By using our website, you agree to the use of cookies as described in our Cookie Policy

Blog

Inflation Update

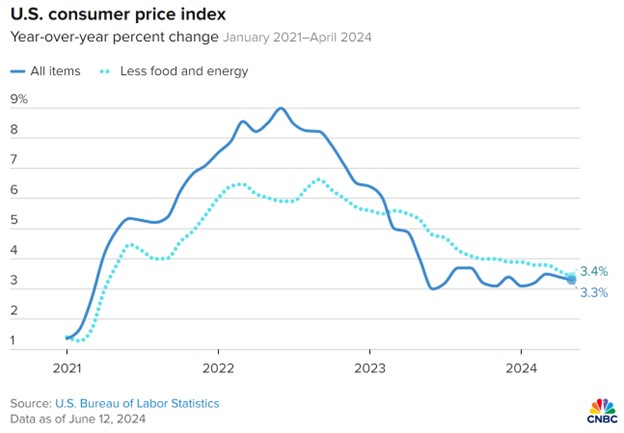

The fight against inflation has been mired in a stalemate for the past few months, but May’s inflation report finally brought some good news. The consumer price index (CPI) was flat in May, while core inflation, which excludes more volatile food and energy prices, rose 0.2%. Each of these numbers was 0.1% below expectations, so the data was a positive surprise. Jeff Cox at CNBC also provides this historical perspective of the CPI:

We’re clearly past peak inflation, but core inflation has shown limited movement over recent months, and at 3.4% is still well above the Fed’s 2% target. Unsurprisingly, while the Fed noted modest progress against inflation, it left the federal funds rate unchanged in June.

Fed projections were also updated last week, with the median Federal Open Market Committee (FOMC) participant expecting just 1 25bp rate cut in 2024, but 100bp of rate cuts in 2025. Markets are slightly more optimistic, anticipating a 25bp rate cut in September and another by year’s end. Long-term interest rates have also fallen over the past week, with the 10-year and 30-year rates each down about 10-15bp.

The Fed likely needs to see more good data before embarking on a rate reduction path. Last week’s inflation report was promising, as it represents a good first step. Fed projections are for 2.8% core inflation for 2024 as a whole; to hit that mark, inflation over the second half of the year would need to be about 2.4% annualized, or 0.2% per month. If that target is met, the Fed could be well positioned to engage in more aggressive rate cutting in 2025.

JMS Capital Group Wealth Services LLC

417 Thorn Street, Suite 300 | Sewickley, PA | 15143 | 412‐415‐1177 | jmscapitalgroup.com

An SEC‐registered investment advisor.

This material is not intended as an offer or solicitation for the purchase or sale of any financial instrument or investment strategy. This material has been prepared for informational purposes only, and is not intended to be or interpreted as a recommendation. Any forecasts contained herein are for illustrative purposes only and are not to be relied upon as advice.

‹ Back