The Importance of Infrastructure

As the bipartisan infrastructure bill advances through the Senate, its fate still uncertain upon reaching the House of Representatives...

Read More

As the bipartisan infrastructure bill advances through the Senate, its fate still uncertain upon reaching the House of Representatives...

Read More

In an increasingly rare moment of bipartisan unity, a group of Republican and Democratic Senators, along with President Biden...

Read More

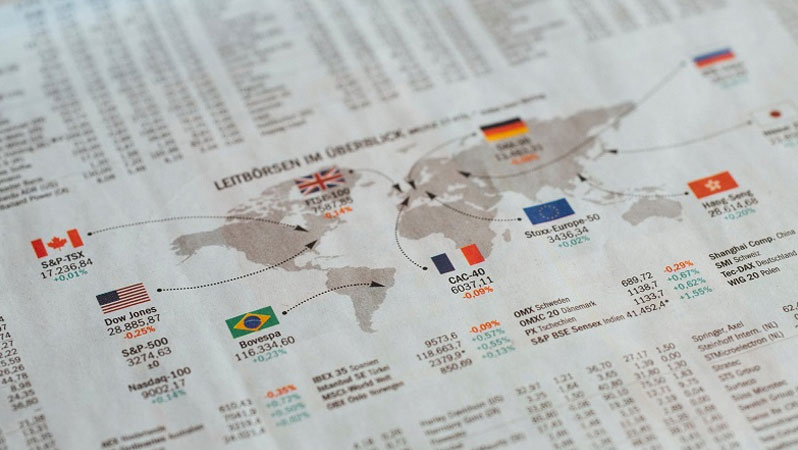

President Trump attracted a great deal of attention through his stance towards China, including his implementation of tariffs against numerous Chinese goods.

Read More

Second Quarter 2021 Key Takeaways, The second quarter of 2021 for equities marked a continuation of the remarkable recovery since the COVID downturn in early 2020.

Read MoreEarlier this month President Biden signed an executive order encompassing 72 actions and recommendations aimed at increasing competition and limiting anti-competitive practices

Read MoreLast week 130 countries agreed to a corporate tax framework with a minimum tax rate of 15%.

Read More

On Thursday, the White House reached a preliminary agreement with a bipartisan group of senators on infrastructure investments.

Read More

Lumber price surged this spring to record levels, spurring concerns about the Fed’s relative nonchalance towards inflation.

Read More

Biogen’s treatment for Alzheimer’s disease was unexpectedly approved last week by the FDA. The ruling was a surprise given that the FDA’s advisory had voted ...

Read More

The good news for electric vehicle manufacturers is that battery costs have been plummeting over time, and that the cost of electric vehicles may soon achieve parity with ...

Read More

Although it’s pulled back from its peak, Tesla’s stock has still risen more than tenfold in the past two years.

Read More

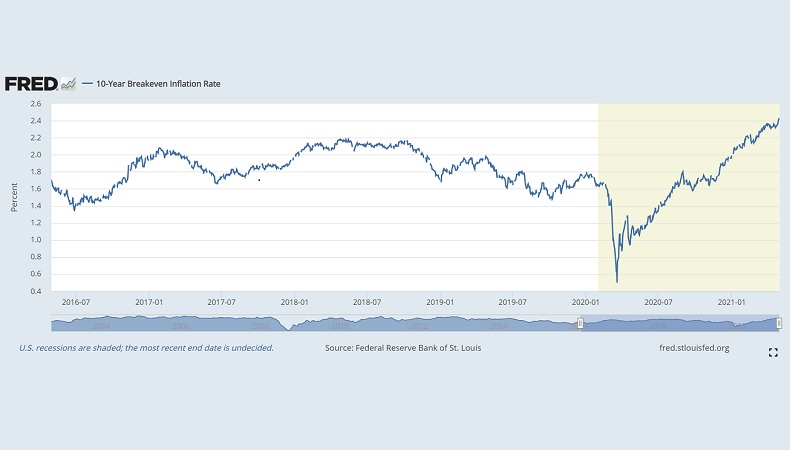

The combination of dovish monetary policy and stimulative fiscal policy has given rise to inflation fears.

Read More

Here’s the current 10-year breakeven inflation rate, which reflects market expectations of the average inflation rate over the next 10 years.

Read More

The jobs report released last Friday contained unexpectedly bad news. Normally a gain of 266,000 jobs would be a strong month...

