By using our website, you agree to the use of cookies as described in our Cookie Policy

Blog

Alternative Investment Strategies Meet Traditional Goals

After a 30‐year bull market for bonds an d a strong, multiyear recovery for equities, many investors are wondering w hat lies ahead. One thing is for certain : the future is unlikely to resemble the past. At JMS Capital Group Wealth Services LLC, we constantly seek out unique and innovative solutions in order to help our clients meet their investment objectives.

In our view, a dding liquid alternative in vestment strategies to a traditional stock/bond portfolio has the potential to enhance long‐term risk‐adjusted returns. In today's evolving investment environment, alternative investment strategies offer investors the ability to complement traditional investments and build more diversified, well‐ rounded portfolios.

Reality of a 60/40 Portfolio

The traditional method of portfolio diversification has been to hold a mix of global stocks and bonds. The idea of the 60/40 portfolio has simply been to avoid “putting all your eggs in one basket”.The natural hope would be that if stocks were down, a portfolio ’s drawdown would be mitigated by the presence of bond coupons. Conversely, if bond yields were low, the n equities would hopefully be there to pick up the slack. In other words, the 60/40 port folio perform s reasonably well as long as one of its components is providing value.

Through much of recent financial history, stocks and bonds indeed complemented each other well. As seen in the chart below, a 60/40 portfolio of global equity and global investment‐grade bonds has historically produced a 10‐ year annualized return of 7 .84%. Even with moderate inflation o f 3%, this kind of portfolio growth would enable retirees to withdraw 5% of their portfolio each year while still maintaining the value of their nest eggs.

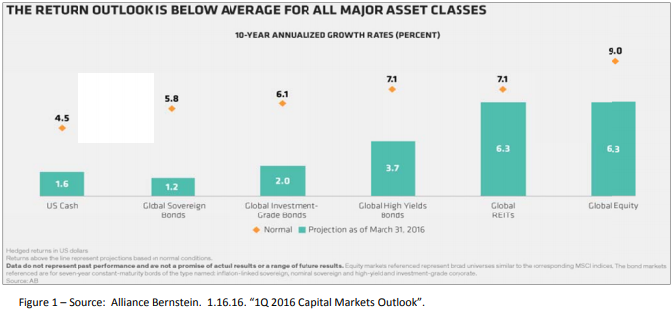

But what if the outlook for both stocks and bonds is muted? Dividing your eggs into two baskets won’t help if both of them are dropped. And, as in Figure 1, even dividing your eggs into six baskets isn’t promising when forward return expectations for each is subpar as compared to historical averages. Global equities have an expected return of only 6.3%, and global investment‐grade bonds 2.0%; the 60/40 portfolio has an expected annual return of only 4.58%. With a 5% withdrawal rate and an even more modest 2% inflation rate, retirees would still typically be draining their principal by about 2.5% per year initially, then by increasing amounts as their principal shrinks.

And this is assuming that returns are steady. In the real world, equities have a great deal of volatility, and bonds hold significant risk in a rising rate environment. A market correction in a low‐returns era would cause many investors to experience drawdowns that would be very difficult to recover from. At this point, we are concerned about potential drawdowns, as equity valuations are historically quite high and bond yields are historically quite low. It’s quite the combination.

Equity Valuations

We have been fortunate enough to experience a seven‐year bull market in the United States since the 2008‐2009 financial crisis. This represents the second longest bull market in United States history. While it is possible that the bull market can continue unabated for some time ‐ and because of this possibility, we certainly will retain positions, albeit underweighted ones, in domestic equities ‐ historical fluctuations in the business cycle would suggest that a downturn would be more likely than an upturn in the near to intermediate future.

We also have other metrics beyond the business cycle that suggest US stocks are currently overpriced. Robert Shiller created the CAPE (cyclically adjusted price to earnings) ratio that indicated overvaluations in the equities market in both 2000, when the tech bubble burst, and 2008, when financial markets crashed. The CAPE ratio has climbed steadily over recent years to reach 26, which is well above its historical average of 17. If you use trailing P/E ratios as your market assessment tool, you come to the same conclusion ‐ according to Factset, the S&P 500 Trailing 12‐Month P/E Ratio is at 19.2, well above its 10‐year average of 16.2. While benchmarks like the CAPE ratio and the trailing P/E ratio don’t indicate when the bull market will end ‐ they certainly are not precision market timing tools ‐ they do provide further evidence for us to tread carefully around US equities. Other firms agree, including Litman Gregory, which forecasted in its recent 9/30/16 projection1 that domestic large caps would only rise by an average of 3.6% per year for the next 5 years.

