By using our website, you agree to the use of cookies as described in our Cookie Policy

Blog

Fed Edits

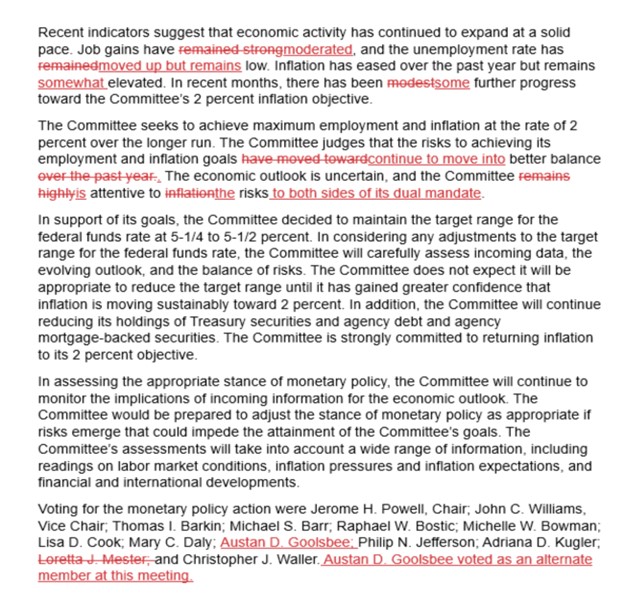

CNBC’s Alex Harring has a terrific article highlighting the difference between the Federal Open Market Committee statement in July and its previous statement in June.

Black text is in both statements. Red text represents change—text in red with a line through it was removed from the June statement, and text in red and underlined was new in the July statement.

Source: CNBC

Source: CNBC

The clear change is a relatively greater focus on the labor market, and less focus on inflation. Inflation is still above target, but has shown improvement. Unemployment is still low, but rising, and the job market has cooled somewhat. All in all, instead of a heavy focus on inflation, there’s more of a balance of risks in reaching employment and inflation targets.

There’s not a guarantee of a September rate cut; the statement indicates that the Fed wants to have greater confidence in disinflation progress before initiating such an action. Still, Fed chair Jerome Powell acknowledged that a September cut could be on the table if inflation continues to cool. As of this writing, though, markets are highly confident that monetary policy will turn dovish in September; CME Fedwatch estimates from futures contracts a 100% chance of a September cut—a 71.5% chance of a 25bp rate reduction, and a 28.5% chance of a 50bp rate reduction.

JMS Capital Group Wealth Services LLC

417 Thorn Street, Suite 300 | Sewickley, PA | 15143 | 412‐415‐1177 | jmscapitalgroup.com

An SEC‐registered investment advisor.

This material is not intended as an offer or solicitation for the purchase or sale of any financial instrument or investment strategy. This material has been prepared for informational purposes only, and is not intended to be or interpreted as a recommendation. Any forecasts contained herein are for illustrative purposes only and are not to be relied upon as advice.

‹ Back