Quarterly Market Commentary

Fourth Quarter 2021 Key Takeaways. If the market resurgence paused in the 3rd quarter of 2021, it then rebounded in the 4th quarter, at least for the headline‐grabbing domestic ...

Read MoreHome › Blog

Fourth Quarter 2021 Key Takeaways. If the market resurgence paused in the 3rd quarter of 2021, it then rebounded in the 4th quarter, at least for the headline‐grabbing domestic ...

Read More

When Jerome Powell described last year’s inflation surge as largely transitory in nature, we all had the hopes that that would mean that pandemic-related supply and demand...

Read More

Is the economy doing well, or not? If you skimmed the headlines last week, you may have seen that retail sales – the purchases we make from stores in-person ...

Read More

What do fund managers expect for 2022? Bloomberg’s John Authers discusses a set of survey results on economic expectations for the upcoming year.

Read More

Here’s a little story about a group called the Fed… In the 1950’s, then Fed Chair William McChesney Martin described the Federal Reserve...

Read More

We’ve all witnessed the explosive growth of Tesla stock, which has reached a market capitalization of over $1 trillion.

Read More

2021 was a fizzing mints-in-soda kind of year. Everything seemed to shoot higher – from COVID-19 cases and vaccinations to economic growth and global stock markets.

Read More

Who spoke the words of wisdom above? We’ll get to that in a minute. But as 2021 gives way to 2022, we want to take a moment to look ...

Read More

Investors were feeling bullish. Last week, the Standard & Poor’s 500 (S&P 500) Index closed at a record high for the 68th time this year.

Read More

On Wednesday, the Fed held its December meeting and adopted a significantly more aggressive posture to combating the inflation surge of 2021.

Read More

Stock and bond markets diverged. Last week, the Bank of England surprised markets with a rate hike, its first in three years, and the Bank of Mexico raised ...

Read More

The omicron variant, first detected in South Africa in late November and spreading rapidly, appeared to threaten the current equities bull run as markets began to swoon after ...

Read More

Inflation met expectations. When the Bureau of Labor Statistics released the Consumer Price Index (CPI) last week, it showed that inflation was at levels last seen in 1982.

Read More

As emerging economies grow, their markets may increasingly resemble those of developed markets.

Read More

Investors look to the future. Last week, employment and manufacturing data confirmed that the United States economy continued to strengthen in November...

Read More

Although US GDP and the unemployment rate have recovered remarkably quickly, this progress has come with the cost of higher inflation...

Read More

COVID-19 strikes again. Coronavirus cases have been on the rise in Europe, climbing from about 700,000 new cases a week in September to 2.6 million a week in November.

Read More

Last week we noted a massive partisan gap with respect to the direction of this country.

Read More

Economists like to joke that inflation is just right when no one notices it. Last week, investors noticed it.

Read More

Investment management firms are in the business of forecasting the future, particularly those with a heavy emphasis on active management.

Read More

Feeling bullish…Investor bullishness ticked higher last week on all four investor sentiment gauges tracked by Barron’s.

Read More

Investment management firms are in the business of forecasting the future, particularly those with a heavy emphasis on active management.

Read More

The road to recovery is slow and bumpy. Last week, we learned that economic growth slowed in the third quarter as a new wave of COVID-19 surged across ...

Read More

After its November 3rd meeting, the Fed is expected to announce a tapering of its asset purchase program...

Read More

It’s MESSI! No, this commentary is not about Lionel Messi, the Argentine soccer phenom who is widely regarded as one of the greatest footballers of all time.

Read More

Third Quarter 2021 Key Takeaways. The market rebound may not be over, but it took a break in the third quarter of 2021.

Read More

Years ago, one of us at JMS had a teacher who had a poster tacked up in his classroom that showed a chimpanzee deep in thought.

Read More

Don’t get spooked! Barron’s Big Money Poll is an exclusive survey of market sentiment among professional investors.

Read More

The September jobs report provided fodder for economic pessimists and optimists.

