By using our website, you agree to the use of cookies as described in our Cookie Policy

Blog

Mid-Year Review

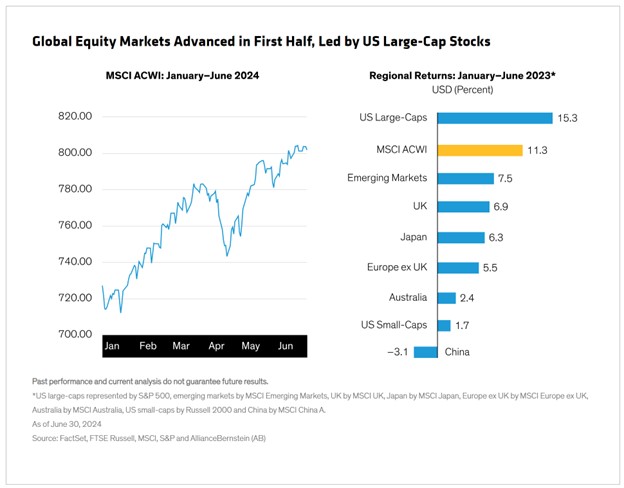

Nelson Yu at AllianceBerstein looks back at equity performance for the first half of 2024 and gives his outlook going forward. Equities have done well so far this year, led by US large caps:

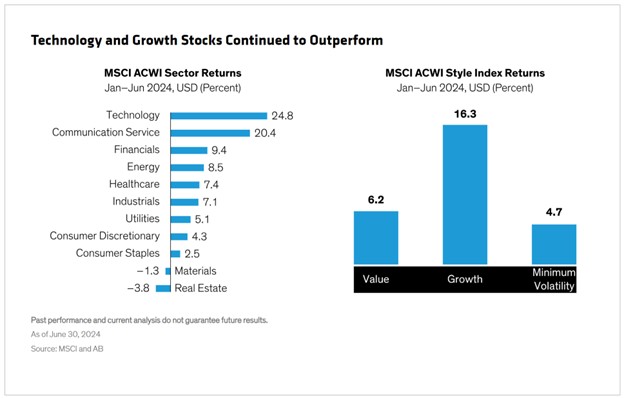

In terms of sectors and style, technology/communications growth stocks have continued to set a torrid pace:

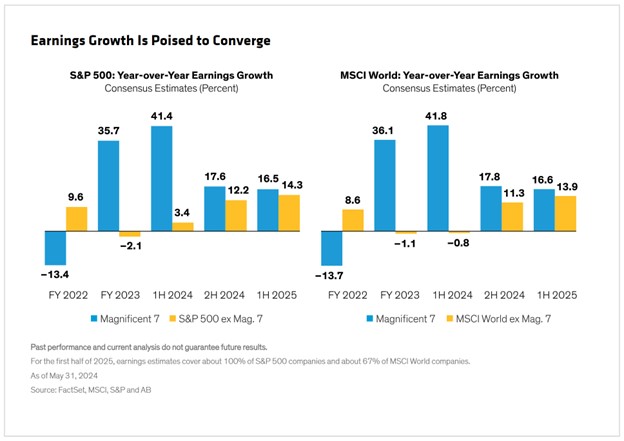

Yu notes that market concentration in the S&P 500 is particularly high, with the top 10 stocks now comprising more than 35% of the index’s market capitalization. However, Yu suggests that the bull market may be ready to extend its reach beyond the Magnificent Seven of Alphabet, Apple, Amazon, Meta, Microsoft, Nvidia, and Tesla, and provides a chart showing expectations for the earnings gap between these seven stocks and the rest of broader markets to narrow considerably:

While we don’t expect tech stock dominance to continue forever, and would expect to see mean reversion over time, it’s impossible to predict exactly when and how such a cooldown will occur (along with when and how other areas of equities markets will catch up). The above chart splits the difference somewhat, expecting relatively better performance from the Magnificent 7, but by a margin that steadily shrinks over the next 18 months. While the rest of the S&P 500 may be poised to outpace the megacap stocks over the longer term, we would not rule out the possibility of a continued tech surge, or a reversal of fortune, as occurred in 2022.

JMS Capital Group Wealth Services LLC

417 Thorn Street, Suite 300 | Sewickley, PA | 15143 | 412‐415‐1177 | jmscapitalgroup.com

An SEC‐registered investment advisor.

This material is not intended as an offer or solicitation for the purchase or sale of any financial instrument or investment strategy. This material has been prepared for informational purposes only, and is not intended to be or interpreted as a recommendation. Any forecasts contained herein are for illustrative purposes only and are not to be relied upon as advice.

‹ Back