By using our website, you agree to the use of cookies as described in our Cookie Policy

Blog

Expectations For 2024

Joseph Politano reviewed outlooks for 2024, and found that not only have economic expectations improved over the past year (which is not surprising, given how well the US economy held up in 2023), but also that uncertainty about the economy appears to be diminishing in a variety of areas. As such 2024 may mark a renormalization of the economy, and the end of the COVID-disrupted economic era marked by lockdowns, supply chain snarls, inflation, and strong monetary response to that inflation.

Source: Joseph Politano (Apricitas Economics), Federal Reserve

Source: Joseph Politano (Apricitas Economics), Federal Reserve

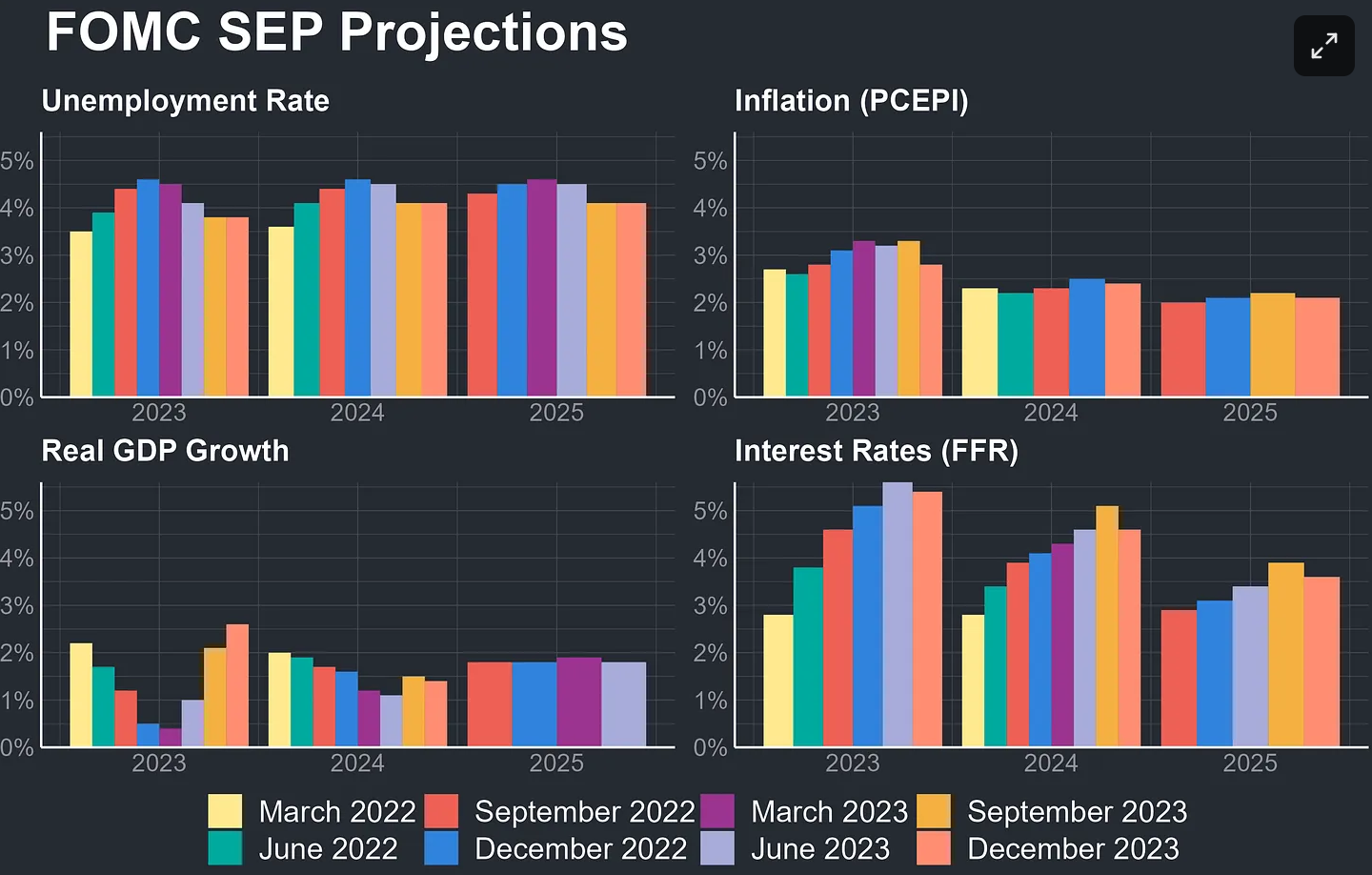

As more data came in last year, the Fed (Federal Open Market Committee) became more optimistic about GDP growth for 2023. Overall, forecasts for 2024 and 2025 show that the Fed expects inflation to near the 2% target, unemployment to remain around 4%, growth to slow but remain positive, and the federal funds rate to be cut several times in 2024 and 2025.