Read More

The word “jouncy” may have started life as a combination of bouncy and jolting – and it’s a pretty good way to describe what happened to stock markets ...

Read More

Fed Chair Jerome Powell has regularly expressed the hope that the current inflation spike would be transitory. He may well be proven correct..

Read More

If you look back over the last 20 years, September has been the worst performing month for the Standard & Poor’s 500 Index, according to Nasdaq.

Read More

On Monday equities slipped markedly, with the S&P 500 down nearly 2% and other global markets down even more.

Read More

Central banks have a lot of influence on investors, markets and economies.

Read More

On Monday equities slipped markedly, with the S&P 500 down nearly 2% and other global markets down even more.

Read More

In recent weeks, bullish sentiment has drifted lower like sediment settling after a storm.

Read More

In 1950, Americans who made it to the retirement age of 65 could expect on average to live another 14 years; by 2010 this number had risen to 19 years.

Read More

Last week Fed Chair Jerome Powell gave a closely watched speech at the Fed’s annual Jackson Hole, Wyoming, symposium.

Read More

Raise your words, not your voice. It is rain that grows flowers, not thunder,” advised the Persian poet Rumi.

Read More

This spring we discussed JP Morgan’s annual energy report, which sounded a note of skepticism regarding how quickly we can expect to transition away from fossil fuels ...

Read More

Markets were shaken last week by a potent cocktail of central bank tapering and economic growth concerns mixed with coronavirus and a splash of the new Chinese privacy ...

Read More

As the bipartisan infrastructure bill advances through the Senate, its fate still uncertain upon reaching the House of Representatives...

Read More

Are we there yet? For months, investors have wondered when the Federal Reserve (Fed) might begin to “normalize” its policies...

Read More

In an increasingly rare moment of bipartisan unity, a group of Republican and Democratic Senators, along with President Biden...

Read More

The Chinese dragon cast a shadow over free trade and foreign investment last week.

Read More

President Trump attracted a great deal of attention through his stance towards China, including his implementation of tariffs against numerous Chinese goods.

Read More

Shortest ever. Last week, the National Bureau of Economic Research (NBER) finally announced the official dates for the recession that occurred in 2020.

Read More

Second Quarter 2021 Key Takeaways, The second quarter of 2021 for equities marked a continuation of the remarkable recovery since the COVID downturn in early 2020.

Read More

The term “peak growth” has become almost as popular as the comedy show Ted Lasso.

Read MoreEarlier this month President Biden signed an executive order encompassing 72 actions and recommendations aimed at increasing competition and limiting anti-competitive practices

Read More

There was a gapers’ block in financial markets last week as equity investors slowed to see what the United States Treasury bond market was up to.

Read MoreLast week 130 countries agreed to a corporate tax framework with a minimum tax rate of 15%.

Read More

What begins with the letter “I”? Infrastructure is essential and sometimes taken for granted. Pipes carry drinking water to our homes, offices, and healthcare facilities...

Read More

On Thursday, the White House reached a preliminary agreement with a bipartisan group of senators on infrastructure investments.

Read More

Is that a hawk? The Federal Reserve Open Market Committee (FOMC) met last week.

Read More

Lumber price surged this spring to record levels, spurring concerns about the Fed’s relative nonchalance towards inflation.

Read More

It’s transitory. It’s not transitory. It’s transitory. It’s not transitory. Media analysts were plucking the inflation daisy petals last week.

Read More

Biogen’s treatment for Alzheimer’s disease was unexpectedly approved last week by the FDA. The ruling was a surprise given that the FDA’s advisory had voted ...

Read More

Pulling the economy out of the shed. If you’ve ever stored tools or machinery in a shed or garage for an extended period of time, you know ...

Read More

The good news for electric vehicle manufacturers is that battery costs have been plummeting over time, and that the cost of electric vehicles may soon achieve parity with ...

Read More

Although it’s pulled back from its peak, Tesla’s stock has still risen more than tenfold in the past two years.

