By using our website, you agree to the use of cookies as described in our Cookie Policy

Blog

Cooling Inflation

Hopefully 2024 marks the end of the inflationary surge begun 3 years ago; the good news is that much disinflation has already occurred, and inflation has continued to trend downward. Here’s some perspective—a core inflation table:

Source: Ycharts

Source: Ycharts

The past 15 months have seen a steady drop in the year-over-year core inflation rate from 6.63% to 3.93%. This number is likely to drop further in 2024, in large part because older observations from 13 months ago (with higher inflation) will be replaced by newer observations from the past month (with lower inflation). While currently still above the 2% target, the Fed expects core inflation to fall to 2.4% in 2024, even as it anticipates cutting the federal funds rate by 50bp-100bp during the year.

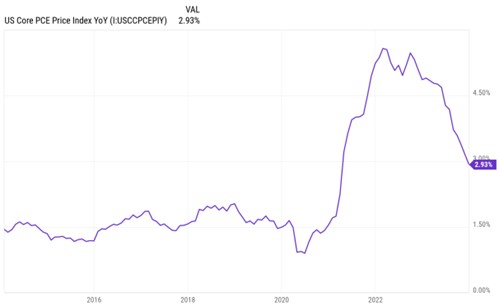

Another measure of inflation shows even further progress. The core personal consumption expenditures price index was up only 2.9% in December year-over-year. It, too, has fallen significantly from its 2022 peak:

Source: Ycharts

Source: Ycharts

The fight against inflation may not be over yet, but much progress has been made, with modest macroeconomic fallout at this point. Circumstances could change, and the Fed is cautious about suggesting when it could begin cutting rates, but the fact that the Fed and markets are both forecasting significant declines in the federal funds rate this year indicates that the taming of inflation may be on the horizon in 2024.

###

JMS Capital Group Wealth Services LLC

417 Thorn Street, Suite 300 | Sewickley, PA | 15143 | 412‐415‐1177 | jmscapitalgroup.com

An SEC‐registered investment advisor.

This material is not intended as an offer or solicitation for the purchase or sale of any financial instrument or investment strategy. This material has been prepared for informational purposes only, and is not intended to be or interpreted as a recommendation. Any forecasts contained herein are for illustrative purposes only and are not to be relied upon as advice.

‹ Back