By using our website, you agree to the use of cookies as described in our Cookie Policy

Blog

AI and Productivity

James Pethokoukis conducts a lengthy review of AI and productivity, with a focus on analyses by Goldman Sachs. While the future is unknown, the latest Goldman Sachs assessment suggests that the impact of AI will be comparable to that of the personal computer and internet, while acknowledging the possibility that the repercussions of AI could be much greater.

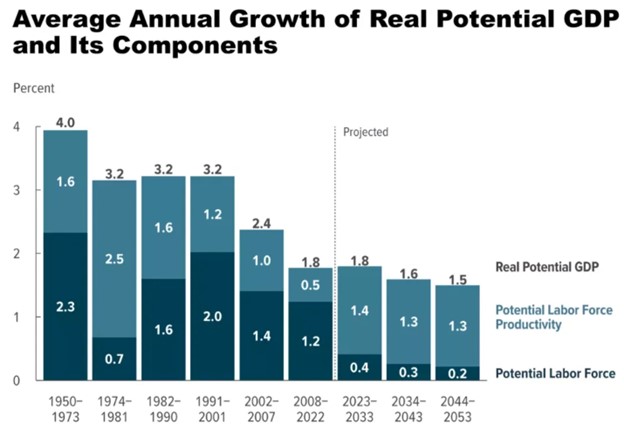

Goldman Sachs focuses largely on the potential productivity impact of AI, and as Pethokoukis observes, greater productivity would reverse a long-term downward trend:

Source: CBO via James Pethokoukis

Source: CBO via James Pethokoukis

Potential labor force isn’t likely to grow much, given that population growth is low, and the labor force participation rate isn’t likely to spike. So increasing GDP growth is likely to depend most on labor force productivity.

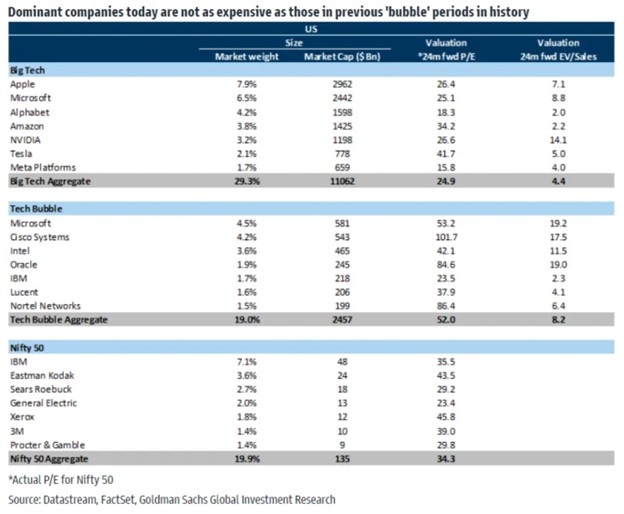

The Goldman Sachs estimate is that by late this decade and extending into the 2030s, AI will impove productivity by 0.4%--not a massive shift, but enough to move us near the labor force productivity growth rates of the last century, rather than the weak growth rates of the past twenty years. Pethokoukis hopes for even more, and in his review of Goldman Sachs analyses from the past three years, pulls an interesting chart from September, 2024, suggesting that the Magnificent 7 tech stocks could still have room to run.

JMS Capital Group Wealth Services LLC

417 Thorn Street, Suite 300 | Sewickley, PA | 15143 | 412‐415‐1177 | jmscapitalgroup.com

An SEC‐registered investment advisor.

This material is not intended as an offer or solicitation for the purchase or sale of any financial instrument or investment strategy. This material has been prepared for informational purposes only, and is not intended to be or interpreted as a recommendation. Any forecasts contained herein are for illustrative purposes only and are not to be relied upon as advice.

‹ Back