Read More

Are we at a tipping point? One side effect of the pandemic was a collapse in demand for oil, which led to “the largest revision to the value ...

Read More

The combination of dovish monetary policy and stimulative fiscal policy has given rise to inflation fears.

Read More

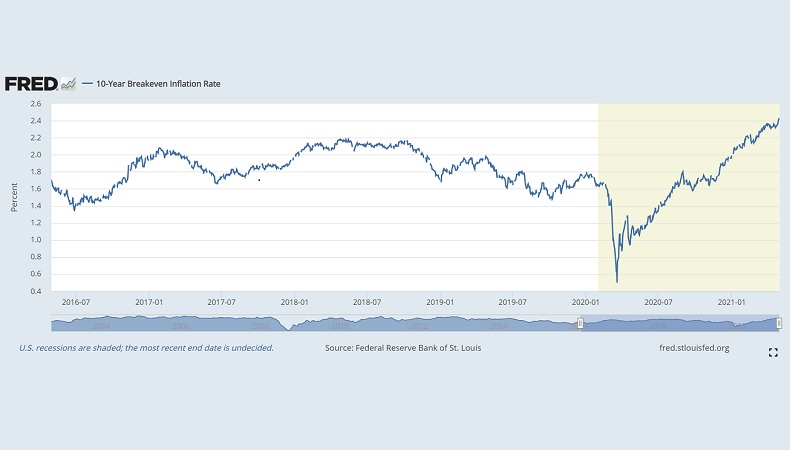

Here’s the current 10-year breakeven inflation rate, which reflects market expectations of the average inflation rate over the next 10 years.

Read More

Uncle Inflation is here. Will he overstay his welcome? Ever since the financial crisis, central banks have pursued expansionary monetary policies to encourage reflation and avoid deflation.

Read More

The jobs report released last Friday contained unexpectedly bad news. Normally a gain of 266,000 jobs would be a strong month...

Read More

Like a gender reveal gone wrong, last week’s employment report delivered an unexpected surprise.

Read More

It’s Spring and economic recovery is in the air. Last week, the Bureau of Economic Analysis reported the U.S.

Read More

Here’s the current 10-year breakeven inflation rate, which reflects market expectations of the average inflation rate over the next 10 years.

Read More

The Markets It wasn’t just the price of pork chops. Last week, as investors weighed the news, strong corporate earnings were offset by higher grocery ...

Read More Comments

First Quarter 2021 Key Takeaways. The market marches on. On the heels of its post-recession resurgence last year, stocks have continued their remarkable runup.

Read More

Where are Treasury bonds going? The direction of bond yields is influenced by investors’ expectations for economic growth, among other factors.

Read More

Investors didn’t stumble over inflation last week. Why not? Inflation – rising prices of goods and services – can be measured in a variety of ways.

Read More

The Biden Administration is seeking to enact a $2 trillion infrastructure plan, which then raises the question of how to finance this government spending.

Read More

The market’s recovery over the past year can be attributed in part to expectations that COVID would be largely suppressed and that the economy could then regain ...

Read More

Zoom, zoom, zoom. Big economies tend to recover from recessions about as quickly as semi-trucks accelerate from stop lights.

Read More

In recent years the Fed’s communication style has become increasingly direct...

Read More

Last week, unemployment claims were looking good and consumers were feeling good...

Read More

Last week we discussed optimistic economic growth forecasts for 2021, highlighted by a Goldman Sachs projection of 8% growth...

Read More

What are professional asset managers thinking? Bank of America recently published the results of its March global asset managers’ survey...

Read More

March 17, 2025

March 10, 2025

March 3, 2025

February 17, 2025

February 10, 2025

Advisory services offered through JMS Capital Group Wealth Services, LLC, a Registered Investment Advisor.

Business Continuity Plan • Privacy Policy • JMS Capital Group Wealth Services, LLC ADV Brochure • CRS Form

417 Thorn Street #300

Sewickley, PA 15143

By using our website, you agree to the use of cookies as described in our Cookie Policy