By using our website, you agree to the use of cookies as described in our Cookie Policy

Blog

Inflation and the Money Stock

The combination of dovish monetary policy and stimulative fiscal policy has given rise to inflation fears. The path of inflation is going to be challenging to interpret, as most economists have been expecting at least a temporary surge in inflation during 2021, so the key question will be whether the inflation we’re seeing now will dissipate over time, or will lead to the more stubborn problem of higher inflation expectations.

One factor that’s been overemphasized, however, is the rise in the money stock. The money stock inflation story argues that the government revs up the money printer, everyone has more cash to spend, more cash spending pushes prices up, the government compensates by printing even more money, and we repeat the Weimar hyperinflation of the 1920s.

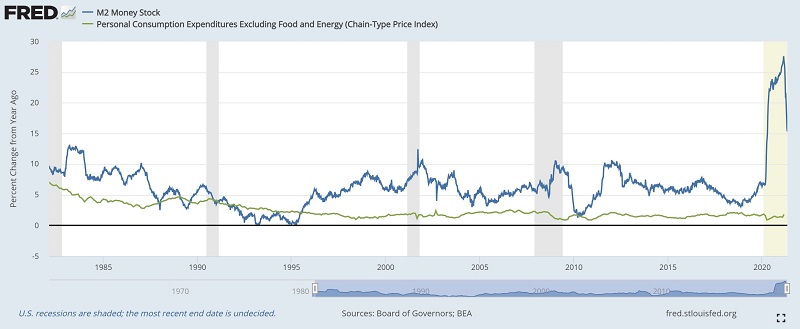

This story makes some intuitive sense, but in practice hasn’t reflected reality:

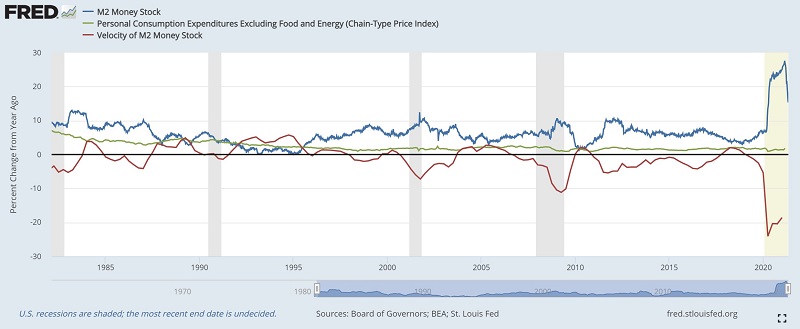

The money stock has fluctuated considerably over the past 40 years; core inflation has not moved in tandem whatsoever. A reason for the lack of correlation can be seen by adding a third line to the above graph:

Increases in the money stock have usually been counterbalanced by a decrease in money velocity. In other words, money stock increases have not been leading to an upswing in consumer activity that could then spark an inflation outburst.

Economist Paul Krugman’s recent analysis at https://twitter.com/paulkrugman/status/1395097769862381572 appears reasonable--since the pandemic began households placed $2 trillion in banks, banks placed that money at the Fed, and the Fed bought $2 trillion in government debt to pay for the household aid packages. The money stock increased by $2 trillion due to the bank deposits, and the Fed provided liquidity to skittish markets, but nothing happened to instigate inflation.

The Fed is currently conducting an ongoing experiment to see how much more unemployment can be reduced without pushing inflation consistently above its 2% goal. Fed Chair Jerome Powell believes the current inflation uptick will prove transitory. Time will tell whether Powell’s view is correct. However, if Powell is wrong, and inflation persists at an undesirable level, it will likely not be derived from a money stock issue.

###

JMS Capital Group Wealth Services LLC

417 Thorn Street, Suite 300 | Sewickley, PA | 15143 | 412‐415‐1177 | jmscapitalgroup.com

An SEC‐registered investment advisor.

This material is not intended as an offer or solicitation for the purchase or sale of any financial instrument or investment strategy. This material has been prepared for informational purposes only, and is not intended to be or interpreted as a recommendation. Any forecasts contained herein are for illustrative purposes only and are not to be relied upon as advice.

‹ Back