By using our website, you agree to the use of cookies as described in our Cookie Policy

Blog

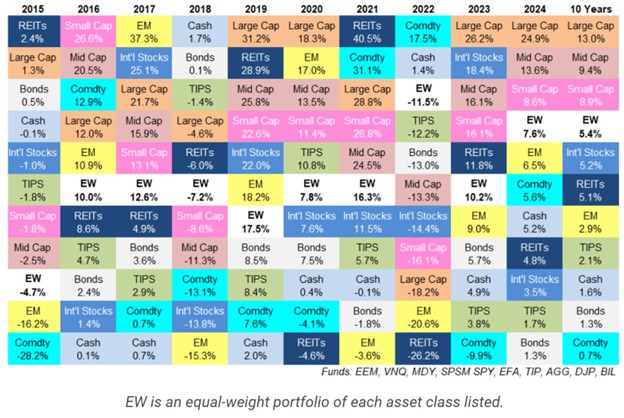

Asset Class Performance History

Ben Carlson reviews asset class performance over the past decade, via patchwork quilt:

Source: Ben Carlson

Source: Ben Carlson

It’s been an excellent decade for large caps, and a lousy one for bonds, which were hammered by inflation and the Fed’s rate hikes in 2022. Commodities have also fared poorly.

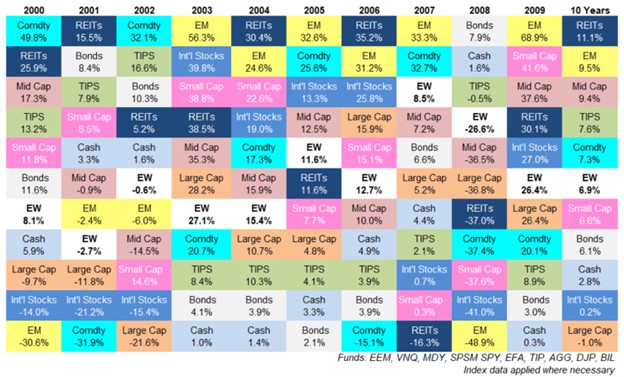

But while large cap dominance has been pronounced over the past six years, and may well continue if AI optimism proves justified, Carlson points out that we shouldn’t be too presumptuous in predicting the future. In particular, he provides an asset allocation quilt for 2000-2009:

Source: Ben Carlson

Source: Ben Carlson

Thanks to the bursting of the tech bubble from 2000-2002, and the financial crisis of 2008, large caps had a negative decade, and finished last among asset classes, as real estate and emerging markets led the way.

Carlson speculates that the large cap boom of the 1980s and 1990s may have set the stage for the 2000s lost decade, which in turn may have set the stage for the large cap revival over the past ten years. While large caps may continue to thrive, Carlson is inclined to believe that the next ten years will be markedly different from the past ten.

JMS Capital Group Wealth Services LLC

417 Thorn Street, Suite 300 | Sewickley, PA | 15143 | 412‐415‐1177 | jmscapitalgroup.com

An SEC‐registered investment advisor.

This material is not intended as an offer or solicitation for the purchase or sale of any financial instrument or investment strategy. This material has been prepared for informational purposes only, and is not intended to be or interpreted as a recommendation. Any forecasts contained herein are for illustrative purposes only and are not to be relied upon as advice.

‹ Back