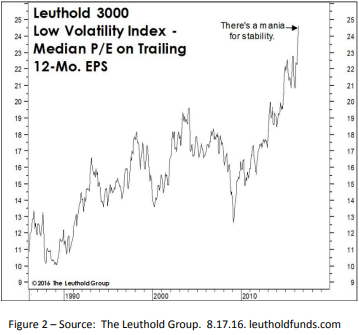

You might argue that if stocks, in general, carry above average risk, then we should consider moving our money into safer stocks. Indeed, there has been a virtual stampede of money into funds within the low volatility index (bottom 10% of realized volatility ‐ included firms fluctuate from month to month, but are predominantly from sectors such as telecom, utilities, and consumer staples). The result? As Figure 2 shows, so much money has been poured into these “safe” sectors that their prices have skyrocketed to the point that they have become quite risky, with median P/E on 12‐month trailing EPS reaching levels nearly 50% above its 30‐year average.

Some international and emerging market stocks provide much better value, but in a broad equity selloff could get hit quite hard. Furthermore, underpinning global equities are the actions by most central banks to keep interest rates at record‐low levels. While these were understandable efforts to spur growth in sluggish economies, they have had the side effect of propping up equity prices, as investors increasingly eschewed bonds to chase returns in the stock market. The Fed’s likely December increase of the federal funds rate may indicate the beginning of an unwinding of this support.

Welcome to t he New Normal

Back in 2000, at the time the tech bubble burst, the US 10‐year bond paid about 6% per year. Inflation was about 3 % per year. So if you were heavily in vested in stocks at that time but were skeptical of the market’s ability to maintain its run, bonds represented an excellent fallback position that would generate real returns of 3%. Unfortunately, today is a different story . As of November 30, 2016, the US 1 0‐year bond only pays about 2.36%. Inflation is about 1.1% this year which means the real return on the US 10‐year bond is currently a paltry 1.26%.

Yet even if rates rise, we e counter a n w set of difficulties. Rate normalization, while likely beneficial in the long run, carries the threat of duration risk. If interest rates rise, low‐yield bonds suffer large losses in principal, as investors would otherwise flock to new er, higher‐yielding bonds . All in all, duration risk means that a 50 basis point rise in interest rates would generate about $1. 6 trillion in losses in the bond market.

So, according to its own projections and rhetoric, a s well as the expectation s derived from futures markets, the F ed is likely t o raise rates, albeit very gradually, over the next few years. A gradual rise in rates will mitigate duration risk, but it will also mean bond yields will continue to remain quite low. It is hard to envision core bonds generating large positive returns in the near to inter mediate future.

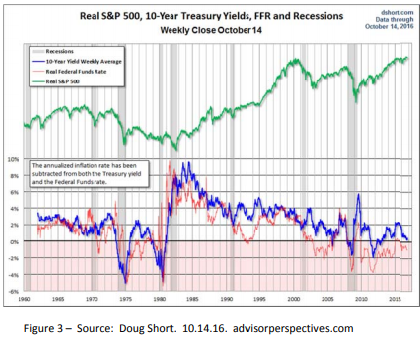

And even in the long run, interest rates may remain low. Many o f us remember the sky‐high interest rates of the late 1970s and early 1980s, which peaked at an astonishing 20.06 % in January of 1981. High interest rates tamed the stagflation that afflicted the 1970s (albeit at t e cost of a painful recession in the early 1980s),and after inflation fell in the 1980s, real interest rates continued to average about 4%until 2002. Looking strictly at this history would lead us to expect interest rates to rebound significantly over the coming years.

Unfortunately, taking a longer view engenders considerable skepticism of this idea. As Figure 3 shows, while real interest rates nearly always exceeded 2%, and averaged over 4%, from 1982‐2002, real rates were much lower from 1962‐1982,never reaching 4% and barely averaging above 0%. And with tepid growth rates and forecasts, central banks may find it difficult to raise interest rates back to even 4%. Hence we are in a situation described by Mohamed El‐Erian, chief economic advisor of Allianz, as the “new normal” of low rates and low growth.

