By using our website, you agree to the use of cookies as described in our Cookie Policy

Blog

Market Concentration

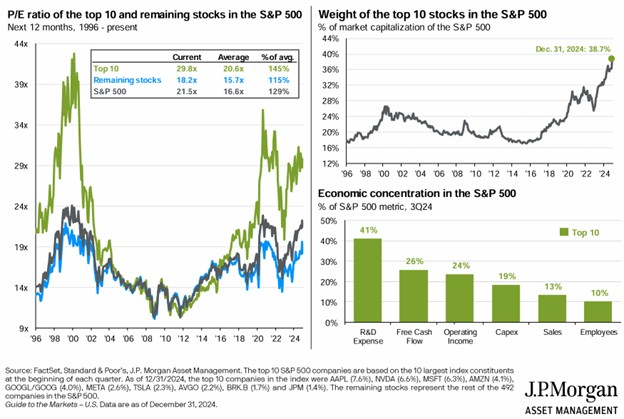

The outsized performance of the Magnificent 7 stocks—Alphabet (Google), Amazon, Apple, Meta, Microsoft, Nvidia, and Tesla—has rendered the S&P 500 top heavy. One way to visualize this fact is to look at a JPMorgan chart on S&P concentration (which focuses on the top 10 stocks):

The market cap of the top 10 stocks comprises almost 40% of the market cap of the S&P 500 as a whole. This level of concentration is far above anything we’ve seen in the past 30 years.

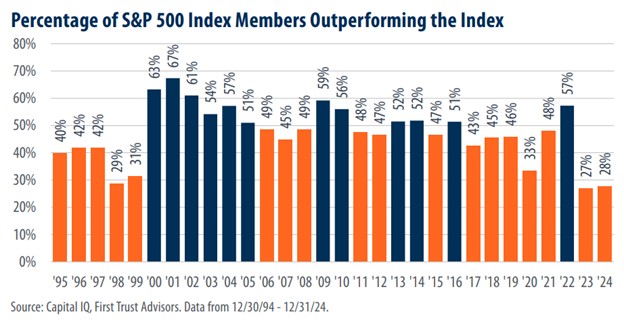

Another way to look at the S&P 500 is through comparative performance. If the bulk of the S&P 500’s price gains are derived from the top 7 stocks, as was true in 2023 and 2024, it almost axiomatically follows that much of the remaining 493 stocks will have relatively subpar returns. And indeed, as this chart from First Trust shows, we are in uncharted territory:

For the first time since 1998, less than 30% of S&P 500 members outperformed the index in 2023, and this event recurred in 2024. Indeed, the dot com runup of 1998-2000 is a cautionary tale, as the bursting of the tech bubble resulted in the S&P 500 plummeting nearly 50% from August 2000 to September 2002. Over the longer term, history would suggest that megacap outperformance will subside; hopefully such an event would occur from a broadening rally rather than a sharp correction for tech stocks.

JMS Capital Group Wealth Services LLC

417 Thorn Street, Suite 300 | Sewickley, PA | 15143 | 412‐415‐1177 | jmscapitalgroup.com

An SEC‐registered investment advisor.

This material is not intended as an offer or solicitation for the purchase or sale of any financial instrument or investment strategy. This material has been prepared for informational purposes only, and is not intended to be or interpreted as a recommendation. Any forecasts contained herein are for illustrative purposes only and are not to be relied upon as advice.

‹ Back