By using our website, you agree to the use of cookies as described in our Cookie Policy

Blog

Fed Cuts

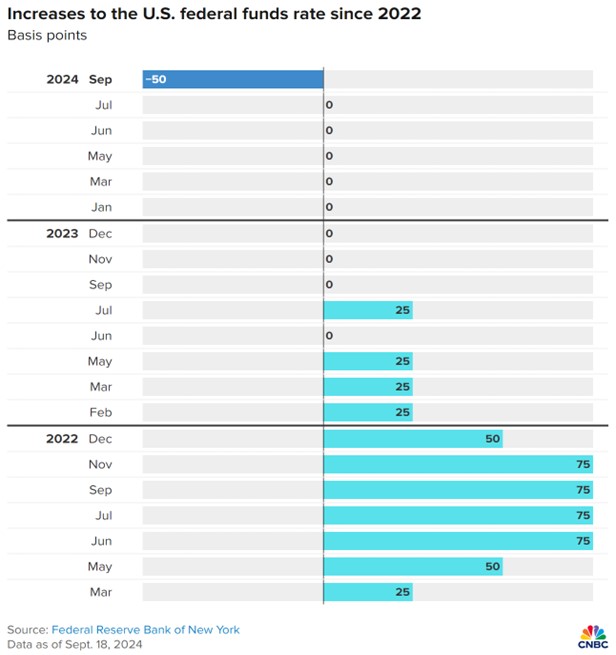

As anticipated, the Federal Reserve cut the federal funds rate in September. The big question was whether the Fed would make a 25bp or a 50bp cut and, with markets viewing each of those outcomes as equally likely, the Fed opted for the larger rate reduction. CNBC’s Jeff Cox provided a recent history of Fed rate movements:

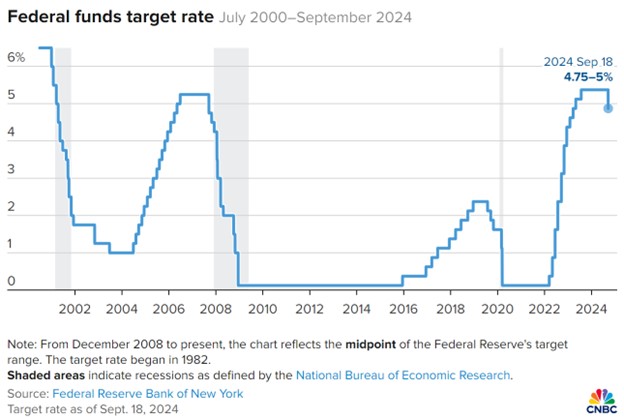

Cox also gave a broader historical perspective of the federal funds rate:

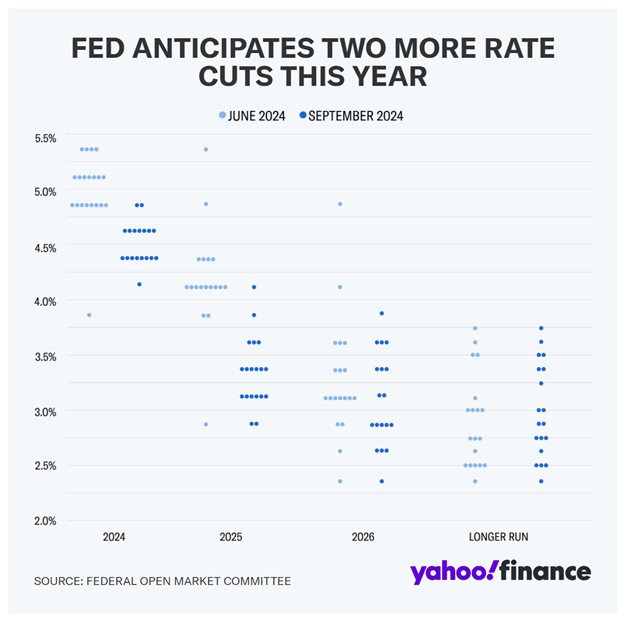

It’s noteworthy that in 2001 and 2008, rate cuts by the Fed were followed by recessions. At a press conference on Wednesday, Fed Chair Jerome Powell stated that “I think you can take this as a sign of our commitment not to get behind.” Still, even though the 50bp initial reduction represented an aggressive kickstart, Powell cautioned against assuming that “this is the new pace.” The Fed’s September projections, as conveyed by the dot plot, has the median FOMC member expecting only an additional 50bp in rate cuts through the rest of 2024:

Still, in anticipation of falling rates, long-term interest rates have declined over the past several months. Mortgage rates have also fallen significantly—the standard, 30-year fixed-rate mortgage average slid to 6.09% this past week, which is well off the two-decade high of 7.79% reached last fall. As rates normalize, time will tell whether the Fed can finish the “soft landing” of cooling inflation to its 2% target without provoking a recession.

JMS Capital Group Wealth Services LLC

417 Thorn Street, Suite 300 | Sewickley, PA | 15143 | 412‐415‐1177 | jmscapitalgroup.com

An SEC‐registered investment advisor.

This material is not intended as an offer or solicitation for the purchase or sale of any financial instrument or investment strategy. This material has been prepared for informational purposes only, and is not intended to be or interpreted as a recommendation. Any forecasts contained herein are for illustrative purposes only and are not to be relied upon as advice.

‹ Back