Read More

Here’s the current 10-year breakeven inflation rate, which reflects market expectations of the average inflation rate over the next 10 years.

Read More

Where are Treasury bonds going? The direction of bond yields is influenced by investors’ expectations for economic growth, among other factors.

Read More

Investors didn’t stumble over inflation last week. Why not? Inflation – rising prices of goods and services – can be measured in a variety of ways.

Read More

The Biden Administration is seeking to enact a $2 trillion infrastructure plan, which then raises the question of how to finance this government spending.

Read More

The market’s recovery over the past year can be attributed in part to expectations that COVID would be largely suppressed and that the economy could then regain ...

Read More

Zoom, zoom, zoom. Big economies tend to recover from recessions about as quickly as semi-trucks accelerate from stop lights.

Read More

In recent years the Fed’s communication style has become increasingly direct...

Read More

Last week, unemployment claims were looking good and consumers were feeling good...

Read More

Last week we discussed optimistic economic growth forecasts for 2021, highlighted by a Goldman Sachs projection of 8% growth...

Read More

What are professional asset managers thinking? Bank of America recently published the results of its March global asset managers’ survey...

Read More

3,2,1 Takeoff! We may still be cooped up far more than we want to be, but if Goldman Sachs is right, the economy is ready to take off. As ...

Read More Comments

This weekend the Senate passed a $1.9 trillion COVID relief package. The House is expected to approve the bill later this week and send it on to President Biden ...

Read More Comments

Students of financial markets may have noted a historically unusual event last week.

Read More

After the yield curve flattened in 2020, with the US 10 year rate falling to under 0.6% and the 30 year rate briefly slipping to under 1%, we’ve started to see significant ...

Read More

It’s a contrarian’s dream come true. Contrarian investors like to buck the trend.

Read More

The Fed has long been known as a chief fighter of inflation, ever since Paul Volcker in the 1980s hiked interest rates sharply in an effort to bring ...

Read More

Way back, when radio disk jockeys played 45-rpm vinyl singles, the A-side of a disk was the song the record company was promoting and the other side.

Read More

The stunning recovery of US and global markets has been generally excellent for portfolios, but leaves a challenge going forward...

Read More

It’s not a black diamond ski run yet, but the yield curve for U.S. Treasuries is steeper than it has been in a while.

Read More

The Gamestop short squeeze has prompted discussion of short selling, in which an investor who believes a stock is overvalued borrows shares of that stock...

Read More

They say people watching the same event often see different things.

Read More

If a group of Redditors dislike hedge funds, dislike the idea of shorting a gaming company that has sentimental value for many...

Read More

The Biden Administration has proposed an additional $1.9 trillion in spending on a COVID relief package, and unsurprisingly, many Republicans ...

Read More

Last week, as COVID-19 vaccination efforts continued, there was speculation about stock market corrections and asset bubbles.

Read More

Investors were rocked by economic data showing the economy hit the brakes hard in December.

Read More

Bitcoin has been in the news quite a bit lately, both for its meteoric rise and its sharp selloffs.

Read More

The November 3rd election appeared to be a mixed bag for the Democratic Party.

Read More

Last week was the cherry on top of a turbulent year for investors.

Read More

We were going to close out what’s been a very interesting 2020 by discussing 2021 capital market forecasts.

Read More

We don’t expect to see much in the way of bipartisan legislation in the coming years, but perhaps Democrats and Republicans were imbued with the holiday spirit

Read More

Joe Biden is expected to nominate Janet Yellen for Treasury Secretary for his administration...

Read More

For many of us, Thanksgiving in 2020 was a more subdued affair, as rising caseloads of COVID-19...

Read More

The last time the United States elected a new president during a crisis, in 2008, the recovery was a painful and protracted one.

Read More

News broke a little over a week ago that preliminary results for Pfizer’s COVID-19 vaccine showed that the vaccine reduced symptomatic cases by 90%...

Read More

Despite all the turmoil in the world, led by COVID‐19, the US Presidential Election horserace has had a very consistent result for months: Joe Biden is clearly leading, ...

Read More

As mortgage rates hit a record low, many Americans are considering refinancing their homes.

Read More

In a recession, there are a lot of forces out of your control, including job loss and loss of income. Experts recommend doing the following during a recession ...

