By using our website, you agree to the use of cookies as described in our Cookie Policy

Blog

National Debts Still Don’t Matter (to the campaigns)

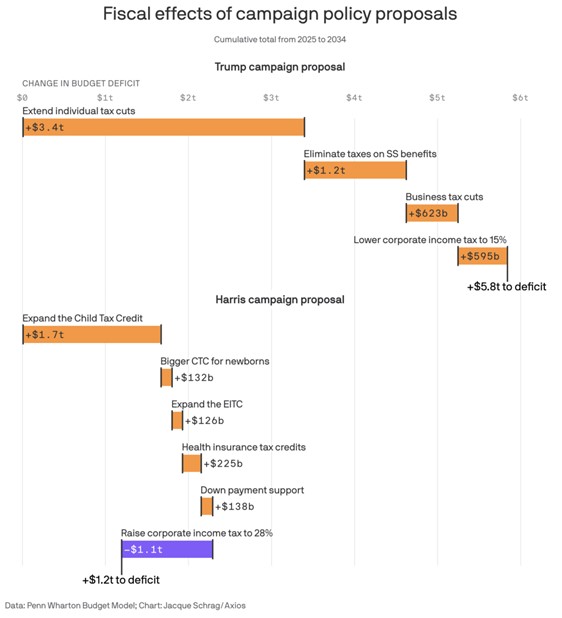

Felix Salmon at Axios laid out details of the fiscal impacts of proposals by the Trump and Harris campaigns. If you’re fiscally conservative and concerned about the national debt, you will not find comfort here:

Much of the Tax Cuts and Jobs Act is set to expire after 2025. Trump wants to extend the tax cuts from that legislation and then add a host of additional tax cuts. Harris is advocating for a large expansion of the child tax credit, as well as some smaller credits for employment, health insurance, and home purchases. Her corporate tax increase does blunt the deficit impact of her other proposed policies, but if she wants to retain some aspects of the Tax Cuts and Jobs Act, that will cost even more.

While the Presidential election is a tossup, prediction markets currently give a significantly greater chance of a Republican sweep of the Presidency and Congress (34%), as compared to a Democratic sweep (22%), so we would assess that some version of the Trump plan has a greater chance of becoming law. But even if the election yields split control of government, given that neither party is prioritizing deficit reduction, we would guess some sort of compromise legislation would be passed in 2025, with an amalgam of Trump and Harris priorities.

As Josh Barro pointed out, both parties have motivated reasoning for ignoring deficit concerns. For Democrats, lowering deficits means giving up on passing extensive spending programs. For Republicans, lowering deficits means giving up on large tax cuts. Barro also asked when higher interest rates would make voters care about deficits again, but from their policy proposals, it appears that both parties have decided that voters’ answer to that question lies between ‘later’ and ‘never’.

JMS Capital Group Wealth Services LLC

417 Thorn Street, Suite 300 | Sewickley, PA | 15143 | 412‐415‐1177 | jmscapitalgroup.com

An SEC‐registered investment advisor.

This material is not intended as an offer or solicitation for the purchase or sale of any financial instrument or investment strategy. This material has been prepared for informational purposes only, and is not intended to be or interpreted as a recommendation. Any forecasts contained herein are for illustrative purposes only and are not to be relied upon as advice.

‹ Back