By using our website, you agree to the use of cookies as described in our Cookie Policy

Blog

A Look Inside the Collapse of the Silicon Valley Bank

Silicon Valley Bank has collapsed. How did this happen? What are the possible consequences for its customers, other banks, and the larger financial system? Are there larger repercussions for markets and the economy? It’s obviously premature to claim a definitive answer to these questions, but Bloomberg’s Matt Levine and economist Noah Smith have both provided excellent overviews of SVB’s downfall. Alas, Levin’s article is subscribers-only, so we’ll focus instead on Smith’s outline.

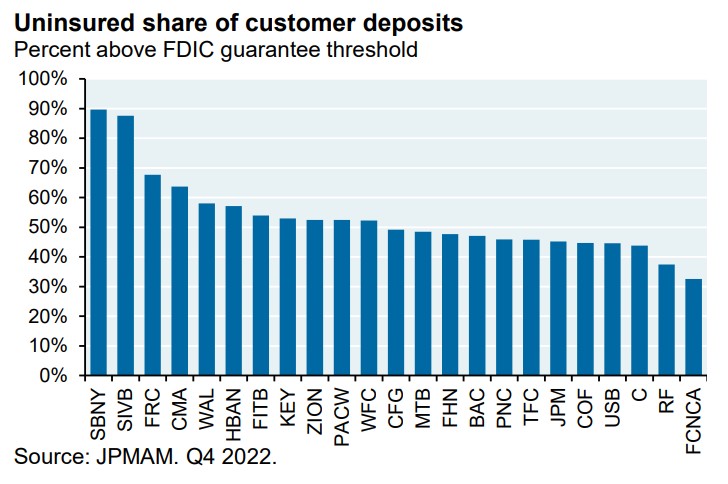

Silicon Valley Bank was something of an outlier among regional banks, as it was largely a bank for startups. Startups typically raise cash by selling equity to venture capitalists, then they deposit the cash into banks like SVB. Consequently, SVB had a lot of deposits that were over the maximum FDIC-insured amount of $250,000 per depositor. A JPMorgan note includes an insightful chart:

Typically about half of a bank’s customer deposits are uninsured, but for Silicon Valley Bank (denoted by ticker SIVB) the percentage was nearly 90%. Having most deposits uninsured left SVB vulnerable to a classic bank run, as depicted in the film It’s a Wonderful Life.

What prompted the bank run? SVB’s investment strategy left it doubly vulnerable to interest rate increases. First, when flush with pandemic cash, SVB invested heavily in fixed-rate long-term bonds, whose value plummeted as the Fed sharply hiked rates over the past year. Second, SVB’s customer base of tech startups was disproportionally vulnerable to higher interest rates, and as venture capital funding dried up, these companies needed to burn through more and more cash simply to pay their employees and to stay afloat. So, as depositors withdrew funds, SVB needed to sell assets to raise the necessary cash to fund the withdrawals. Some venture capitalists, such as Peter Thiel, were increasingly concerned that SVB couldn’t meet its obligations, and advised withdrawing funds from the bank, and once enough customers started pulling money from the bank due to solvency concerns, insolvency became a self-fulfilling prophecy.

As of this writing it appears that SVB is an outlier in terms of its exposure to interest rate risks. It may also be an outlier in terms of the close-knit nature of its clientele—if a few venture capitalists are pulling out their money, others will know quickly, and once uninsured depositors believe their cash is at risk, it’s a rational decision to withdraw money while they still can. Still, other banks, particularly mid-sized ones like SVB, may be at elevated risk, from some combination of the risk of a panic bank run, potential balance sheet weaknesses, or expectations of tighter regulation in the future. Indeed, regional bank stocks fell over 15% last week and another 12% on Monday, though they are up 8% as of Tuesday morning. In an effort to forestall a potential bank panic, the government has stepped in to guarantee deposits at SVB and at Signature Bank in New York, and has also created a new bank funding facility.

While we would expect continued volatility for regional banks, broader indices haven’t moved much. The S&P 500 is up almost 2% on Tuesday morning, and is down only about 1.5% over the past 5 days. Markets appear to believe that SVB’s problems are unlikely to spread to other sectors.

One consequence of SVB’s downfall may be a minor pullback from the Fed in terms of its rate hiking. Markets had been expecting a 50bp increase in the federal funds rate in March after gloomy testimony from Fed Chair Jerome Powell, but expectations have now shifted to just a 25bp increase. It’s not clear if there will be any longer-term ramifications of SVB’s failure on Fed monetary policy.

At this moment the SVB fallout appears to be relatively contained. Tech startups may have more difficulty getting funding; bank stocks, especially those of regional banks, may experience continued choppiness. New regulation or legislation could be forthcoming—if the federal government is inclined to guarantee customer deposits in the event of a crisis, it may make sense to just implement that policy, along with its funding mechanism (most likely additional payments into the FDIC from banks), instead of reacting post-crisis. Overall, though, markets may be shifting attention away from SVB and back to an increasingly hawkish Fed inflationary outlook.

###

JMS Capital Group Wealth Services LLC

417 Thorn Street, Suite 300 | Sewickley, PA | 15143 | 412‐415‐1177 | jmscapitalgroup.com

An SEC‐registered investment advisor.

This material is not intended as an offer or solicitation for the purchase or sale of any financial instrument or investment strategy. This material has been prepared for informational purposes only, and is not intended to be or interpreted as a recommendation. Any forecasts contained herein are for illustrative purposes only and are not to be relied upon as advice.

‹ Back