By using our website, you agree to the use of cookies as described in our Cookie Policy

Blog

Balancing Retirement Goals

In 1950, Americans who made it to the retirement age of 65 could expect on average to live another 14 years; by 2010 this number had risen to 19 years. An obvious implication of increased longevity is the corresponding need for increased retirement income. The question then becomes how to save and invest to ideally attain sufficient retirement income to comfortably live on, as well as retain growth potential to capture significant upside from bull markets.

A recent AllianceBernstein post has a nice summary of the various goals and retirement risks investors face, along with interesting survey results.

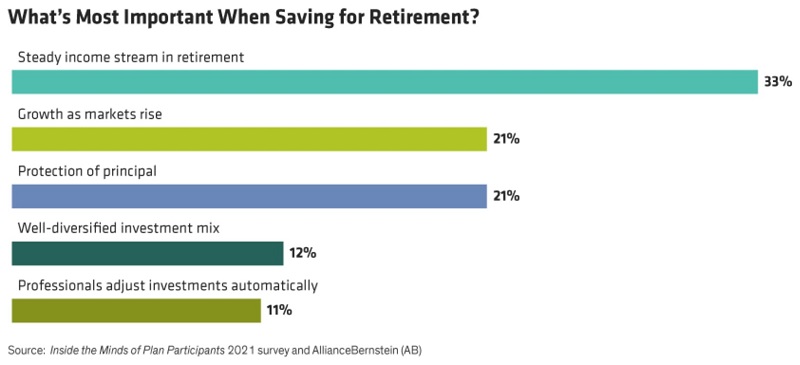

Retirement savings goals are mixed. While a plurality voted for a steady income stream as most important, significant shares of survey respondents chose aggressiveness (growth), defensiveness (protection), or a diversified mix as most critical.

If the only goal is a steady income stream in retirement, an annuity could be ideal. However, annuities may come with high mortality risk—if they are rigidly governed by life expectancy charts, then you “win” if you live longer than expected, but you would receive minimal annuity payments if you die at 67.

And although fixed income streams reduce the risks stemming from an equities downturn, they also come with inflation and interest rate risks. Inflation erodes the value of retirement income, while higher interest rates means that a fixed income stream can’t take advantage of these higher rates.

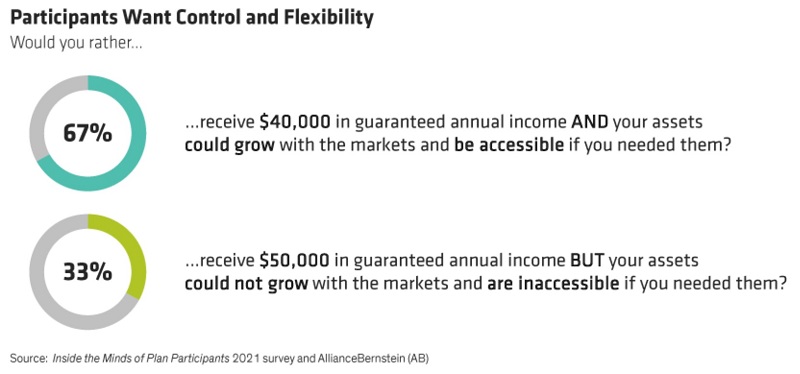

Moreover, fixed income streams are unlikely to capture the full benefits of a rising equities market, an important goal for many investors:

Two thirds of survey respondents would accept $10,000 less in guaranteed annual income in exchange for liquidity and growth potential.

So what’s the best retirement portfolio? It’s going to depend on individual financial situations, preferences, and risk tolerances. Investors understandably want steady income, growth potential, principal protection, and diversification without an excess of risk from mortality, interest rate increases, inflation, and market downturns. As much as we all want to have our cake and eat it too, no single portfolio can perfectly capture all upside while eliminating all downside; the “best” portfolio is likely to be one that is defined enough to have the best chance of achieving the investor’s goals while flexible enough to adapt to changing circumstances.

###

JMS Capital Group Wealth Services LLC

417 Thorn Street, Suite 300 | Sewickley, PA | 15143 | 412‐415‐1177 | jmscapitalgroup.com

An SEC‐registered investment advisor.

This material is not intended as an offer or solicitation for the purchase or sale of any financial instrument or investment strategy. This material has been prepared for informational purposes only, and is not intended to be or interpreted as a recommendation. Any forecasts contained herein are for illustrative purposes only and are not to be relied upon as advice.

‹ Back