By using our website, you agree to the use of cookies as described in our Cookie Policy

Blog

Fed – Constraints and Independence

Josh Barro notes that while Donald Trump has argued for greater presidential influence on monetary policy, his ability to transform the Fed and policy in accordance with his wishes is likely to be significantly constrained. Scott Bessent, a top Trump economic advisor, suggested that even before Fed Chair Jerome Powell’s term ends in 2026, Trump could create a “shadow” Fed Chair by having the Senate confirm Powell’s replacement in the spring of 2025. Since forward guidance affects interest rates, the future Fed Chair would have influence simply by indicating his intentions for 2026 and beyond.

However, as Barro observes, the Federal Open Market Committee that sets Fed policy consists of 12 members, including 5 whose terms extend beyond the next Presidential administration, and 4 regional Fed bank heads, whose appointments are outside the President’s control. Forward guidance that conflicts with current Fed consensus may yield more uncertainty than interest rate changes.

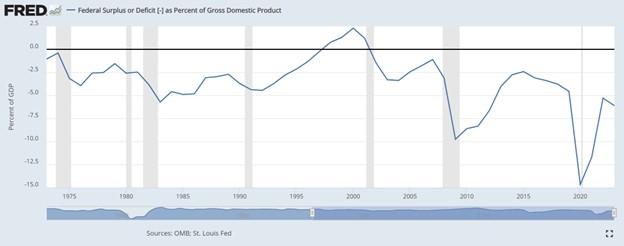

But Barro argues that even if Trump succeeds in aligning the Fed with his vision (which Barro believes is lower interest rates), there remains an additional problem—the Federal Deficit:

The U.S has typically reduced deficits over time after recovering from recessions. But President Trump increased the deficit (as a percentage of GDP) even before the pandemic, and President Biden has maintained a high deficit even after the COVID recession ended. Barro believes that if Trump succeeds in implementing more fiscal stimulus (via tax cuts) and loosening monetary policy, he risks bringing back the inflation spike that has infuriated so many people during the past four years. The bottom line is that the economy isn’t the same as it was five years ago, and there’s less runway for either Donald Trump or Kamala Harris to implement expansionary policy.

JMS Capital Group Wealth Services LLC

417 Thorn Street, Suite 300 | Sewickley, PA | 15143 | 412‐415‐1177 | jmscapitalgroup.com

An SEC‐registered investment advisor.

This material is not intended as an offer or solicitation for the purchase or sale of any financial instrument or investment strategy. This material has been prepared for informational purposes only, and is not intended to be or interpreted as a recommendation. Any forecasts contained herein are for illustrative purposes only and are not to be relied upon as advice.

‹ Back