By using our website, you agree to the use of cookies as described in our Cookie Policy

Blog

Headlines

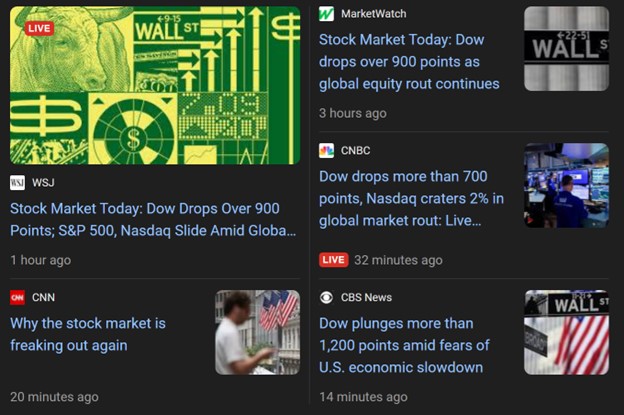

Markets have had a rough week. The S&P 500 lost 3% on Monday, and was down nearly 7% over the past week. Is it time to panic? The news media, or at least headline writers, appear to think so:

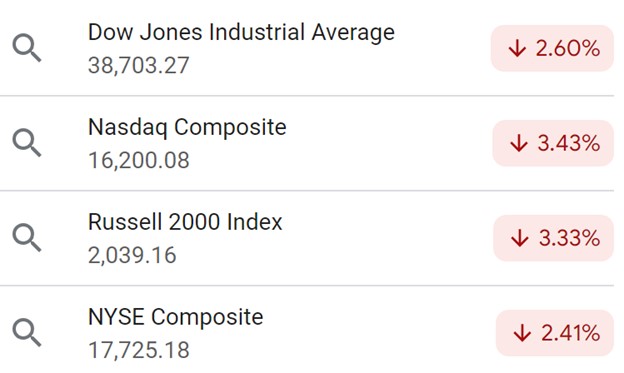

As of about noon on Monday, the news was that the Nasdaq craters, the global equity rout continues, and the stock market is freaking out again. Granted, there was an extraordinary spike in volatility, as the VIX leapt from 23 to 65 before ending the day at 38—a high number, but a level we’ve seen many times before. But a 3% drop in the S&P 500, while the worst daily drop in 2 years, isn’t a massive concern in and of itself, nor is a 7% drop over the past week. The S&P 500 isn’t an outlier, either, as other equities markets also fell similar percentages on Monday:

The Nasdaq and small caps fell about 3.4% each; the global 1200 index also dropped 3.3% today. These indices are down 5%-9% over the past week as well. There is a significant chance that we’ll enter 10% correction territory soon.

But 10% corrections, as Ben Carlson discussed back in 2022, are a fairly common occurrence. From 1950-2021 the S&P 500 has undergone a 10% correction about once every 2 years, and a bear market (20% loss) about once every seven years. Nasdaq and Russell 2000 indices only go back to the 1970s, but those indices also have witnessed a correction about once every 2 years, and a bear market about once every 4 years.

Could we be on the brink of a correction, or even a bear market? Sure. There are legitimate reasons to be concerned that equities got over their skis, from high valuations to recession worries. But more often than not, markets recover from their bad periods, and even with the S&P’s rough week, it’s still up over 9% for the year. Scary headlines may be good clickbait, but they are not typically a good guide to reality

JMS Capital Group Wealth Services LLC

417 Thorn Street, Suite 300 | Sewickley, PA | 15143 | 412‐415‐1177 | jmscapitalgroup.com

An SEC‐registered investment advisor.

This material is not intended as an offer or solicitation for the purchase or sale of any financial instrument or investment strategy. This material has been prepared for informational purposes only, and is not intended to be or interpreted as a recommendation. Any forecasts contained herein are for illustrative purposes only and are not to be relied upon as advice.

‹ Back