Reaching for Yield /Safety

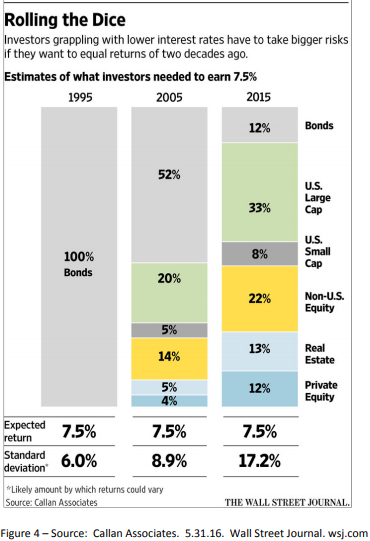

In this low‐growth, low‐rate environment, Many investors who have become accustomed to 7‐10% annual increases in portfolio value are finding such returns now hard to come by. Although we would argue that some retrenchment is the proper course, as we moderate our expectations, it is still well worth examining what we would need to do for a client who wants to reach for the high returns of the past. Figure 4 illustrates this challenge.

In 1995 investors could simply park their money in core bonds and earn an excellent 7.5% return on their investment. By 2005, bond yields had fallen significantly, so in order to achieve the same 7.5% return investors would need a mix of bonds, stocks, and other asset classes. It’s true that investors’ risk, as measured by standard deviation, rose from 6.0% to 8.9%, but this portfolio was nonetheless still significantly less risky than just holding stocks. By 2015, however, bond yields had dropped so low that investors seeking a projected 7.5% return would need to undertake major risk to achieve their goals. While a portfolio of 12% bonds, 63% equities, and 25% private equity/real estate would achieve a 7.5% return, it would do so with a tremendous increase in risk ‐ the standard deviation of 17.2% is comparable to that of an all‐equity portfolio.

Investors with an appetite for risk, who can absorb a drawdown of 20% or more, may be happy with such a portfolio. But there are many who do not wish to ride the equities roller coaster, yet still seek moderate returns in a significantly safer portfolio. The question then becomes: in a world in which bond yields are minimal and equities growth expectations are constrained, how can we construct a portfolio that will generate desirable returns without taking on risk that we may not be compensated for? At JMS, we believe that alternative investments will be a critical component of such a portfolio, as we seek to maximize our clients’ risk‐adjusted returns.

What are alternatives?

Generally speaking, alternatives seek to generate returns that are uncorrelated with broader stock and bond market indices while also providing additional diversification. Alternatives can include any investment outside of traditional asset classes such as stocks, bonds, and cash. However, it is important to delineate between two factions within the world of alternatives ‐ alternative asset classes and alternative investment strategies.

Alternative asset classes, e.g. real estate, commodities, private equity, collectibles, etc., are what investors traditionally think of when they hear alternatives, and they are correct in doing so.

Alternative investment strategies include long/short equity, market neutral, managed futures, merger arbitrage, global macro, and multialternative, to name a few. The investment mandate of such funds is unconstrained, which enables each manager to utilize sophisticated techniques across all asset classes to manage overall risk and volatility, especially to the downside.

In summary, alternative investment strategies exhibit the following characteristics:

- designed to deliver moderate, consistent returns while minimizing volatility

- help manage risk independent of broad equity indices

- provide downside protection in poor market environments

- emphasize non‐traditional asset classes, offering highly diversified exposure across geographies, sectors, and time horizons

- deliver returns that exhibit minimal correlation to traditional benchmarks

Accessing alternatives

Alternative investment strategies are a mainstay of hedge funds, and have been famously popularized by David Swensen, the longtime manager of Yale's endowment fund. However, until recently, such strategies were fairly illiquid, highly complex, and came with very high fees and enormous minimum initial investments, and therefore were only realistically accessible to institutional investors and extremely affluent individuals. Since the financial crises, today's so‐called liquid alternatives ‐ alternative assets and strategies provided within a mutual fund structure ‐ make these types of investments far more accessible to retail investors.

Alternative strategies are best suited for investors who:

- desire a flexible and nimble portfolio but also need to manage volatility

- want to capture opportunities in strong market environments

- seek downside protection in weaker markets

Why use alternatives? Why now?