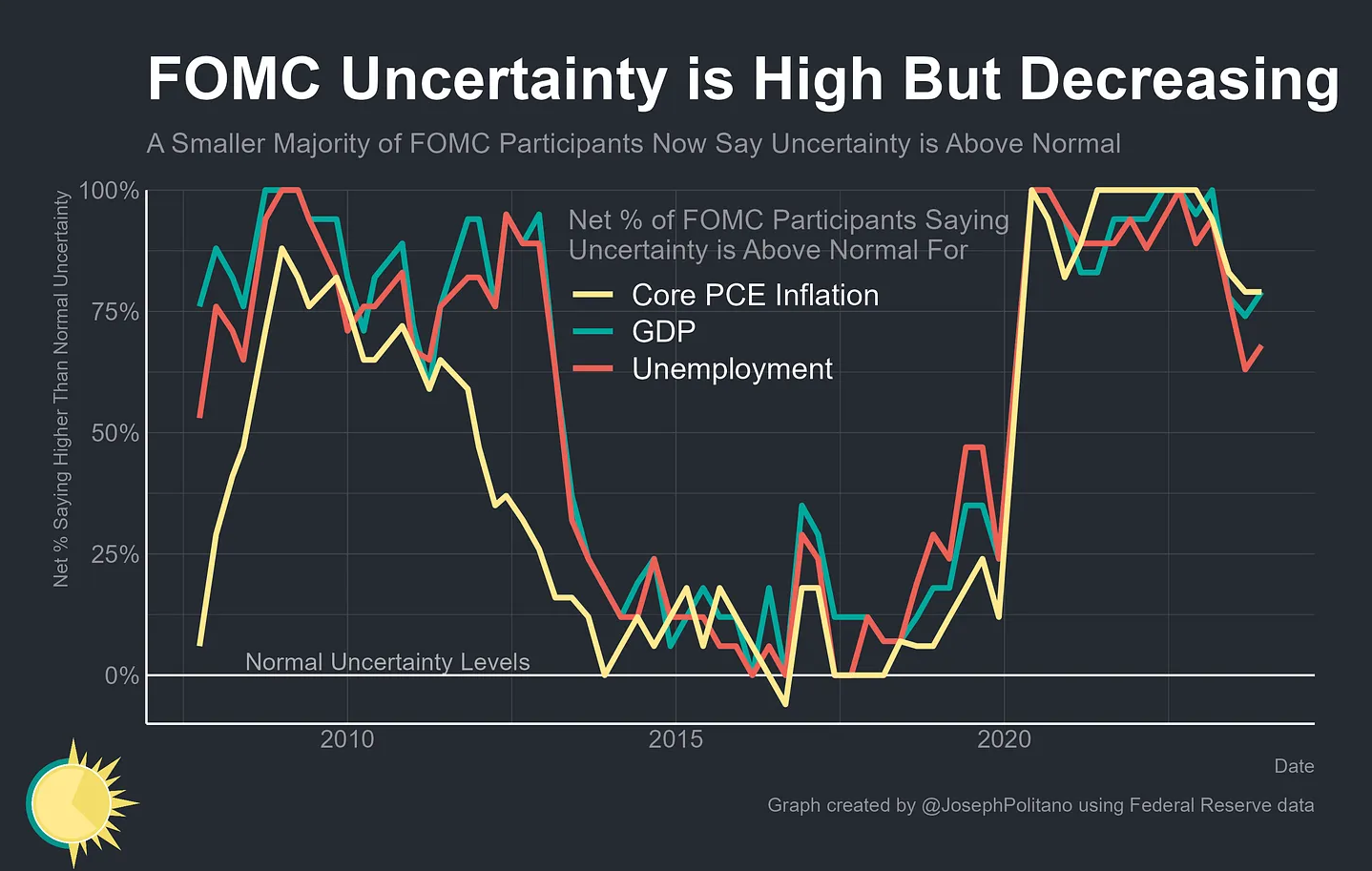

While forecasts should always be taken with a heavy dose of salt, Politano points out through a series of charts that uncertainty has been declining in a variety of economic surveys. For instance, Fed uncertainty, while elevated, has fallen:

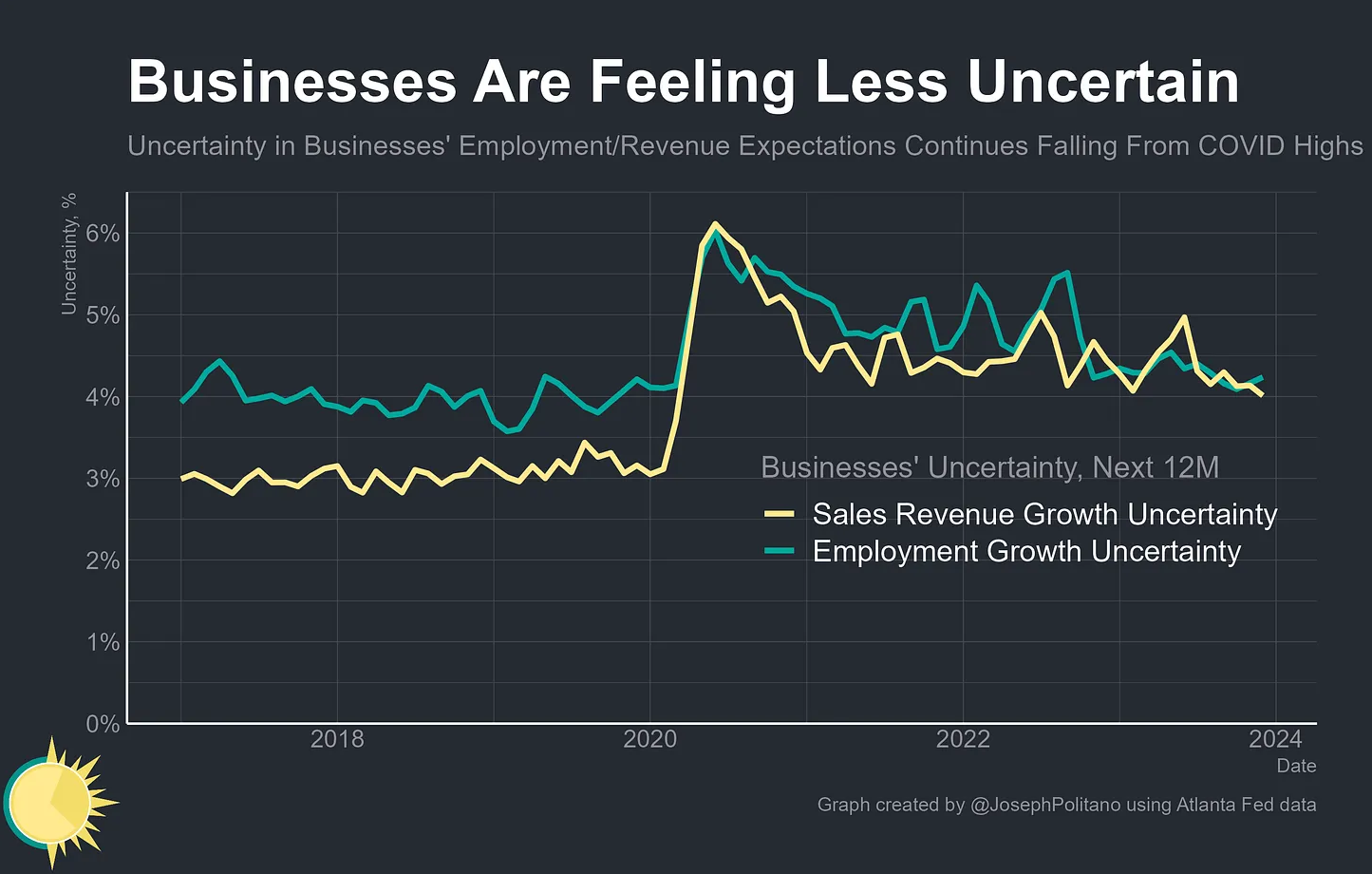

Business uncertainty has dipped as well:

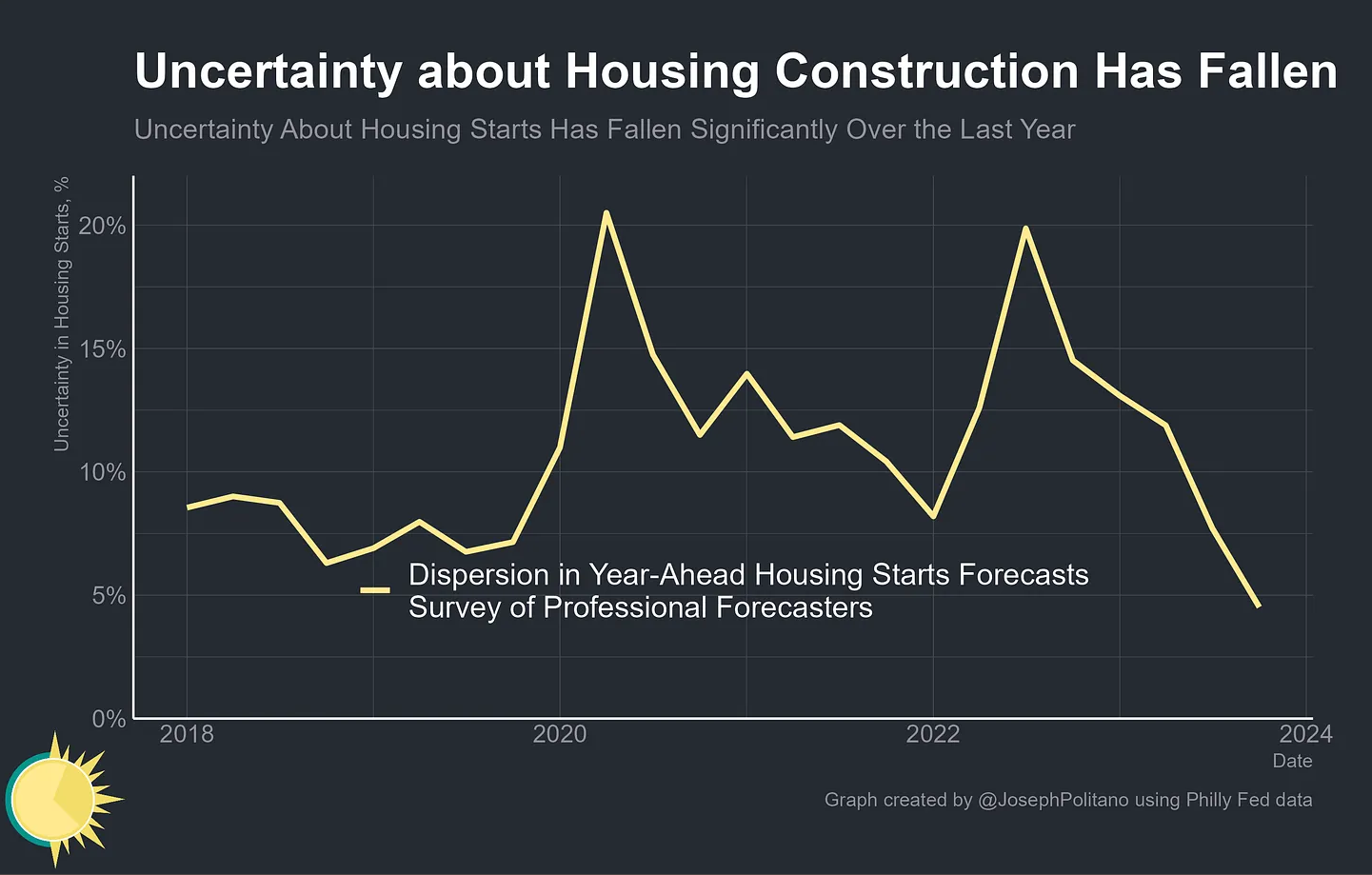

Uncertainty about housing starts has also tumbled:

The decline in uncertainty suggests an increased comfort level in assessing what the economic environment will look like going forward. The turbulence of the last few years may finally be settling down. Politano suggests that the Fed may feel it has enough of a grip on the economy to ease up on the inflation fight and to reorient towards normalizing monetary policy. After the past few years, a return to normalcy may be welcome news.

###

JMS Capital Group Wealth Services LLC

417 Thorn Street, Suite 300 | Sewickley, PA | 15143 | 412‐415‐1177 | jmscapitalgroup.com

An SEC‐registered investment advisor.

This material is not intended as an offer or solicitation for the purchase or sale of any financial instrument or investment strategy. This material has been prepared for informational purposes only, and is not intended to be or interpreted as a recommendation. Any forecasts contained herein are for illustrative purposes only and are not to be relied upon as advice.

‹ Back