Read More

The U.S. stock market lost 34% in February and March, as the coronavirus pandemic’s effects hit the economy. While the market has recovered nearly all of its ...

Read More

As the financial strain on the families of college students worsen due to the coronavirus, several colleges and universities have announced that they will freeze tuition for the ...

Read More

Economists are debating what the economy’s recovery from the current recession will look like using letters of the alphabet. On a chart, the gross domestic product could ...

Read More

As difficult as the coronavirus crisis has been, both in terms of the cost of human life and comatose economies, we are taking a moment to note that ...

Read More

The new Coronavirus Relief law says that beneficiaries of inherited IRAs and 401(k)s do not have to take mandatory withdrawals in 2020.

Read MoreWhile the coronavirus has been blamed for much of the recent stock market volatility, there are other factors too.

Read More

We would like to provide a quick reminder that the IRS has extended tax filing and payment deadlines from April 15th to July 15th. The IRS has provided ...

Read More

S&P Global Analysts estimate that a severe coronavirus outbreak could cost US health insurers $90 billion in medical expenses, leading to losses for those insurers.

Read More

You shouldn’t make a withdrawal from your 401(k) or make rash decisions about your allocations during this economic downturn. However, you should check that your asset ...

Read More

Volatility has been on the rise in financial markets this year, and December seems to be unfolding as potentially the worst month of 2018 for stock market volatility.

Read More

The recurring drama of U.S.-China trade relations reached a temporary truce this weekend, albeit with the promise of additional acts to come in jU.S.t ...

Read More

Third Quarter 2018 Key Takeaways Larger-cap US stocks hit new highs in late September and gained 7.7% for the quarter, while smaller-cap US stocks gained 3.6%. S&P 500 operating earnings ...

Read More

Here’s a number that will knock your socks off: $400 trillion.1 By 2050, the retirement savings shortfall in eight of the world’s largest economies is expected to reach $400 ...

Read More

Investor demand for private investments continues to grow. According to Preqin, a global leader in alternative assets data, 921 private equity funds that closed during 2017 raised a total of $453 ...

Read More

Second Quarter 2018 Key Takeaways US stocks rose to the top of asset class performance charts with solid returns in the second quarter. Larger-cap US stocks gained 3.4%, but were ...

Read More

First Quarter 2018 Key Takeaways Volatility returned to the financial markets in the first quarter, for the first time in a while. Stocks surged out of the gates in ...

Read More

When President Trump announced he would be placing tariffs on steel and aluminum for national security purposes, there was great dismay among many economists. In terms of protecting ...

Read More

Here’s a million dollar question: How will you transform your savings into income that will last throughout your retirement?1 There are probably as many answers to that ...

Read More

The Republican tax legislation has just passed. The bill makes sweeping changes to the US tax code, beginning on January 1, 2018. This very brief period before implementation means that ...

Read More

How times change! In 1940, half of Americans finished their education in eighth grade. College degrees were relatively rare. Just 6 percent of men and 4 percent of women had one. 1 ...

Read More

If you want to retire with confidence, have a plan. “As you near retirement age or even within a decade or so, it is time to ...

Read More

The world’s first central bank offered unprecedented convenience. It gave 17th century Swedes the option to pay with paper notes rather than 40-pound copper plates, which were ...

Read More

How Do You Make Money in Stocks? Have you ever watched Family Feud? Perhaps you were a child when Richard Dawson hosted the game show or maybe ...

Read More

You may have heard of tax loss harvesting. Some people harvest losses every year, while others do so only when they have taken significant capital gains or have ...

Read More

At JMS Capital Group Wealth Services, many of our clients have multiple accounts. Our bulging file cabinets attest to this fact while making a mockery of the ...

Read More

With tax season in the rearview mirror, now is a good time to start thinking about how you can minimize future tax bills. Many people take advantage of ...

Read More

More than one‐half of working Americans know little or nothing about Medicare costs.1 Not knowing can be expensive. On average, people who haven’t ...

Read More

March 17, 2025

March 10, 2025

March 3, 2025

February 17, 2025

February 10, 2025

Advisory services offered through JMS Capital Group Wealth Services, LLC, a Registered Investment Advisor.

Business Continuity Plan • Privacy Policy • JMS Capital Group Wealth Services, LLC ADV Brochure • CRS Form

417 Thorn Street #300

Sewickley, PA 15143

By using our website, you agree to the use of cookies as described in our Cookie Policy