We concur with the views expressed in a 2015 Registered Investment Advisor (RIA) Trend Report survey2 with respect to the top three reasons to advocate using alternatives in your portfolio ‐ we see the potential benefits of alternative investment strategies as three‐fold:

- Improved risk‐adjusted returns ‐ Alternative strategies have generally provided higher risk‐adjusted returns than traditional asset classes, as demonstrated by their higher Sharpe ratios (return relative to risk) over the last 20‐plus years. These results were achieved by using flexible investment approaches and by opportunistically exploiting mispricings both within and across asset classes.

- Reduced downside ‐ Alternative strategies have historically preserved capital by losing less than traditional equity strategies during times of market stress (but also benefitting during equity market rallies). During the dot.com bust of the early 2000's and again during the financial crises in 2008, alternatives lost less than stocks. Most recently, during the first 6 weeks of 2016 when equity markets experienced a widespread sell‐off, alternatives provided much needed downside protection.

- Low sensitivity to stocks and bonds ‐ Because alternative investment strategies are designed and managed in different ways than traditional stock and bond strategies, they tend to produce different return patterns as well. Their low correlation to traditional asset classes makes them less sensitive to movements of broader markets, a valuable diversification characteristic.

How we evaluate alternatives

We scrutinize numerous aspects of an alternative fund before deciding whether to invest in it.Initially, we conduct a screen in which we score funds based on volatility, fees, investment returns, managerial stability, and Sharpe ratio. We then measure its behavior relative to its stated benchmark as well as to its best fit index to get a better understanding of how it performs under various market conditions. We also interview key managers to further scrutinize the structure, execution, and performance drivers of each fund. Uncovering managers that have an unemotional and repeatable investment process enables us to better assess expectations on a forward‐ looking basis, as these characteristics often lead to more consistent results.

We then examine how the alternative fund would fit within our overall alternatives portfolio, so that we achieve suitable diversification across the realm of alternatives. We examine correlations and performance of funds against benchmarks and against each other to ensure sufficient diversification is achieved. Finally, using risk modeling software, we stress test our portfolio to analyze performance under various market conditions and scenarios.

Our goal with respect to alternatives is twofold, reflecting our desire to limit downside risk while still garnishing adequate returns ‐ we seek low volatility of 4‐8% (as a reference, the S&P 500 has a volatility of about 16%), and reasonable returns of 4‐6% annualized, over a full market cycle.

Closing Thoughts

Although we can clearly make the case for their inclusion in any portfolio, we believe the current market environment, with its muted return expectations across nearly all asset classes, is an especially propitious one for liquid alternatives. In what we believe to be a moderate return era, a focus on limiting drawdowns becomes vital, as recovering from losses presents even greater challenges.

As both the Brexit vote in Great Britain and the recent Presidential election have shown, life is full of surprises and they manifest themselves in the markets through volatility. There is no way to know what will occur as we move forward, but we can prepare for the unknown accordingly. We believe that, just as there are times for traditional stock/bond portfolios, there are also times to approach portfolio management in a more non‐traditional manner. Today, we prefer to focus on risk‐adjusted returns and downside protection in portfolios. This makes liquid alternatives an essential part of our well‐diversified portfolios in addition to serving as a standalone wealth preservation strategy.

Footnotes

1. Litman Gregory | “Asset Class Return Estimates as of 9.30.16.” | advisorintelligence.com

2. Raymond James | “Embracing Alternatives.” | 8.31.16 | http://www.wealthmanagement.com/white‐papers/embracingalternatives

Disclosure:

This material is not intended as an offer or solicitation for the purchase or sale of any financial instrument or investment strategy. This material has been prepared for informational purposes only. References to future returns are not promises or even estimates of actual returns a client portfolio may achieve. Any forecasts contained herein are for illustrative purposes only and are not to be relied upon as advice or interpreted as a recommendation for a specific investment. Past performance is not a guarantee of future results.

With the exception of historical matters, the matters discussed in this presentation are forward‐looking statements that involve risks and uncertainties that could cause actual results to differ materially from projected results. We have based these projections on our current expectations and assumptions about future events as of November 2016. While we consider these expectations and assumptions to be reasonable, they are inherently subject to significant business, economic, competitive, regulatory and other risks, contingencies and uncertainties, most of which are difficult to predict and many of which are beyond our control. There can be no assurances, however, that the returns presented will be achieved. Specific risks and uncertainties related to these matters include, but are not limited to: management effectiveness, general real estate risks, economic conditions, interest rates, inflation, financing, liquidity, environmental or tax considerations.

‹ Back