By using our website, you agree to the use of cookies as described in our Cookie Policy

Blog

Diversifying with Emerging Markets

The stunning recovery of US and global markets has been generally excellent for portfolios, but leaves a challenge going forward—how to continue to generate positive returns with so many asset prices already well above historical norms. Emerging markets could be a piece of this puzzle.

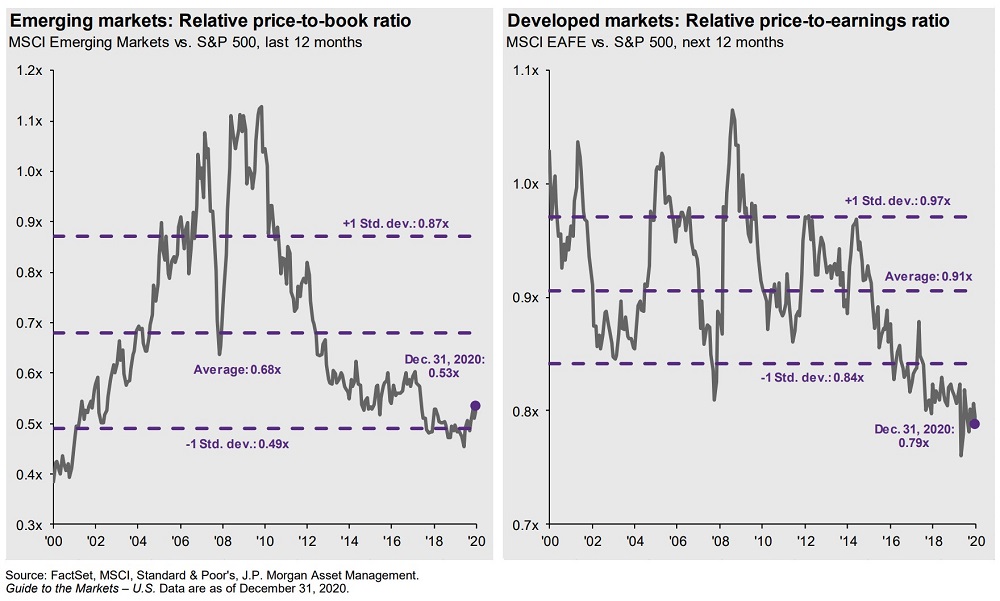

The appeal of emerging markets is twofold. First, Emerging Markets have relatively attractive valuations when compared to the US:

(We’ll note as well that international markets also have appealing valuations as well—it’s a tribute to how much the US bull market has stampeded for the last 5 years.) Second, global interest rates are incredibly low, and with accommodative monetary policy across the world, there is a good chance that rates will remain low for quite some time. If the risk/return profile of domestic stocks and global bonds is not ideal, it may make sense to explore investment opportunities elsewhere.

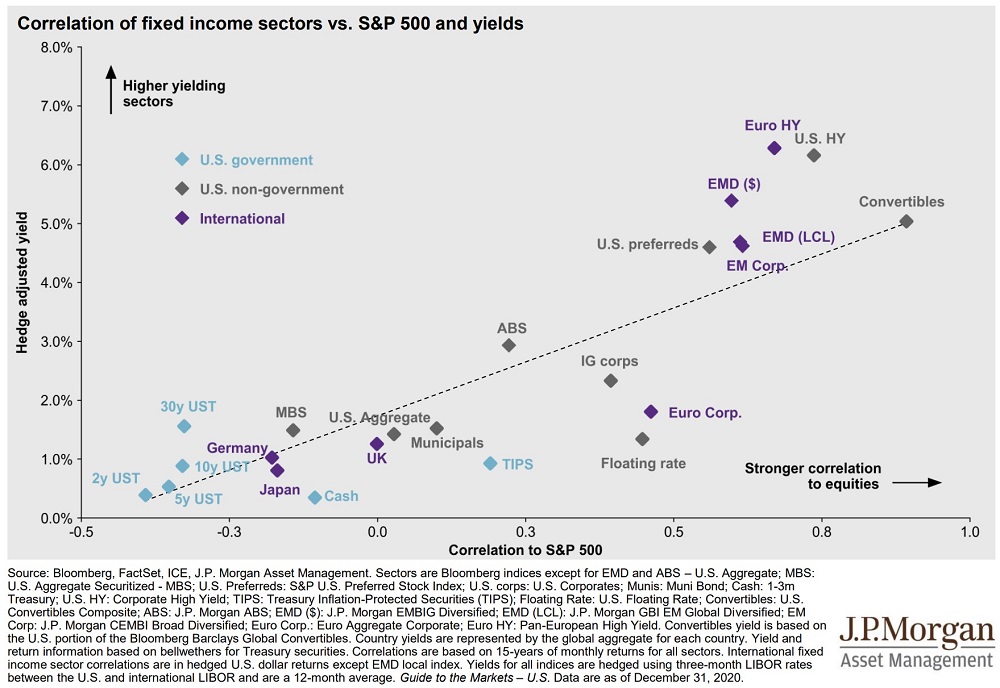

In addition to EM stocks, EM bonds hold the appeal of higher yields. Both the promise, and the peril, of EM bonds are depicted in this excellent JPMorgan chart:

You can see Emerging Market Debt (local and dollar denominated) as denoted by EMD in the upper right part of the graph. The good news: relatively high yields. The bad news: stronger correlation to the S&P 500 than most other fixed income sectors. We have some optimism with respect to EM markets—the unprecedentedly dovish global monetary and fiscal policy from the past year, along with the dollar’s potential weakening due to widening budget and trade deficits—could prove especially beneficial to emerging economies. However, the potential higher returns come with higher risk, and a downturn in US stocks will likely hit EM stocks and bonds hard as well. That’s as it should be—there are few free lunches in the investing world—but we believe that Emerging Markets can play a useful role in a well balanced portfolio.

JMS Capital Group Wealth Services LLC

417 Thorn Street, Suite 300 | Sewickley, PA | 15143 | 412‐415‐1177 | jmscapitalgroup.com

An SEC‐registered investment advisor.

This material is not intended as an offer or solicitation for the purchase or sale of any financial instrument or investment strategy. This material has been prepared for informational purposes only, and is not intended to be or interpreted as a recommendation. Any forecasts contained herein are for illustrative purposes only and are not to be relied upon as advice.

‹ Back