception, as the tech bubble bursting and the financial crisis bookended his 8 years in office). Corrections and bear markets have occurred regularly, but at the end of the term the S&P 500’s gains have usually substantially outweighed its losses. Come November, half the country may be unhappy with the election results, but markets will march on.

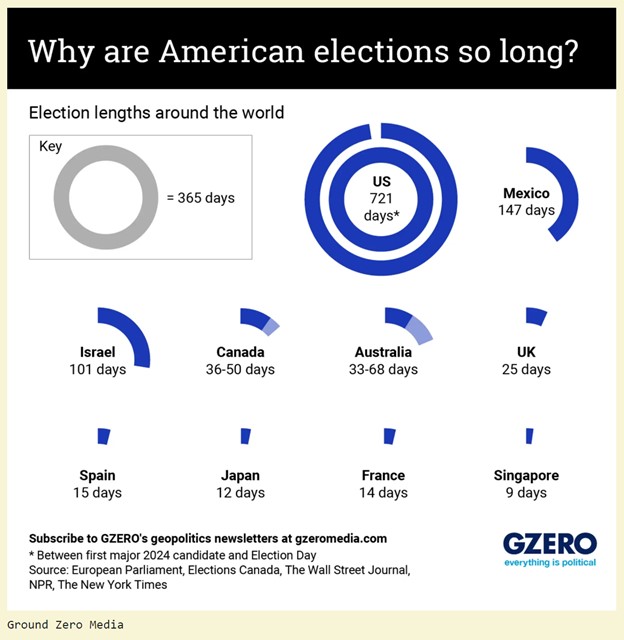

Campaigns, however, along with their flood of advertising, will mercifully come to an end in November, at least until campaigning for the next election begins. Ben Smith points out that the United States is unusual in how long its campaigns last. Smith provides a comparative chart, via Ground Zero Media:

In other countries election season runs in the weeks-to-months range, and not years. Whatever the final outcome, perhaps Harris’ quick-start campaign and subsequent rise in the polls will help usher in an end to the permanent campaign, in which politicians elected to office are barely on the job before turning their attention to running for another office.

JMS Capital Group Wealth Services LLC

417 Thorn Street, Suite 300 | Sewickley, PA | 15143 | 412‐415‐1177 | jmscapitalgroup.com

An SEC‐registered investment advisor.

This material is not intended as an offer or solicitation for the purchase or sale of any financial instrument or investment strategy. This material has been prepared for informational purposes only, and is not intended to be or interpreted as a recommendation. Any forecasts contained herein are for illustrative purposes only and are not to be relied upon as advice.

‹ Back